ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

tive effect of about SEK 90 M due to a transition to defined-contribution<br />

pension plans. The earnings of the California-based portion of<br />

<strong>Skanska</strong> USA Civil increased as planned, and the unit showed a small<br />

profit for the full year. However, Construction operations in the Czech<br />

Republic and Finland showed somewhat poorer margins.<br />

Czech operations took a charge of SEK 67 M for an order to<br />

pay a fine and recognized an impairment loss of SEK 68 M on a<br />

property that is leased to an external party.<br />

In Denmark, operating income included project impairment<br />

losses and restructuring expenses totaling about SEK 395 M.<br />

A supplementary review of the Danish operations was undertaken,<br />

and the business was reorganized in order to improve profitability.<br />

In this context, <strong>Skanska</strong> is ceasing to accept new commercial<br />

building assignments for external customers in Denmark, but construction<br />

for <strong>Skanska</strong>’s residential and commercial development<br />

businesses as well as civil construction operations will continue.<br />

Residential Development<br />

The business stream increased its operating income by 36 percent to<br />

SEK 852 M (625). The operating margin rose to 12.6 (10.6) percent.<br />

The strong housing market in the Group’s main markets in the<br />

Nordic countries continued, and all units showed improved operating<br />

income. In the Czech Republic, the residential market is showing<br />

good demand, but due to greater supply it is taking longer to<br />

conclude sales agreements. This resulted in somewhat lower operating<br />

income for Czech residential operations. Starting in <strong>2006</strong>,<br />

<strong>Skanska</strong> resumed residential development in Denmark, which<br />

showed positive earnings for the year.<br />

Commercial Development<br />

Commercial Development reported an operating income of<br />

SEK 1,210 M (1,740). The lower earnings are explained by lower<br />

divestments of commercial projects as well as lower operating net,<br />

the latter as a consequence of <strong>Skanska</strong>’s reduced property portfolio<br />

compared to prior years.<br />

Of operating income, SEK 1,300 M was related to divestments<br />

of fully developed properties, with a total sale price of about<br />

SEK 3 billion. Property divestments occurred at prices averaging<br />

25 percent above the fair values assigned at the end of 2005.<br />

A number of large property divestments were carried out,<br />

including the sale during the second quarter of a portfolio of five<br />

properties, one of them in Malmö and four in the Stockholm<br />

region. The sale price totaled SEK 750 M, with a gain of more than<br />

SEK 500 M. During the same quarter, <strong>Skanska</strong> sold a property in<br />

Stockholm for SEK 480 M, with a gain in excess of SEK 200 M.<br />

Infrastructure Development<br />

Operating income amounted to SEK –8 M (–9). During <strong>2006</strong>,<br />

<strong>Skanska</strong> divested eight percentage points of its holding in Maputo<br />

Port, Mozambique, its entire 20 percent holding in Bridgend Prison,<br />

United Kingdom, and its entire 33 percent holding in Kings<br />

College Hospital, with an overall gain of SEK 125 M in the Group<br />

financial statements.<br />

Central<br />

Costs reported under “Central” rose from SEK 345 M to SEK 514 M.<br />

This item included the cost of Group headquarters, earnings of a<br />

number of central companies as well as central provisions. This<br />

also included the International unit, with a number of businesses<br />

that are being phased out or shut down, among them <strong>Skanska</strong>’s<br />

Russian operations.<br />

Eliminations of intra-Group profits<br />

Elimination of intra-Group profits amounted to SEK –114 M (–73).<br />

This included net eliminations of intra-Group profits related to<br />

Infrastructure Development projects in the amount of SEK –100 M,<br />

net eliminations related to Commercial Development in the<br />

amount of SEK –18 M and other items totaling SEK 4 M.<br />

Infrastructure Commercial<br />

SEK M Development Development Other Total<br />

New intra-Group profits –123 –58 –181<br />

Reversals 16 4 20<br />

Projects and properties divested 7 40 47<br />

Total –100 –18 4 –114<br />

Income after financial items<br />

Net financial items totaled SEK 223 M (120). As a consequence of<br />

rising interest rates and higher average financial investment volume<br />

than the preceding year, interest income improved from SEK 308 M<br />

to SEK 406 M. Interest expenses shrank to SEK –107 M (–137),<br />

which was explained among other things by lower average borrowings<br />

during the year. During <strong>2006</strong>, interest expenditures of<br />

SEK 34 M (39) were capitalized, mainly in ongoing projects for<br />

<strong>Skanska</strong>’s own account. The change in the fair value of financial<br />

instruments amounted to SEK –118 M (19), which was mainly<br />

related to negative interest rate differences in currency hedging of<br />

investments in Infrastructure Development in Latin America as<br />

well as <strong>Skanska</strong>’s 50 percent currency hedging of equity denominated<br />

in American dollars. Other financial items amounted to<br />

SEK 42 M (–70) and were related, among other things, to currency<br />

rate effects plus various financial fees.<br />

Profit for the year<br />

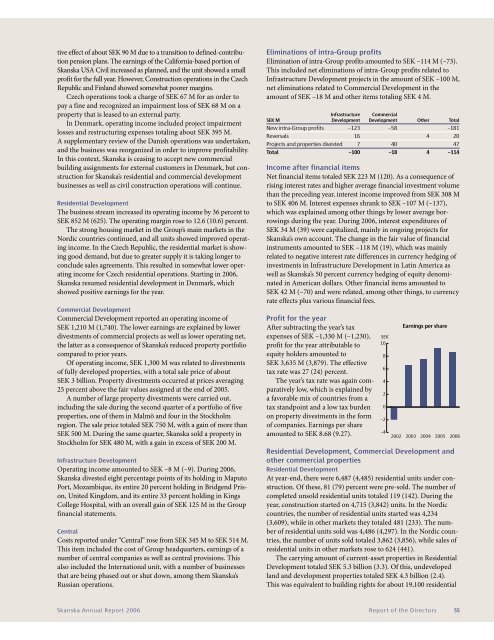

After subtracting Resultat per the aktieyear’s tax<br />

expenses Kr of SEK –1,330 M (–1,230),<br />

10<br />

profit for the year attributable to<br />

equity 8 holders amounted to<br />

SEK 3,635 M (3,879). The effective<br />

6<br />

tax rate was 27 (24) percent.<br />

4 The year’s tax rate was again comparatively<br />

low, which is explained by<br />

2<br />

a favorable mix of countries from a<br />

tax 0 standpoint and a low tax burden<br />

on<br />

–2<br />

property divestments in the form<br />

of companies. Earnings per share<br />

–4<br />

amounted 2002 2003 to SEK 2004 8.68 2005 (9.27). <strong>2006</strong><br />

SEK<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

–2<br />

–4<br />

Earnings per share<br />

2002 2003 2004 2005 <strong>2006</strong><br />

Residential Development, Commercial Development and<br />

other commercial properties<br />

Residential Development<br />

At year-end, there were 6,487 (4,485) residential units under construction.<br />

Of these, 81 (79) percent were pre-sold. The number of<br />

completed unsold residential units totaled 119 (142). During the<br />

year, construction started on 4,715 (3,842) units. In the Nordic<br />

countries, the number of residential units started was 4,234<br />

(3,609), while in other markets they totaled 481 (233). The number<br />

of residential units sold was 4,486 (4,297). In the Nordic countries,<br />

the number of units sold totaled 3,862 (3,856), while sales of<br />

residential units in other markets rose to 624 (441).<br />

The carrying amount of current-asset properties in Residential<br />

Development totaled SEK 5.3 billion (3.3). Of this, undeveloped<br />

land and development properties totaled SEK 4.3 billion (2.4).<br />

This was equivalent to building rights for about 19,100 residential<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Report of the Directors 55