Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 73<br />

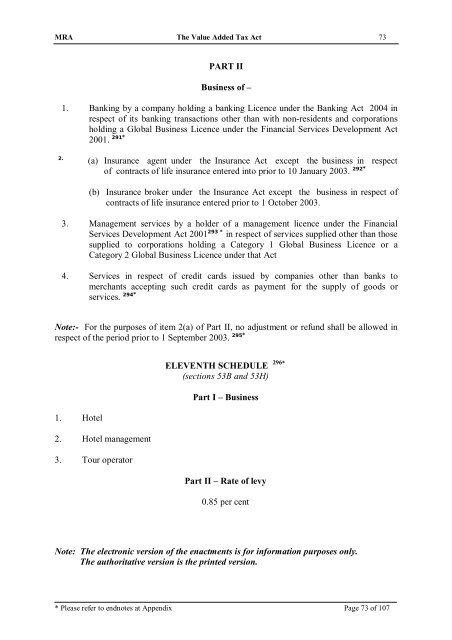

PART II<br />

Business <strong>of</strong> –<br />

1. Banking by a company holding a banking Licence under the Banking <strong>Act</strong> 2004 in<br />

respect <strong>of</strong> its banking transactions other than with non-residents and corporations<br />

holding a Global Business Licence under the Financial Services Development <strong>Act</strong><br />

2001. 291*<br />

2.<br />

(a) Insurance agent under the Insurance <strong>Act</strong> except the business in respect<br />

<strong>of</strong> contracts <strong>of</strong> life insurance entered into prior to 10 January 2003. 292*<br />

(b) Insurance broker under the Insurance <strong>Act</strong> except the business in respect <strong>of</strong><br />

contracts <strong>of</strong> life insurance entered prior to 1 October 2003.<br />

3. Management services by a holder <strong>of</strong> a management licence under the Financial<br />

Services Development <strong>Act</strong> 2001 293 * in respect <strong>of</strong> services supplied other than those<br />

supplied to corporations holding a Category 1 Global Business Licence or a<br />

Category 2 Global Business Licence under that <strong>Act</strong><br />

4. Services in respect <strong>of</strong> credit cards issued by companies other than banks to<br />

merchants accepting such credit cards as payment for the supply <strong>of</strong> goods or<br />

services. 294*<br />

Note:- For the purposes <strong>of</strong> item 2(a) <strong>of</strong> Part II, no adjustment or refund shall be allowed in<br />

respect <strong>of</strong> the period prior to 1 September 2003. 295*<br />

1. Hotel<br />

2. Hotel management<br />

3. Tour operator<br />

ELEVENTH SCHEDULE 296*<br />

(sections 53B and 53H)<br />

Part I – Business<br />

Part II – Rate <strong>of</strong> levy<br />

0.85 per cent<br />

Note: <strong>The</strong> electronic version <strong>of</strong> the enactments is for information purposes only.<br />

<strong>The</strong> authoritative version is the printed version.<br />

* Please refer to endnotes at Appendix Page 73 <strong>of</strong> 107