Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

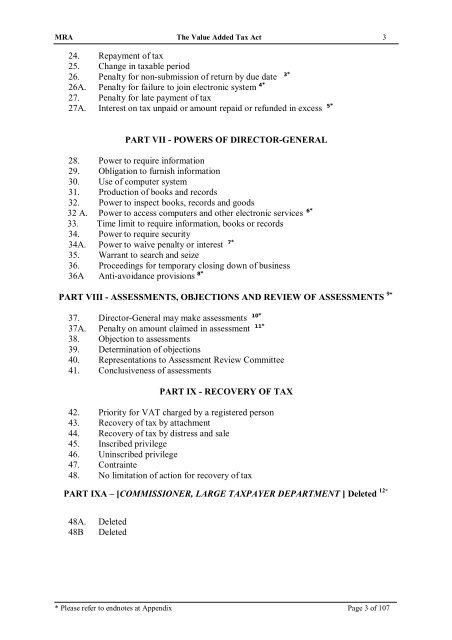

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 3<br />

24. Repayment <strong>of</strong> tax<br />

25. Change in taxable period<br />

26. Penalty for non-submission <strong>of</strong> return by due date 3*<br />

26A. Penalty for failure to join electronic system 4*<br />

27. Penalty for late payment <strong>of</strong> tax<br />

27A. Interest on tax unpaid or amount repaid or refunded in excess 5*<br />

PART VII - POWERS OF DIRECTOR-GENERAL<br />

28. Power to require information<br />

29. Obligation to furnish information<br />

30. Use <strong>of</strong> computer system<br />

31. Production <strong>of</strong> books and records<br />

32. Power to inspect books, records and goods<br />

32 A. Power to access computers and other electronic services 6*<br />

33. Time limit to require information, books or records<br />

34. Power to require security<br />

34A. Power to waive penalty or interest 7*<br />

35. Warrant to search and seize<br />

36. Proceedings for temporary closing down <strong>of</strong> business<br />

36A Anti-avoidance provisions 8*<br />

PART VIII - ASSESSMENTS, OBJECTIONS AND REVIEW OF ASSESSMENTS 9*<br />

37. Director-General may make assessments 10*<br />

37A. Penalty on amount claimed in assessment 11*<br />

38. Objection to assessments<br />

39. Determination <strong>of</strong> objections<br />

40. Representations to Assessment Review Committee<br />

41. Conclusiveness <strong>of</strong> assessments<br />

PART IX - RECOVERY OF TAX<br />

42. Priority for VAT charged by a registered person<br />

43. Recovery <strong>of</strong> tax by attachment<br />

44. Recovery <strong>of</strong> tax by distress and sale<br />

45. Inscribed privilege<br />

46. Uninscribed privilege<br />

47. Contrainte<br />

48. No limitation <strong>of</strong> action for recovery <strong>of</strong> tax<br />

PART IXA – [COMMISSIONER, LARGE TAXPAYER DEPARTMENT ] Deleted 12*<br />

48A. Deleted<br />

48B Deleted<br />

* Please refer to endnotes at Appendix Page 3 <strong>of</strong> 107