Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 62<br />

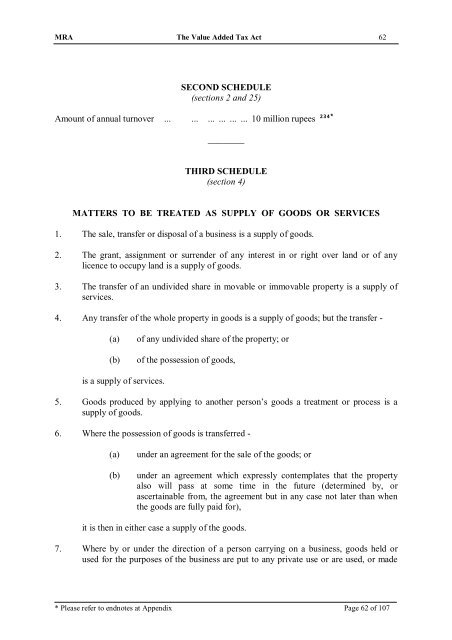

SECOND SCHEDULE<br />

(sections 2 and 25)<br />

Amount <strong>of</strong> annual turnover ... ... ... ... ... ... 10 million rupees 234*<br />

________<br />

THIRD SCHEDULE<br />

(section 4)<br />

MATTERS TO BE TREATED AS SUPPLY OF GOODS OR SERVICES<br />

1. <strong>The</strong> sale, transfer or disposal <strong>of</strong> a business is a supply <strong>of</strong> goods.<br />

2. <strong>The</strong> grant, assignment or surrender <strong>of</strong> any interest in or right over land or <strong>of</strong> any<br />

licence to occupy land is a supply <strong>of</strong> goods.<br />

3. <strong>The</strong> transfer <strong>of</strong> an undivided share in movable or immovable property is a supply <strong>of</strong><br />

services.<br />

4. Any transfer <strong>of</strong> the whole property in goods is a supply <strong>of</strong> goods; but the transfer -<br />

(a)<br />

(b)<br />

<strong>of</strong> any undivided share <strong>of</strong> the property; or<br />

<strong>of</strong> the possession <strong>of</strong> goods,<br />

is a supply <strong>of</strong> services.<br />

5. Goods produced by applying to another person’s goods a treatment or process is a<br />

supply <strong>of</strong> goods.<br />

6. Where the possession <strong>of</strong> goods is transferred -<br />

(a)<br />

(b)<br />

under an agreement for the sale <strong>of</strong> the goods; or<br />

under an agreement which expressly contemplates that the property<br />

also will pass at some time in the future (determined by, or<br />

ascertainable from, the agreement but in any case not later than when<br />

the goods are fully paid for),<br />

it is then in either case a supply <strong>of</strong> the goods.<br />

7. Where by or under the direction <strong>of</strong> a person carrying on a business, goods held or<br />

used for the purposes <strong>of</strong> the business are put to any private use or are used, or made<br />

* Please refer to endnotes at Appendix Page 62 <strong>of</strong> 107