Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

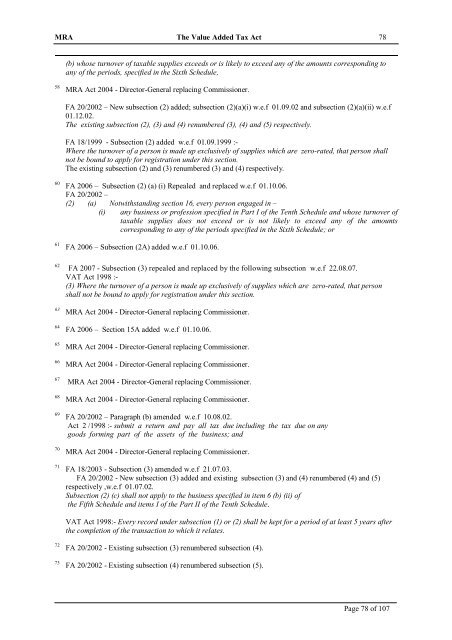

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 78<br />

(b) whose turnover <strong>of</strong> taxable supplies exceeds or is likely to exceed any <strong>of</strong> the amounts corresponding to<br />

any <strong>of</strong> the periods, specified in the Sixth Schedule,<br />

58<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 20/2002 – New subsection (2) added; subsection (2)(a)(i) w.e.f 01.09.02 and subsection (2)(a)(ii) w.e.f<br />

01.12.02.<br />

<strong>The</strong> existing subsection (2), (3) and (4) renumbered (3), (4) and (5) respectively.<br />

FA 18/1999 - Subsection (2) added w.e.f 01.09.1999 :-<br />

Where the turnover <strong>of</strong> a person is made up exclusively <strong>of</strong> supplies which are zero-rated, that person shall<br />

not be bound to apply for registration under this section.<br />

<strong>The</strong> existing subsection (2) and (3) renumbered (3) and (4) respectively.<br />

60<br />

61<br />

FA 2006 – Subsection (2) (a) (i) Repealed and replaced w.e.f 01.10.06.<br />

FA 20/2002 –<br />

(2) (a) Notwithstanding section 16, every person engaged in –<br />

(i) any business or pr<strong>of</strong>ession specified in Part I <strong>of</strong> the Tenth Schedule and whose turnover <strong>of</strong><br />

taxable supplies does not exceed or is not likely to exceed any <strong>of</strong> the amounts<br />

corresponding to any <strong>of</strong> the periods specified in the Sixth Schedule; or<br />

FA 2006 – Subsection (2A) added w.e.f 01.10.06.<br />

62<br />

63<br />

64<br />

65<br />

66<br />

67<br />

68<br />

69<br />

70<br />

71<br />

FA 2007 - Subsection (3) repealed and replaced by the following subsection w.e.f 22.08.07.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

(3) Where the turnover <strong>of</strong> a person is made up exclusively <strong>of</strong> supplies which are zero-rated, that person<br />

shall not be bound to apply for registration under this section.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 2006 – Section 15A added w.e.f 01.10.06.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 20/2002 – Paragraph (b) amended w.e.f 10.08.02.<br />

<strong>Act</strong> 2 /<strong>1998</strong> :- submit a return and pay all tax due including the tax due on any<br />

goods forming part <strong>of</strong> the assets <strong>of</strong> the business; and<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 18/2003 - Subsection (3) amended w.e.f 21.07.03.<br />

FA 20/2002 - New subsection (3) added and existing subsection (3) and (4) renumbered (4) and (5)<br />

respectively ,w.e.f 01.07.02.<br />

Subsection (2) (c) shall not apply to the business specified in item 6 (b) (ii) <strong>of</strong><br />

the Fifth Schedule and items I <strong>of</strong> the Part II <strong>of</strong> the Tenth Schedule.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Every record under subsection (1) or (2) shall be kept for a period <strong>of</strong> at least 5 years after<br />

the completion <strong>of</strong> the transaction to which it relates.<br />

72<br />

73<br />

FA 20/2002 - Existing subsection (3) renumbered subsection (4).<br />

FA 20/2002 - Existing subsection (4) renumbered subsection (5).<br />

Page 78 <strong>of</strong> 107