Corporate Tax 2010 - BMR Advisors

Corporate Tax 2010 - BMR Advisors

Corporate Tax 2010 - BMR Advisors

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Eubelius<br />

Belgium<br />

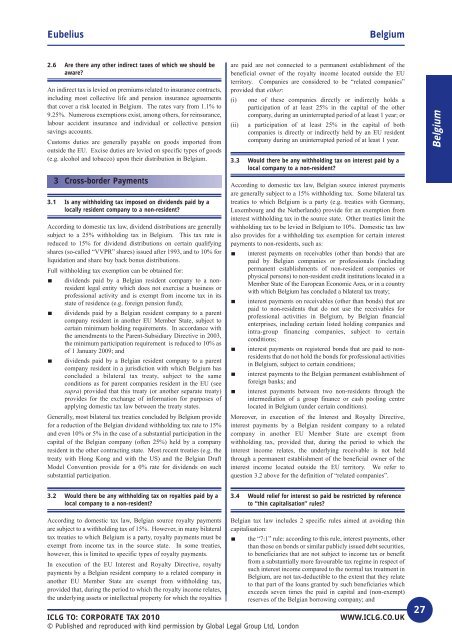

2.6 Are there any other indirect taxes of which we should be<br />

aware<br />

An indirect tax is levied on premiums related to insurance contracts,<br />

including most collective life and pension insurance agreements<br />

that cover a risk located in Belgium. The rates vary from 1.1% to<br />

9.25%. Numerous exemptions exist, among others, for reinsurance,<br />

labour accident insurance and individual or collective pension<br />

savings accounts.<br />

Customs duties are generally payable on goods imported from<br />

outside the EU. Excise duties are levied on specific types of goods<br />

(e.g. alcohol and tobacco) upon their distribution in Belgium.<br />

3 Cross-border Payments<br />

3.1 Is any withholding tax imposed on dividends paid by a<br />

locally resident company to a non-resident<br />

According to domestic tax law, dividend distributions are generally<br />

subject to a 25% withholding tax in Belgium. This tax rate is<br />

reduced to 15% for dividend distributions on certain qualifying<br />

shares (so-called “VVPR” shares) issued after 1993, and to 10% for<br />

liquidation and share buy back bonus distributions.<br />

Full withholding tax exemption can be obtained for:<br />

dividends paid by a Belgian resident company to a nonresident<br />

legal entity which does not exercise a business or<br />

professional activity and is exempt from income tax in its<br />

state of residence (e.g. foreign pension fund);<br />

dividends paid by a Belgian resident company to a parent<br />

company resident in another EU Member State, subject to<br />

certain minimum holding requirements. In accordance with<br />

the amendments to the Parent-Subsidiary Directive in 2003,<br />

the minimum participation requirement is reduced to 10% as<br />

of 1 January 2009; and<br />

dividends paid by a Belgian resident company to a parent<br />

company resident in a jurisdiction with which Belgium has<br />

concluded a bilateral tax treaty, subject to the same<br />

conditions as for parent companies resident in the EU (see<br />

supra) provided that this treaty (or another separate treaty)<br />

provides for the exchange of information for purposes of<br />

applying domestic tax law between the treaty states.<br />

Generally, most bilateral tax treaties concluded by Belgium provide<br />

for a reduction of the Belgian dividend withholding tax rate to 15%<br />

and even 10% or 5% in the case of a substantial participation in the<br />

capital of the Belgian company (often 25%) held by a company<br />

resident in the other contracting state. Most recent treaties (e.g. the<br />

treaty with Hong Kong and with the US) and the Belgian Draft<br />

Model Convention provide for a 0% rate for dividends on such<br />

substantial participation.<br />

are paid are not connected to a permanent establishment of the<br />

beneficial owner of the royalty income located outside the EU<br />

territory. Companies are considered to be “related companies”<br />

provided that either:<br />

(i) one of these companies directly or indirectly holds a<br />

participation of at least 25% in the capital of the other<br />

company, during an uninterrupted period of at least 1 year; or<br />

(ii) a participation of at least 25% in the capital of both<br />

companies is directly or indirectly held by an EU resident<br />

company during an uninterrupted period of at least 1 year.<br />

3.3 Would there be any withholding tax on interest paid by a<br />

local company to a non-resident<br />

According to domestic tax law, Belgian source interest payments<br />

are generally subject to a 15% withholding tax. Some bilateral tax<br />

treaties to which Belgium is a party (e.g. treaties with Germany,<br />

Luxembourg and the Netherlands) provide for an exemption from<br />

interest withholding tax in the source state. Other treaties limit the<br />

withholding tax to be levied in Belgium to 10%. Domestic tax law<br />

also provides for a withholding tax exemption for certain interest<br />

payments to non-residents, such as:<br />

interest payments on receivables (other than bonds) that are<br />

paid by Belgian companies or professionals (including<br />

permanent establishments of non-resident companies or<br />

physical persons) to non-resident credit institutions located in a<br />

Member State of the European Economic Area, or in a country<br />

with which Belgium has concluded a bilateral tax treaty;<br />

interest payments on receivables (other than bonds) that are<br />

paid to non-residents that do not use the receivables for<br />

professional activities in Belgium, by Belgian financial<br />

enterprises, including certain listed holding companies and<br />

intra-group financing companies, subject to certain<br />

conditions;<br />

interest payments on registered bonds that are paid to nonresidents<br />

that do not hold the bonds for professional activities<br />

in Belgium, subject to certain conditions;<br />

interest payments to the Belgian permanent establishment of<br />

foreign banks; and<br />

interest payments between two non-residents through the<br />

intermediation of a group finance or cash pooling centre<br />

located in Belgium (under certain conditions).<br />

Moreover, in execution of the Interest and Royalty Directive,<br />

interest payments by a Belgian resident company to a related<br />

company in another EU Member State are exempt from<br />

withholding tax, provided that, during the period to which the<br />

interest income relates, the underlying receivable is not held<br />

through a permanent establishment of the beneficial owner of the<br />

interest income located outside the EU territory. We refer to<br />

question 3.2 above for the definition of “related companies”.<br />

Belgium<br />

3.2 Would there be any withholding tax on royalties paid by a<br />

local company to a non-resident<br />

3.4 Would relief for interest so paid be restricted by reference<br />

to “thin capitalisation” rules<br />

According to domestic tax law, Belgian source royalty payments<br />

are subject to a withholding tax of 15%. However, in many bilateral<br />

tax treaties to which Belgium is a party, royalty payments must be<br />

exempt from income tax in the source state. In some treaties,<br />

however, this is limited to specific types of royalty payments.<br />

In execution of the EU Interest and Royalty Directive, royalty<br />

payments by a Belgian resident company to a related company in<br />

another EU Member State are exempt from withholding tax,<br />

provided that, during the period to which the royalty income relates,<br />

the underlying assets or intellectual property for which the royalties<br />

ICLG TO: CORPORATE TAX <strong>2010</strong><br />

© Published and reproduced with kind permission by Global Legal Group Ltd, London<br />

Belgian tax law includes 2 specific rules aimed at avoiding thin<br />

capitalisation:<br />

the “7:1” rule: according to this rule, interest payments, other<br />

than those on bonds or similar publicly issued debt securities,<br />

to beneficiaries that are not subject to income tax or benefit<br />

from a substantially more favourable tax regime in respect of<br />

such interest income compared to the normal tax treatment in<br />

Belgium, are not tax-deductible to the extent that they relate<br />

to that part of the loans granted by such beneficiaries which<br />

exceeds seven times the paid in capital and (non-exempt)<br />

reserves of the Belgian borrowing company; and<br />

WWW.ICLG.CO.UK 27