Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

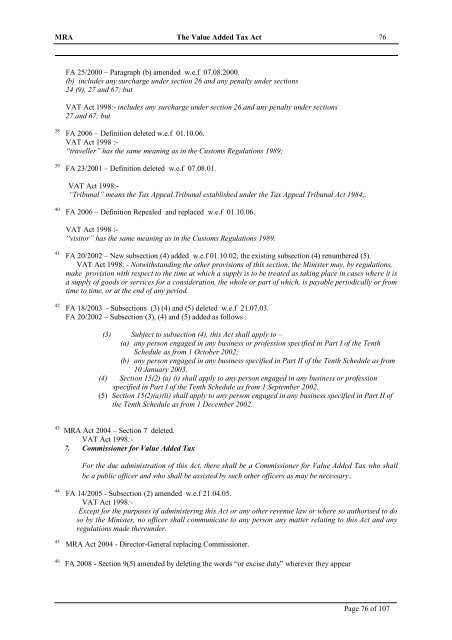

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 76<br />

FA 25/2000 – Paragraph (b) amended w.e.f 07.08.2000.<br />

(b) includes any surcharge under section 26 and any penalty under sections<br />

24 (9), 27 and 67; but<br />

VAT <strong>Act</strong> <strong>1998</strong>:- includes any surcharge under section 26 and any penalty under sections<br />

27 and 67; but<br />

38<br />

39<br />

FA 2006 – Definition deleted w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

“traveller” has the same meaning as in the Customs Regulations 1989;<br />

FA 23/2001 – Definition deleted w.e.f 07.08.01.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

“Tribunal” means the <strong>Tax</strong> Appeal Tribunal established under the <strong>Tax</strong> Appeal Tribunal <strong>Act</strong> 1984;.<br />

40<br />

FA 2006 – Definition Repealed and replaced w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

“visitor” has the same meaning as in the Customs Regulations 1989.<br />

41<br />

42<br />

FA 20/2002 – New subsection (4) added w.e.f 01.10.02; the existing subsection (4) renumbered (5).<br />

VAT <strong>Act</strong> <strong>1998</strong>: - Notwithstanding the other provisions <strong>of</strong> this section, the Minister may, by regulations,<br />

make provision with respect to the time at which a supply is to be treated as taking place in cases where it is<br />

a supply <strong>of</strong> goods or services for a consideration, the whole or part <strong>of</strong> which, is payable periodically or from<br />

time to time, or at the end <strong>of</strong> any period.<br />

FA 18/2003 - Subsections (3) (4) and (5) deleted w.e.f 21.07.03.<br />

FA 20/2002 – Subsection (3), (4) and (5) added as follows :<br />

(3) Subject to subsection (4), this <strong>Act</strong> shall apply to –<br />

(a) any person engaged in any business or pr<strong>of</strong>ession specified in Part I <strong>of</strong> the Tenth<br />

Schedule as from 1 October 2002;<br />

(b) any person engaged in any business specified in Part II <strong>of</strong> the Tenth Schedule as from<br />

10 January 2003.<br />

(4) Section 15(2) (a) (i) shall apply to any person engaged in any business or pr<strong>of</strong>ession<br />

specified in Part I <strong>of</strong> the Tenth Schedule as from 1 September 2002.<br />

(5) Section 15(2)(a)(ii) shall apply to any person engaged in any business specified in Part II <strong>of</strong><br />

the Tenth Schedule as from 1 December 2002.<br />

43 MRA <strong>Act</strong> 2004 – Section 7 deleted.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

7. Commissioner for <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong><br />

For the due administration <strong>of</strong> this <strong>Act</strong>, there shall be a Commissioner for <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> who shall<br />

be a public <strong>of</strong>ficer and who shall be assisted by such other <strong>of</strong>ficers as may be necessary.<br />

44<br />

45<br />

46<br />

FA 14/2005 - Subsection (2) amended w.e.f 21.04.05.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

Except for the purposes <strong>of</strong> administering this <strong>Act</strong> or any other revenue law or where so authorised to do<br />

so by the Minister, no <strong>of</strong>ficer shall communicate to any person any matter relating to this <strong>Act</strong> and any<br />

regulations made thereunder.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 2008 - Section 9(5) amended by deleting the words “or excise duty” wherever they appear<br />

Page 76 <strong>of</strong> 107