Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 101<br />

225<br />

226<br />

227<br />

228<br />

229<br />

230<br />

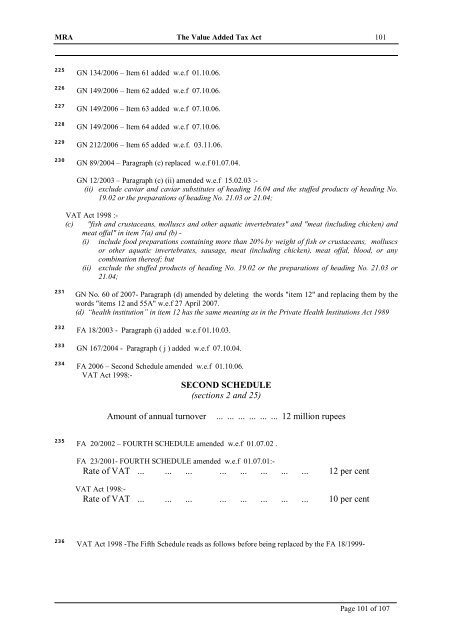

GN 134/2006 – Item 61 added w.e.f 01.10.06.<br />

GN 149/2006 – Item 62 added w.e.f 07.10.06.<br />

GN 149/2006 – Item 63 added w.e.f 07.10.06.<br />

GN 149/2006 – Item 64 added w.e.f 07.10.06.<br />

GN 212/2006 – Item 65 added w.e.f. 03.11.06.<br />

GN 89/2004 – Paragraph (c) replaced w.e.f 01.07.04.<br />

GN 12/2003 – Paragraph (c) (ii) amended w.e.f 15.02.03 :-<br />

(ii) exclude caviar and caviar substitutes <strong>of</strong> heading 16.04 and the stuffed products <strong>of</strong> heading No.<br />

19.02 or the preparations <strong>of</strong> heading No. 21.03 or 21.04;<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

(c) "fish and crustaceans, molluscs and other aquatic invertebrates" and "meat (including chicken) and<br />

meat <strong>of</strong>fal" in item 7(a) and (b) -<br />

(i) include food preparations containing more than 20% by weight <strong>of</strong> fish or crustaceans, molluscs<br />

or other aquatic invertebrates, sausage, meat (including chicken), meat <strong>of</strong>fal, blood, or any<br />

combination there<strong>of</strong>; but<br />

(ii) exclude the stuffed products <strong>of</strong> heading No. 19.02 or the preparations <strong>of</strong> heading No. 21.03 or<br />

21.04;<br />

231<br />

232<br />

233<br />

234<br />

GN No. 60 <strong>of</strong> 2007- Paragraph (d) amended by deleting the words "item 12" and replacing them by the<br />

words "items 12 and 55A" w.e.f 27 April 2007.<br />

(d) “health institution” in item 12 has the same meaning as in the Private Health Institutions <strong>Act</strong> 1989<br />

FA 18/2003 - Paragraph (i) added w.e.f 01.10.03.<br />

GN 167/2004 - Paragraph ( j ) added w.e.f 07.10.04.<br />

FA 2006 – Second Schedule amended w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

SECOND SCHEDULE<br />

(sections 2 and 25)<br />

Amount <strong>of</strong> annual turnover<br />

... ... ... ... ... ... 12 million rupees<br />

235<br />

FA 20/2002 – FOURTH SCHEDULE amended w.e.f 01.07.02 .<br />

FA 23/2001- FOURTH SCHEDULE amended w.e.f 01.07.01:-<br />

Rate <strong>of</strong> VAT ... ... ... ... ... ... ... ... 12 per cent<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

Rate <strong>of</strong> VAT ... ... ... ... ... ... ... ... 10 per cent<br />

236<br />

VAT <strong>Act</strong> <strong>1998</strong> -<strong>The</strong> Fifth Schedule reads as follows before being replaced by the FA 18/1999-<br />

Page 101 <strong>of</strong> 107