Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 74<br />

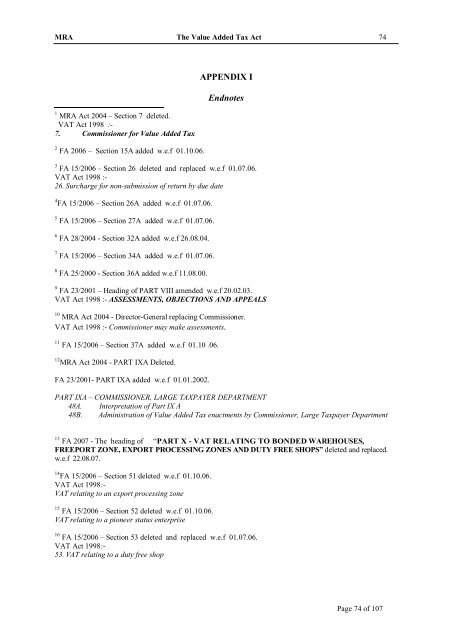

1 MRA <strong>Act</strong> 2004 – Section 7 deleted.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

7. Commissioner for <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong><br />

2 FA 2006 – Section 15A added w.e.f 01.10.06.<br />

APPENDIX I<br />

Endnotes<br />

3 FA 15/2006 – Section 26 deleted and replaced w.e.f 01.07.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

26. Surcharge for non-submission <strong>of</strong> return by due date<br />

4 FA 15/2006 – Section 26A added w.e.f 01.07.06.<br />

5 FA 15/2006 – Section 27A added w.e.f 01.07.06.<br />

6 FA 28/2004 - Section 32A added w.e.f 26.08.04.<br />

7 FA 15/2006 – Section 34A added w.e.f 01.07.06.<br />

8 FA 25/2000 - Section 36A added w.e.f 11.08.00.<br />

9 FA 23/2001 – Heading <strong>of</strong> PART VIII amended w.e.f 20.02.03.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- ASSESSMENTS, OBJECTIONS AND APPEALS<br />

10 MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Commissioner may make assessments.<br />

11 FA 15/2006 – Section 37A added w.e.f 01.10 .06.<br />

12 MRA <strong>Act</strong> 2004 - PART IXA Deleted.<br />

FA 23/2001- PART IXA added w.e.f 01.01.2002.<br />

PART IXA – COMMISSIONER, LARGE TAXPAYER DEPARTMENT<br />

48A. Interpretation <strong>of</strong> Part IX A<br />

48B. Administration <strong>of</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> enactments by Commissioner, Large <strong>Tax</strong>payer Department<br />

13 FA 2007 - <strong>The</strong> heading <strong>of</strong> “PART X - VAT RELATING TO BONDED WAREHOUSES,<br />

FREEPORT ZONE, EXPORT PROCESSING ZONES AND DUTY FREE SHOPS” deleted and replaced.<br />

w.e.f 22.08.07.<br />

14 FA 15/2006 – Section 51 deleted w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

VAT relating to an export processing zone<br />

15 FA 15/2006 – Section 52 deleted w.e.f 01.10.06.<br />

VAT relating to a pioneer status enterprise<br />

16 FA 15/2006 – Section 53 deleted and replaced w.e.f 01.07.06.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

53. VAT relating to a duty free shop<br />

Page 74 <strong>of</strong> 107