Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

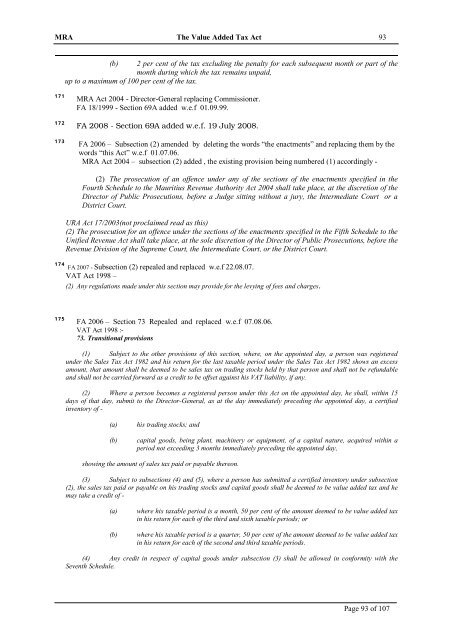

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 93<br />

(b) 2 per cent <strong>of</strong> the tax excluding the penalty for each subsequent month or part <strong>of</strong> the<br />

month during which the tax remains unpaid,<br />

up to a maximum <strong>of</strong> 100 per cent <strong>of</strong> the tax.<br />

171<br />

172<br />

173<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 18/1999 - Section 69A added w.e.f 01.09.99.<br />

FA 2008 - Section 69A added w.e.f. 19 July 2008.<br />

FA 2006 – Subsection (2) amended by deleting the words “the enactments” and replacing them by the<br />

words “this <strong>Act</strong>” w.e.f 01.07.06.<br />

MRA <strong>Act</strong> 2004 – subsection (2) added , the existing provision being numbered (1) accordingly -<br />

(2) <strong>The</strong> prosecution <strong>of</strong> an <strong>of</strong>fence under any <strong>of</strong> the sections <strong>of</strong> the enactments specified in the<br />

Fourth Schedule to the <strong>Mauritius</strong> Revenue Authority <strong>Act</strong> 2004 shall take place, at the discretion <strong>of</strong> the<br />

Director <strong>of</strong> Public Prosecutions, before a Judge sitting without a jury, the Intermediate Court or a<br />

District Court.<br />

URA <strong>Act</strong> 17/2003(not proclaimed read as this)<br />

(2) <strong>The</strong> prosecution for an <strong>of</strong>fence under the sections <strong>of</strong> the enactments specified in the Fifth Schedule to the<br />

Unified Revenue <strong>Act</strong> shall take place, at the sole discretion <strong>of</strong> the Director <strong>of</strong> Public Prosecutions, before the<br />

Revenue Division <strong>of</strong> the Supreme Court, the Intermediate Court, or the District Court.<br />

174 FA 2007 - Subsection (2) repealed and replaced w.e.f 22.08.07.<br />

VAT <strong>Act</strong> <strong>1998</strong> –<br />

(2) Any regulations made under this section may provide for the levying <strong>of</strong> fees and charges.<br />

175<br />

FA 2006 – Section 73 Repealed and replaced w.e.f 07.08.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

73. Transitional provisions<br />

(1) Subject to the other provisions <strong>of</strong> this section, where, on the appointed day, a person was registered<br />

under the Sales <strong>Tax</strong> <strong>Act</strong> 1982 and his return for the last taxable period under the Sales <strong>Tax</strong> <strong>Act</strong> 1982 shows an excess<br />

amount, that amount shall be deemed to be sales tax on trading stocks held by that person and shall not be refundable<br />

and shall not be carried forward as a credit to be <strong>of</strong>fset against his VAT liability, if any.<br />

(2) Where a person becomes a registered person under this <strong>Act</strong> on the appointed day, he shall, within 15<br />

days <strong>of</strong> that day, submit to the Director-General, as at the day immediately preceding the appointed day, a certified<br />

inventory <strong>of</strong> -<br />

(a)<br />

(b)<br />

his trading stocks; and<br />

capital goods, being plant, machinery or equipment, <strong>of</strong> a capital nature, acquired within a<br />

period not exceeding 3 months immediately preceding the appointed day,<br />

showing the amount <strong>of</strong> sales tax paid or payable thereon.<br />

(3) Subject to subsections (4) and (5), where a person has submitted a certified inventory under subsection<br />

(2), the sales tax paid or payable on his trading stocks and capital goods shall be deemed to be value added tax and he<br />

may take a credit <strong>of</strong> -<br />

(a)<br />

(b)<br />

where his taxable period is a month, 50 per cent <strong>of</strong> the amount deemed to be value added tax<br />

in his return for each <strong>of</strong> the third and sixth taxable periods; or<br />

where his taxable period is a quarter, 50 per cent <strong>of</strong> the amount deemed to be value added tax<br />

in his return for each <strong>of</strong> the second and third taxable periods.<br />

(4) Any credit in respect <strong>of</strong> capital goods under subsection (3) shall be allowed in conformity with the<br />

Seventh Schedule.<br />

Page 93 <strong>of</strong> 107