Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

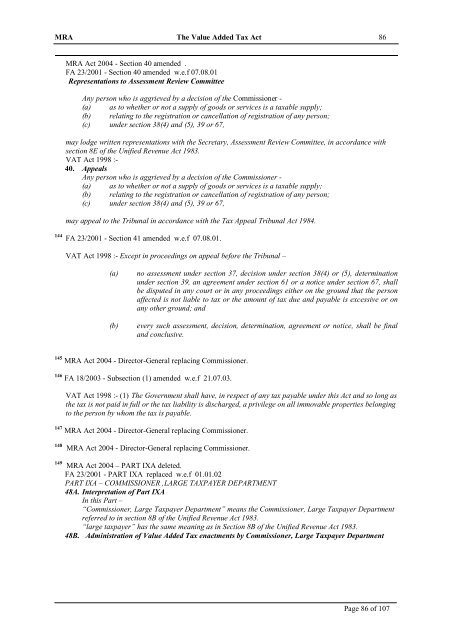

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 86<br />

MRA <strong>Act</strong> 2004 - Section 40 amended .<br />

FA 23/2001 - Section 40 amended w.e.f 07.08.01<br />

Representations to Assessment Review Committee<br />

Any person who is aggrieved by a decision <strong>of</strong> the Commissioner -<br />

(a) as to whether or not a supply <strong>of</strong> goods or services is a taxable supply;<br />

(b) relating to the registration or cancellation <strong>of</strong> registration <strong>of</strong> any person;<br />

(c) under section 38(4) and (5), 39 or 67,<br />

may lodge written representations with the Secretary, Assessment Review Committee, in accordance with<br />

section 8E <strong>of</strong> the Unified Revenue <strong>Act</strong> 1983.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

40. Appeals<br />

Any person who is aggrieved by a decision <strong>of</strong> the Commissioner -<br />

(a) as to whether or not a supply <strong>of</strong> goods or services is a taxable supply;<br />

(b) relating to the registration or cancellation <strong>of</strong> registration <strong>of</strong> any person;<br />

(c) under section 38(4) and (5), 39 or 67,<br />

may appeal to the Tribunal in accordance with the <strong>Tax</strong> Appeal Tribunal <strong>Act</strong> 1984.<br />

144 FA 23/2001 - Section 41 amended w.e.f 07.08.01.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Except in proceedings on appeal before the Tribunal –<br />

(a)<br />

(b)<br />

no assessment under section 37, decision under section 38(4) or (5), determination<br />

under section 39, an agreement under section 61 or a notice under section 67, shall<br />

be disputed in any court or in any proceedings either on the ground that the person<br />

affected is not liable to tax or the amount <strong>of</strong> tax due and payable is excessive or on<br />

any other ground; and<br />

every such assessment, decision, determination, agreement or notice, shall be final<br />

and conclusive.<br />

145 MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

146 FA 18/2003 - Subsection (1) amended w.e.f 21.07.03.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- (1) <strong>The</strong> Government shall have, in respect <strong>of</strong> any tax payable under this <strong>Act</strong> and so long as<br />

the tax is not paid in full or the tax liability is discharged, a privilege on all immovable properties belonging<br />

to the person by whom the tax is payable.<br />

147 MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

148 MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

149 MRA <strong>Act</strong> 2004 – PART IXA deleted.<br />

FA 23/2001 - PART IXA replaced w.e.f 01.01.02<br />

PART IXA – COMMISSIONER ,LARGE TAXPAYER DEPARTMENT<br />

48A. Interpretation <strong>of</strong> Part IXA<br />

In this Part –<br />

“Commissioner, Large <strong>Tax</strong>payer Department” means the Commissioner, Large <strong>Tax</strong>payer Department<br />

referred to in section 8B <strong>of</strong> the Unified Revenue <strong>Act</strong> 1983.<br />

“large taxpayer” has the same meaning as in Section 8B <strong>of</strong> the Unified Revenue <strong>Act</strong> 1983.<br />

48B. Administration <strong>of</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> enactments by Commissioner, Large <strong>Tax</strong>payer Department<br />

Page 86 <strong>of</strong> 107