Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 105<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

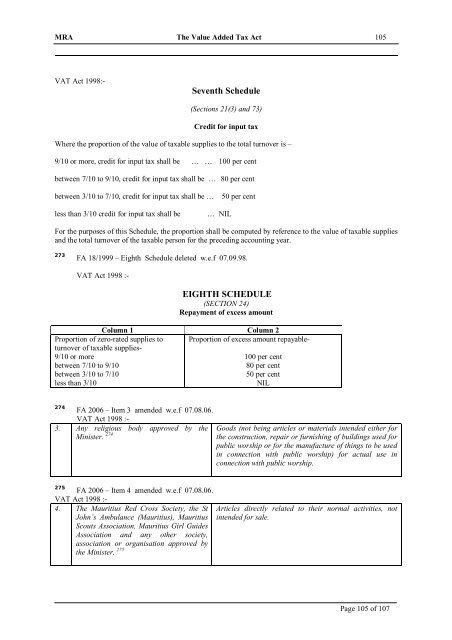

Seventh Schedule<br />

(Sections 21(3) and 73)<br />

Credit for input tax<br />

Where the proportion <strong>of</strong> the value <strong>of</strong> taxable supplies to the total turnover is –<br />

9/10 or more, credit for input tax shall be … … 100 per cent<br />

between 7/10 to 9/10, credit for input tax shall be … 80 per cent<br />

between 3/10 to 7/10, credit for input tax shall be … 50 per cent<br />

less than 3/10 credit for input tax shall be<br />

… NIL<br />

For the purposes <strong>of</strong> this Schedule, the proportion shall be computed by reference to the value <strong>of</strong> taxable supplies<br />

and the total turnover <strong>of</strong> the taxable person for the preceding accounting year.<br />

273<br />

FA 18/1999 – Eighth Schedule deleted w.e.f 07.09.98.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

EIGHTH SCHEDULE<br />

(SECTION 24)<br />

Repayment <strong>of</strong> excess amount<br />

Column 1 Column 2<br />

Proportion <strong>of</strong> excess amount repayable-<br />

Proportion <strong>of</strong> zero-rated supplies to<br />

turnover <strong>of</strong> taxable supplies-<br />

9/10 or more<br />

between 7/10 to 9/10<br />

between 3/10 to 7/10<br />

less than 3/10<br />

100 per cent<br />

80 per cent<br />

50 per cent<br />

NIL<br />

274<br />

FA 2006 – Item 3 amended w.e.f 07.08.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

3. Any religious body approved by the<br />

Minister. 274<br />

Goods (not being articles or materials intended either for<br />

the construction, repair or furnishing <strong>of</strong> buildings used for<br />

public worship or for the manufacture <strong>of</strong> things to be used<br />

in connection with public worship) for actual use in<br />

connection with public worship.<br />

275<br />

FA 2006 – Item 4 amended w.e.f 07.08.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

4. <strong>The</strong> <strong>Mauritius</strong> Red Cross Society, the St<br />

John’s Ambulance (<strong>Mauritius</strong>), <strong>Mauritius</strong><br />

Scouts Association, <strong>Mauritius</strong> Girl Guides<br />

Association and any other society,<br />

association or organisation approved by<br />

the Minister. 275<br />

Articles directly related to their normal activities, not<br />

intended for sale.<br />

Page 105 <strong>of</strong> 107