ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 33<br />

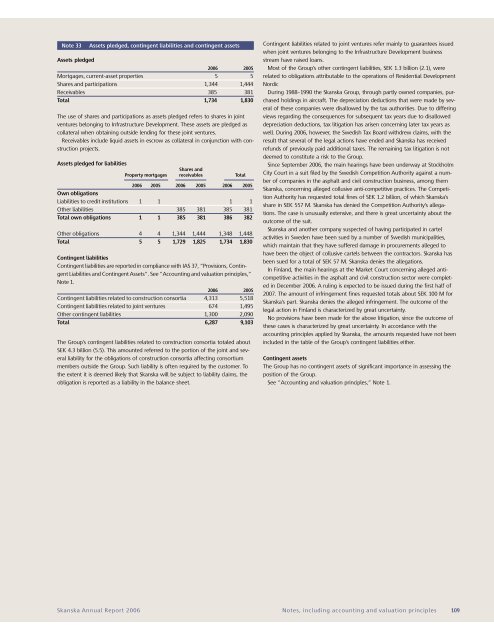

Assets pledged<br />

Assets pledged, contingent liabilities and contingent assets<br />

<strong>2006</strong> 2005<br />

Mortgages, current-asset properties 5 5<br />

Shares and participations 1,344 1,444<br />

Receivables 385 381<br />

Total 1,734 1,830<br />

The use of shares and participations as assets pledged refers to shares in joint<br />

ventures belonging to Infrastructure Development. These assets are pledged as<br />

collateral when obtaining outside lending for these joint ventures.<br />

Receivables include liquid assets in escrow as collateral in conjunction with construction<br />

projects.<br />

Assets pledged for liabilities<br />

Shares and<br />

Property mortgages receivables Total<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Own obligations<br />

Liabilities to credit institutions 1 1 1 1<br />

Other liabilities 385 381 385 381<br />

Total own obligations 1 1 385 381 386 382<br />

Other obligations 4 4 1,344 1,444 1,348 1,448<br />

Total 5 5 1,729 1,825 1,734 1,830<br />

Contingent liabilities<br />

Contingent liabilities are reported in compliance with IAS 37, ”Provisions, Contingent<br />

Liabilities and Contingent Assets”. See ”Accounting and valuation principles,”<br />

Note 1.<br />

<strong>2006</strong> 2005<br />

Contingent liabilities related to construction consortia 4,313 5,518<br />

Contingent liabilities related to joint ventures 674 1,495<br />

Other contingent liabilities 1,300 2,090<br />

Total 6,287 9,103<br />

The Group’s contingent liabilities related to construction consortia totaled about<br />

SEK 4.3 billion (5.5). This amounted referred to the portion of the joint and several<br />

liability for the obligations of construction consortia affecting consortium<br />

members outside the Group. Such liability is often required by the customer. To<br />

the extent it is deemed likely that <strong>Skanska</strong> will be subject to liability claims, the<br />

obligation is reported as a liability in the balance sheet.<br />

Contingent liabilities related to joint ventures refer mainly to guarantees issued<br />

when joint ventures belonging to the Infrastructure Development business<br />

stream have raised loans.<br />

Most of the Group’s other contingent liabilities, SEK 1.3 billion (2.1), were<br />

related to obligations attributable to the operations of Residential Development<br />

Nordic<br />

During 1988–1990 the <strong>Skanska</strong> Group, through partly owned companies, purchased<br />

holdings in aircraft. The depreciation deductions that were made by several<br />

of these companies were disallowed by the tax authorities. Due to differing<br />

views regarding the consequences for subsequent tax years due to disallowed<br />

depreciation deductions, tax litigation has arisen concerning later tax years as<br />

well. During <strong>2006</strong>, however, the Swedish Tax Board withdrew claims, with the<br />

result that several of the legal actions have ended and <strong>Skanska</strong> has received<br />

refunds of previously paid additional taxes. The remaining tax litigation is not<br />

deemed to constitute a risk to the Group.<br />

Since September <strong>2006</strong>, the main hearings have been underway at Stockholm<br />

City Court in a suit filed by the Swedish Competition Authority against a number<br />

of companies in the asphalt and civil construction business, among them<br />

<strong>Skanska</strong>, concerning alleged collusive anti-competitive practices. The Competition<br />

Authority has requested total fines of SEK 1.2 billion, of which <strong>Skanska</strong>’s<br />

share in SEK 557 M. <strong>Skanska</strong> has denied the Competition Authority’s allegations.<br />

The case is unusually extensive, and there is great uncertainty about the<br />

outcome of the suit.<br />

<strong>Skanska</strong> and another company suspected of having participated in cartel<br />

activities in Sweden have been sued by a number of Swedish municipalities,<br />

which maintain that they have suffered damage in procurements alleged to<br />

have been the object of collusive cartels between the contractors. <strong>Skanska</strong> has<br />

been sued for a total of SEK 57 M. <strong>Skanska</strong> denies the allegations.<br />

In Finland, the main hearings at the Market Court concerning alleged anticompetitive<br />

activities in the asphalt and civil construction sector were completed<br />

in December <strong>2006</strong>. A ruling is expected to be issued during the first half of<br />

2007. The amount of infringement fines requested totals about SEK 100 M for<br />

<strong>Skanska</strong>’s part. <strong>Skanska</strong> denies the alleged infringement. The outcome of the<br />

legal action in Finland is characterized by great uncertainty.<br />

No provisions have been made for the above litigation, since the outcome of<br />

these cases is characterized by great uncertainty. In accordance with the<br />

accounting principles applied by <strong>Skanska</strong>, the amounts requested have not been<br />

included in the table of the Group’s contingent liabilities either.<br />

Contingent assets<br />

The Group has no contingent assets of significant importance in assessing the<br />

position of the Group.<br />

See ”Accounting and valuation principles,” Note 1.<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 109