Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

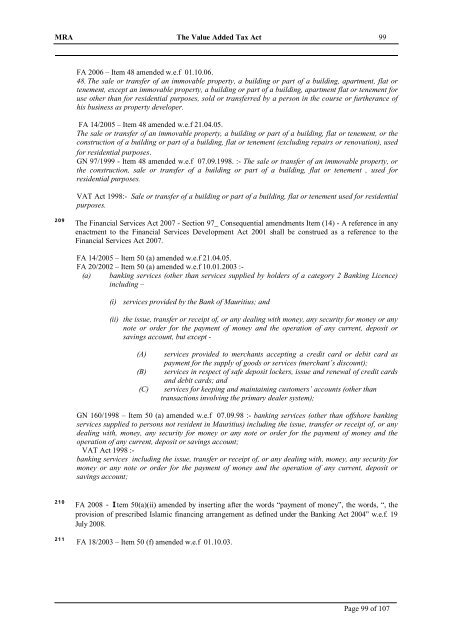

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 99<br />

FA 2006 – Item 48 amended w.e.f 01.10.06.<br />

48. <strong>The</strong> sale or transfer <strong>of</strong> an immovable property, a building or part <strong>of</strong> a building, apartment, flat or<br />

tenement, except an immovable property, a building or part <strong>of</strong> a building, apartment flat or tenement for<br />

use other than for residential purposes, sold or transferred by a person in the course or furtherance <strong>of</strong><br />

his business as property developer.<br />

FA 14/2005 – Item 48 amended w.e.f 21.04.05.<br />

<strong>The</strong> sale or transfer <strong>of</strong> an immovable property, a building or part <strong>of</strong> a building, flat or tenement, or the<br />

construction <strong>of</strong> a building or part <strong>of</strong> a building, flat or tenement (excluding repairs or renovation), used<br />

for residential purposes.<br />

GN 97/1999 - Item 48 amended w.e.f 07.09.<strong>1998</strong>. :- <strong>The</strong> sale or transfer <strong>of</strong> an immovable property, or<br />

the construction, sale or transfer <strong>of</strong> a building or part <strong>of</strong> a building, flat or tenement , used for<br />

residential purposes.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Sale or transfer <strong>of</strong> a building or part <strong>of</strong> a building, flat or tenement used for residential<br />

purposes.<br />

209<br />

<strong>The</strong> Financial Services <strong>Act</strong> 2007 - Section 97_ Consequential amendments Item (14) - A reference in any<br />

enactment to the Financial Services Development <strong>Act</strong> 2001 shall be construed as a reference to the<br />

Financial Services <strong>Act</strong> 2007.<br />

FA 14/2005 – Item 50 (a) amended w.e.f 21.04.05.<br />

FA 20/2002 – Item 50 (a) amended w.e.f 10.01.2003 :-<br />

(a) banking services (other than services supplied by holders <strong>of</strong> a category 2 Banking Licence)<br />

including –<br />

(i) services provided by the Bank <strong>of</strong> <strong>Mauritius</strong>; and<br />

(ii) the issue, transfer or receipt <strong>of</strong>, or any dealing with money, any security for money or any<br />

note or order for the payment <strong>of</strong> money and the operation <strong>of</strong> any current, deposit or<br />

savings account, but except -<br />

(A)<br />

(B)<br />

(C)<br />

services provided to merchants accepting a credit card or debit card as<br />

payment for the supply <strong>of</strong> goods or services (merchant’s discount);<br />

services in respect <strong>of</strong> safe deposit lockers, issue and renewal <strong>of</strong> credit cards<br />

and debit cards; and<br />

services for keeping and maintaining customers’ accounts (other than<br />

transactions involving the primary dealer system);<br />

GN 160/<strong>1998</strong> – Item 50 (a) amended w.e.f 07.09.98 :- banking services (other than <strong>of</strong>fshore banking<br />

services supplied to persons not resident in <strong>Mauritius</strong>) including the issue, transfer or receipt <strong>of</strong>, or any<br />

dealing with, money, any security for money or any note or order for the payment <strong>of</strong> money and the<br />

operation <strong>of</strong> any current, deposit or savings account;<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

banking services including the issue, transfer or receipt <strong>of</strong>, or any dealing with, money, any security for<br />

money or any note or order for the payment <strong>of</strong> money and the operation <strong>of</strong> any current, deposit or<br />

savings account;<br />

210<br />

211<br />

FA 2008 - Item 50(a)(ii) amended by inserting after the words “payment <strong>of</strong> money”, the words, “, the<br />

provision <strong>of</strong> prescribed Islamic financing arrangement as defined under the Banking <strong>Act</strong> 2004” w.e.f. 19<br />

July 2008.<br />

FA 18/2003 – Item 50 (f) amended w.e.f 01.10.03.<br />

Page 99 <strong>of</strong> 107