Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 79<br />

74<br />

75<br />

76<br />

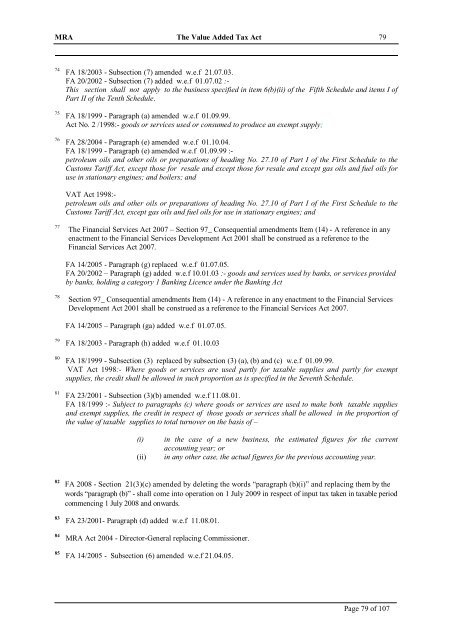

FA 18/2003 - Subsection (7) amended w.e.f 21.07.03.<br />

FA 20/2002 - Subsection (7) added w.e.f 01.07.02 :-<br />

This section shall not apply to the business specified in item 6(b)(ii) <strong>of</strong> the Fifth Schedule and items I <strong>of</strong><br />

Part II <strong>of</strong> the Tenth Schedule.<br />

FA 18/1999 - Paragraph (a) amended w.e.f 01.09.99.<br />

<strong>Act</strong> No. 2 /<strong>1998</strong>:- goods or services used or consumed to produce an exempt supply;<br />

FA 28/2004 - Paragraph (e) amended w.e.f 01.10.04.<br />

FA 18/1999 - Paragraph (e) amended w.e.f 01.09.99 :-<br />

petroleum oils and other oils or preparations <strong>of</strong> heading No. 27.10 <strong>of</strong> Part I <strong>of</strong> the First Schedule to the<br />

Customs Tariff <strong>Act</strong>, except those for resale and except those for resale and except gas oils and fuel oils for<br />

use in stationary engines; and boilers; and<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

petroleum oils and other oils or preparations <strong>of</strong> heading No. 27.10 <strong>of</strong> Part I <strong>of</strong> the First Schedule to the<br />

Customs Tariff <strong>Act</strong>, except gas oils and fuel oils for use in stationary engines; and<br />

77<br />

<strong>The</strong> Financial Services <strong>Act</strong> 2007 – Section 97_ Consequential amendments Item (14) - A reference in any<br />

enactment to the Financial Services Development <strong>Act</strong> 2001 shall be construed as a reference to the<br />

Financial Services <strong>Act</strong> 2007.<br />

FA 14/2005 - Paragraph (g) replaced w.e.f 01.07.05.<br />

FA 20/2002 – Paragraph (g) added w.e.f 10.01.03 :- goods and services used by banks, or services provided<br />

by banks, holding a category 1 Banking Licence under the Banking <strong>Act</strong><br />

78<br />

Section 97_ Consequential amendments Item (14) - A reference in any enactment to the Financial Services<br />

Development <strong>Act</strong> 2001 shall be construed as a reference to the Financial Services <strong>Act</strong> 2007.<br />

FA 14/2005 – Paragraph (ga) added w.e.f 01.07.05.<br />

79<br />

80<br />

81<br />

FA 18/2003 - Paragraph (h) added w.e.f 01.10.03<br />

FA 18/1999 - Subsection (3) replaced by subsection (3) (a), (b) and (c) w.e.f 01.09.99.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Where goods or services are used partly for taxable supplies and partly for exempt<br />

supplies, the credit shall be allowed in such proportion as is specified in the Seventh Schedule.<br />

FA 23/2001 - Subsection (3)(b) amended w.e.f 11.08.01.<br />

FA 18/1999 :- Subject to paragraphs (c) where goods or services are used to make both taxable supplies<br />

and exempt supplies, the credit in respect <strong>of</strong> those goods or services shall be allowed in the proportion <strong>of</strong><br />

the value <strong>of</strong> taxable supplies to total turnover on the basis <strong>of</strong> –<br />

(i)<br />

(ii)<br />

in the case <strong>of</strong> a new business, the estimated figures for the current<br />

accounting year; or<br />

in any other case, the actual figures for the previous accounting year.<br />

82<br />

83<br />

84<br />

85<br />

FA 2008 - Section 21(3)(c) amended by deleting the words “paragraph (b)(i)” and replacing them by the<br />

words “paragraph (b)” - shall come into operation on 1 July 2009 in respect <strong>of</strong> input tax taken in taxable period<br />

commencing 1 July 2008 and onwards.<br />

FA 23/2001- Paragraph (d) added w.e.f 11.08.01.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 14/2005 - Subsection (6) amended w.e.f 21.04.05.<br />

Page 79 <strong>of</strong> 107