Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

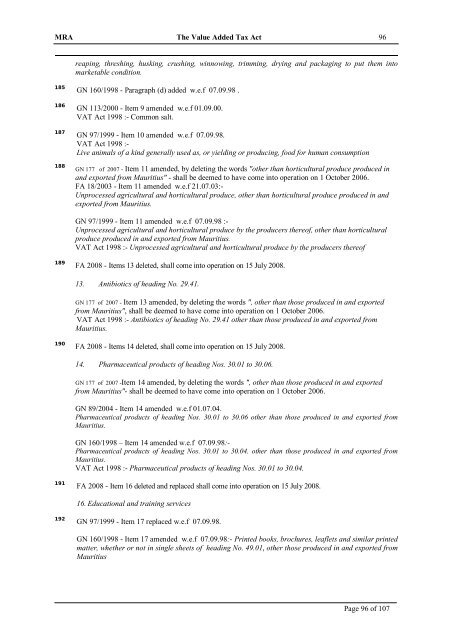

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 96<br />

reaping, threshing, husking, crushing, winnowing, trimming, drying and packaging to put them into<br />

marketable condition.<br />

185<br />

186<br />

187<br />

188<br />

GN 160/<strong>1998</strong> - Paragraph (d) added w.e.f 07.09.98 .<br />

GN 113/2000 - Item 9 amended w.e.f 01.09.00.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Common salt.<br />

GN 97/1999 - Item 10 amended w.e.f 07.09.98.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

Live animals <strong>of</strong> a kind generally used as, or yielding or producing, food for human consumption<br />

GN 177 <strong>of</strong> 2007 - Item 11 amended, by deleting the words "other than horticultural produce produced in<br />

and exported from <strong>Mauritius</strong>" - shall be deemed to have come into operation on 1 October 2006.<br />

FA 18/2003 - Item 11 amended w.e.f 21.07.03:-<br />

Unprocessed agricultural and horticultural produce, other than horticultural produce produced in and<br />

exported from <strong>Mauritius</strong>.<br />

GN 97/1999 - Item 11 amended w.e.f 07.09.98 :-<br />

Unprocessed agricultural and horticultural produce by the producers there<strong>of</strong>, other than horticultural<br />

produce produced in and exported from <strong>Mauritius</strong>.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Unprocessed agricultural and horticultural produce by the producers there<strong>of</strong><br />

189<br />

FA 2008 - Items 13 deleted, shall come into operation on 15 July 2008.<br />

13. Antibiotics <strong>of</strong> heading No. 29.41.<br />

GN 177 <strong>of</strong> 2007 - Item 13 amended, by deleting the words ", other than those produced in and exported<br />

from <strong>Mauritius</strong>", shall be deemed to have come into operation on 1 October 2006.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Antibiotics <strong>of</strong> heading No. 29.41 other than those produced in and exported from<br />

<strong>Mauritius</strong>.<br />

190<br />

FA 2008 - Items 14 deleted, shall come into operation on 15 July 2008.<br />

14. Pharmaceutical products <strong>of</strong> heading Nos. 30.01 to 30.06.<br />

GN 177 <strong>of</strong> 2007 -Item 14 amended, by deleting the words ", other than those produced in and exported<br />

from <strong>Mauritius</strong>"- shall be deemed to have come into operation on 1 October 2006.<br />

GN 89/2004 - Item 14 amended w.e.f 01.07.04.<br />

Pharmaceutical products <strong>of</strong> heading Nos. 30.01 to 30.06 other than those produced in and exported from<br />

<strong>Mauritius</strong>.<br />

GN 160/<strong>1998</strong> – Item 14 amended w.e.f 07.09.98:-<br />

Pharmaceutical products <strong>of</strong> heading Nos. 30.01 to 30.04. other than those produced in and exported from<br />

<strong>Mauritius</strong>.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Pharmaceutical products <strong>of</strong> heading Nos. 30.01 to 30.04.<br />

191<br />

FA 2008 - Item 16 deleted and replaced shall come into operation on 15 July 2008.<br />

16. Educational and training services<br />

192<br />

GN 97/1999 - Item 17 replaced w.e.f 07.09.98.<br />

GN 160/<strong>1998</strong> - Item 17 amended w.e.f 07.09.98:- Printed books, brochures, leaflets and similar printed<br />

matter, whether or not in single sheets <strong>of</strong> heading No. 49.01, other those produced in and exported from<br />

<strong>Mauritius</strong><br />

Page 96 <strong>of</strong> 107