Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

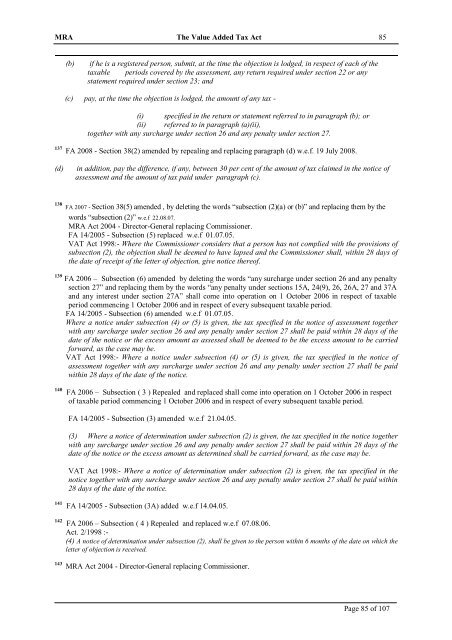

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 85<br />

(b)<br />

if he is a registered person, submit, at the time the objection is lodged, in respect <strong>of</strong> each <strong>of</strong> the<br />

taxable periods covered by the assessment, any return required under section 22 or any<br />

statement required under section 23; and<br />

(c) pay, at the time the objection is lodged, the amount <strong>of</strong> any tax -<br />

(i) specified in the return or statement referred to in paragraph (b); or<br />

(ii) referred to in paragraph (a)(ii),<br />

together with any surcharge under section 26 and any penalty under section 27.<br />

137 FA 2008 - Section 38(2) amended by repealing and replacing paragraph (d) w.e.f. 19 July 2008.<br />

(d)<br />

in addition, pay the difference, if any, between 30 per cent <strong>of</strong> the amount <strong>of</strong> tax claimed in the notice <strong>of</strong><br />

assessment and the amount <strong>of</strong> tax paid under paragraph (c).<br />

138 FA 2007 - Section 38(5) amended , by deleting the words “subsection (2)(a) or (b)” and replacing them by the<br />

words “subsection (2)” w.e.f 22.08.07.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 14/2005 - Subsection (5) replaced w.e.f 01.07.05.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Where the Commissioner considers that a person has not complied with the provisions <strong>of</strong><br />

subsection (2), the objection shall be deemed to have lapsed and the Commissioner shall, within 28 days <strong>of</strong><br />

the date <strong>of</strong> receipt <strong>of</strong> the letter <strong>of</strong> objection, give notice there<strong>of</strong>.<br />

139 FA 2006 – Subsection (6) amended by deleting the words “any surcharge under section 26 and any penalty<br />

section 27” and replacing them by the words “any penalty under sections 15A, 24(9), 26, 26A, 27 and 37A<br />

and any interest under section 27A” shall come into operation on 1 October 2006 in respect <strong>of</strong> taxable<br />

period commencing 1 October 2006 and in respect <strong>of</strong> every subsequent taxable period.<br />

FA 14/2005 - Subsection (6) amended w.e.f 01.07.05.<br />

Where a notice under subsection (4) or (5) is given, the tax specified in the notice <strong>of</strong> assessment together<br />

with any surcharge under section 26 and any penalty under section 27 shall be paid within 28 days <strong>of</strong> the<br />

date <strong>of</strong> the notice or the excess amount as assessed shall be deemed to be the excess amount to be carried<br />

forward, as the case may be.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Where a notice under subsection (4) or (5) is given, the tax specified in the notice <strong>of</strong><br />

assessment together with any surcharge under section 26 and any penalty under section 27 shall be paid<br />

within 28 days <strong>of</strong> the date <strong>of</strong> the notice.<br />

140 FA 2006 – Subsection ( 3 ) Repealed and replaced shall come into operation on 1 October 2006 in respect<br />

<strong>of</strong> taxable period commencing 1 October 2006 and in respect <strong>of</strong> every subsequent taxable period.<br />

FA 14/2005 - Subsection (3) amended w.e.f 21.04.05.<br />

(3) Where a notice <strong>of</strong> determination under subsection (2) is given, the tax specified in the notice together<br />

with any surcharge under section 26 and any penalty under section 27 shall be paid within 28 days <strong>of</strong> the<br />

date <strong>of</strong> the notice or the excess amount as determined shall be carried forward, as the case may be.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Where a notice <strong>of</strong> determination under subsection (2) is given, the tax specified in the<br />

notice together with any surcharge under section 26 and any penalty under section 27 shall be paid within<br />

28 days <strong>of</strong> the date <strong>of</strong> the notice.<br />

141 FA 14/2005 - Subsection (3A) added w.e.f 14.04.05.<br />

142 FA 2006 – Subsection ( 4 ) Repealed and replaced w.e.f 07.08.06.<br />

<strong>Act</strong>. 2/<strong>1998</strong> :-<br />

(4) A notice <strong>of</strong> determination under subsection (2), shall be given to the person within 6 months <strong>of</strong> the date on which the<br />

letter <strong>of</strong> objection is received.<br />

143 MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

Page 85 <strong>of</strong> 107