Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 22<br />

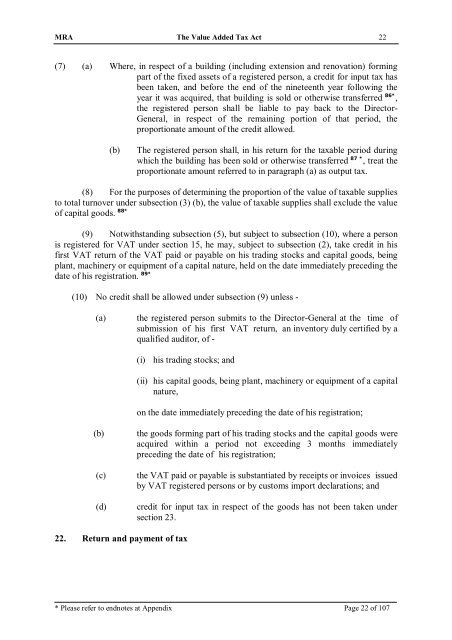

(7) (a) Where, in respect <strong>of</strong> a building (including extension and renovation) forming<br />

part <strong>of</strong> the fixed assets <strong>of</strong> a registered person, a credit for input tax has<br />

been taken, and before the end <strong>of</strong> the nineteenth year following the<br />

year it was acquired, that building is sold or otherwise transferred 86* ,<br />

the registered person shall be liable to pay back to the Director-<br />

General, in respect <strong>of</strong> the remaining portion <strong>of</strong> that period, the<br />

proportionate amount <strong>of</strong> the credit allowed.<br />

(b)<br />

<strong>The</strong> registered person shall, in his return for the taxable period during<br />

which the building has been sold or otherwise transferred 87 * , treat the<br />

proportionate amount referred to in paragraph (a) as output tax.<br />

(8) For the purposes <strong>of</strong> determining the proportion <strong>of</strong> the value <strong>of</strong> taxable supplies<br />

to total turnover under subsection (3) (b), the value <strong>of</strong> taxable supplies shall exclude the value<br />

<strong>of</strong> capital goods. 88*<br />

(9) Notwithstanding subsection (5), but subject to subsection (10), where a person<br />

is registered for VAT under section 15, he may, subject to subsection (2), take credit in his<br />

first VAT return <strong>of</strong> the VAT paid or payable on his trading stocks and capital goods, being<br />

plant, machinery or equipment <strong>of</strong> a capital nature, held on the date immediately preceding the<br />

date <strong>of</strong> his registration. 89*<br />

(10) No credit shall be allowed under subsection (9) unless -<br />

(a)<br />

the registered person submits to the Director-General at the time <strong>of</strong><br />

submission <strong>of</strong> his first VAT return, an inventory duly certified by a<br />

qualified auditor, <strong>of</strong> -<br />

(i) his trading stocks; and<br />

(ii) his capital goods, being plant, machinery or equipment <strong>of</strong> a capital<br />

nature,<br />

on the date immediately preceding the date <strong>of</strong> his registration;<br />

(b)<br />

(c)<br />

(d)<br />

the goods forming part <strong>of</strong> his trading stocks and the capital goods were<br />

acquired within a period not exceeding 3 months immediately<br />

preceding the date <strong>of</strong> his registration;<br />

the VAT paid or payable is substantiated by receipts or invoices issued<br />

by VAT registered persons or by customs import declarations; and<br />

credit for input tax in respect <strong>of</strong> the goods has not been taken under<br />

section 23.<br />

22. Return and payment <strong>of</strong> tax<br />

* Please refer to endnotes at Appendix Page 22 <strong>of</strong> 107