Corporate Tax 2010 - BMR Advisors

Corporate Tax 2010 - BMR Advisors

Corporate Tax 2010 - BMR Advisors

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Bredin Prat<br />

France<br />

consolidated group with said subsidiaries. All the tax-consolidated<br />

group’s members must be subject to French CIT and have the same<br />

financial year; the parent company must not directly - or indirectly<br />

through companies subject to CIT - be held at 95% or more by<br />

another French company subject to French CIT.<br />

ECJ has recently ruled in the “Papillon” decision dated 27<br />

November 2008 that French subsidiaries indirectly held at 95% or<br />

more through an EU-resident company may be included in a French<br />

tax consolidated group. A law is expected to be passed before the<br />

end of 2009 in order to implement this decision into French tax law<br />

and address the subsequent issues it raises.<br />

The group head company is liable to CIT on the group taxable<br />

result, which is calculated by adding all members’ profits and<br />

losses, subject to certain adjustments (such as the neutralisation of<br />

certain intra-group transactions).<br />

Except for small and medium-sized enterprises and subject to specific<br />

conditions, French tax law does not expressly allow for relief of losses<br />

incurred by non French subsidiaries. The possibility to offset losses<br />

incurred by subsidiaries located in the EU and held at 95% or more by<br />

a French tax consolidated company against French tax consolidated<br />

profits, pursuant to ECJ’s “Marks & Spencer” decision dated 13<br />

December 2005, still seems debatable in the absence of case law or<br />

administrative guidelines on this matter.<br />

4.6 Is tax imposed at a different rate upon distributed, as<br />

opposed to retained, profits<br />

The CIT rate does not depend on whether or not the profits are<br />

distributed or retained; the same rate applies in both situations.<br />

4.7 What other national taxes (excluding those dealt with in<br />

“Transaction <strong>Tax</strong>es”, above) are there - e.g. property taxes,<br />

etc.<br />

Apart from social security charges, the main taxes applicable to<br />

enterprises are:<br />

Wage tax (“taxe sur les salaires”) is due by employers that are<br />

not subject to VAT on at least 90% of their turnover. It is<br />

assessed on the amount of salaries and benefits in kind paid to<br />

employees and the applicable rate goes from 4.25% to 13.6%.<br />

A 3% annual tax on real estate is due by any French and<br />

foreign entity, which directly or indirectly owns real estate<br />

assets or rights over such assets located in France. The tax is<br />

assessed on the fair market value of such assets. Various<br />

exemptions apply: tax is not due by entities that have real<br />

estate assets representing less than 50% of their French<br />

assets, by listed entities and their wholly-owned subsidiaries,<br />

by retirement funds and non-profit organisations subject to<br />

certain conditions.<br />

Other national taxes apply such as apprenticeship tax and tax<br />

on corporate cars.<br />

4.8 Are there any local taxes not dealt with in answers to<br />

other questions<br />

Business tax (“taxe professionnelle”) is due by enterprises<br />

that regularly carry on non-salaried activities and is based on<br />

the annual rental value of tangible assets used by the<br />

taxpayer for business purposes (the so-computed tax base is<br />

then notably reduced by a 16% general relief). The<br />

applicable rate differs from a local authority to another. A<br />

minimum business tax, based on the enterprise’s added<br />

value, applies when the turnover of the latter exceeds EUR<br />

7,600,000. A business tax cap also based on the added value<br />

generated by the taxpayer is granted to taxpayers who qualify<br />

and who specifically request its application.<br />

ICLG TO: CORPORATE TAX <strong>2010</strong><br />

© Published and reproduced with kind permission by Global Legal Group Ltd, London<br />

A reform of this regime has recently been announced and could<br />

enter into force as from <strong>2010</strong>.<br />

Real property tax on developed property/undeveloped land<br />

(“taxe foncière”) is based on the net cadastral value of said<br />

property/land (50%/80% of the cadastral value). The rate<br />

differs from one local authority to another.<br />

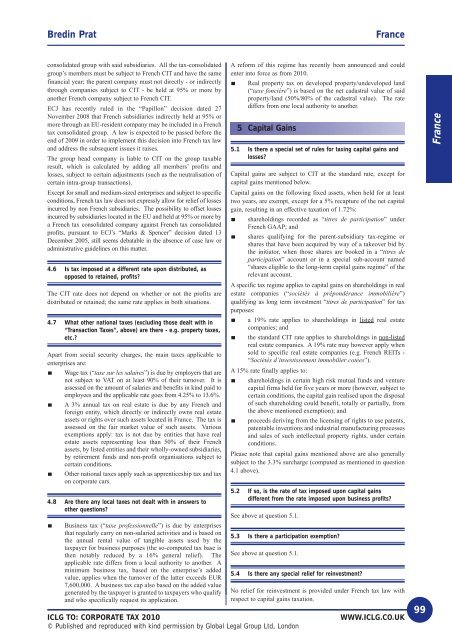

5 Capital Gains<br />

5.1 Is there a special set of rules for taxing capital gains and<br />

losses<br />

Capital gains are subject to CIT at the standard rate, except for<br />

capital gains mentioned below.<br />

Capital gains on the following fixed assets, when held for at least<br />

two years, are exempt, except for a 5% recapture of the net capital<br />

gain, resulting in an effective taxation of 1.72%:<br />

shareholdings recorded as “titres de participation” under<br />

French GAAP; and<br />

shares qualifying for the parent-subsidiary tax-regime or<br />

shares that have been acquired by way of a takeover bid by<br />

the initiator, when those shares are booked in a “titres de<br />

participation” account or in a special sub-account named<br />

“shares eligible to the long-term capital gains regime” of the<br />

relevant account.<br />

A specific tax regime applies to capital gains on shareholdings in real<br />

estate companies (“sociétés à prépondérance immobilière”)<br />

qualifying as long term investment “titres de participation” for tax<br />

purposes:<br />

a 19% rate applies to shareholdings in listed real estate<br />

companies; and<br />

the standard CIT rate applies to shareholdings in non-listed<br />

real estate companies. A 19% rate may however apply when<br />

sold to specific real estate companies (e.g. French REITs -<br />

“Sociétés d’investissement immobilier cotées”).<br />

A 15% rate finally applies to:<br />

shareholdings in certain high risk mutual funds and venture<br />

capital firms held for five years or more (however, subject to<br />

certain conditions, the capital gain realised upon the disposal<br />

of such shareholding could benefit, totally or partially, from<br />

the above mentioned exemption); and<br />

proceeds deriving from the licensing of rights to use patents,<br />

patentable inventions and industrial manufacturing processes<br />

and sales of such intellectual property rights, under certain<br />

conditions.<br />

Please note that capital gains mentioned above are also generally<br />

subject to the 3.3% surcharge (computed as mentioned in question<br />

4.1 above).<br />

5.2 If so, is the rate of tax imposed upon capital gains<br />

different from the rate imposed upon business profits<br />

See above at question 5.1.<br />

5.3 Is there a participation exemption<br />

See above at question 5.1.<br />

5.4 Is there any special relief for reinvestment<br />

No relief for reinvestment is provided under French tax law with<br />

respect to capital gains taxation.<br />

WWW.ICLG.CO.UK 99<br />

France