Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

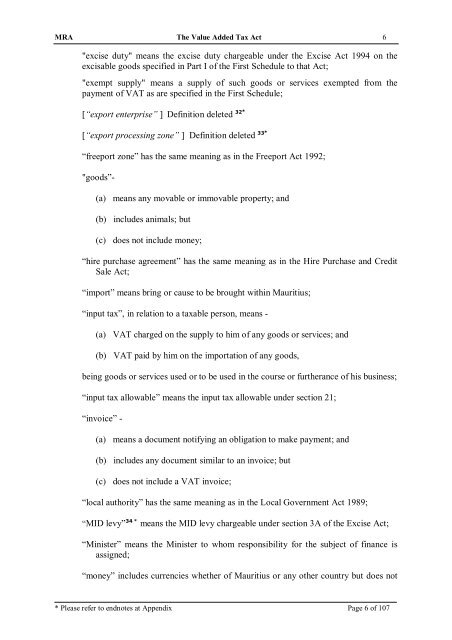

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 6<br />

"excise duty" means the excise duty chargeable under the Excise <strong>Act</strong> 1994 on the<br />

excisable goods specified in Part I <strong>of</strong> the First Schedule to that <strong>Act</strong>;<br />

"exempt supply" means a supply <strong>of</strong> such goods or services exempted from the<br />

payment <strong>of</strong> VAT as are specified in the First Schedule;<br />

[“export enterprise” ] Definition deleted 32*<br />

[“export processing zone” ] Definition deleted 33*<br />

“freeport zone” has the same meaning as in the Freeport <strong>Act</strong> 1992;<br />

"goods”-<br />

(a) means any movable or immovable property; and<br />

(b) includes animals; but<br />

(c) does not include money;<br />

“hire purchase agreement” has the same meaning as in the Hire Purchase and Credit<br />

Sale <strong>Act</strong>;<br />

“import” means bring or cause to be brought within <strong>Mauritius</strong>;<br />

“input tax”, in relation to a taxable person, means -<br />

(a) VAT charged on the supply to him <strong>of</strong> any goods or services; and<br />

(b) VAT paid by him on the importation <strong>of</strong> any goods,<br />

being goods or services used or to be used in the course or furtherance <strong>of</strong> his business;<br />

“input tax allowable” means the input tax allowable under section 21;<br />

“invoice” -<br />

(a) means a document notifying an obligation to make payment; and<br />

(b) includes any document similar to an invoice; but<br />

(c) does not include a VAT invoice;<br />

“local authority” has the same meaning as in the Local Government <strong>Act</strong> 1989;<br />

“MID levy” 34 * means the MID levy chargeable under section 3A <strong>of</strong> the Excise <strong>Act</strong>;<br />

“Minister” means the Minister to whom responsibility for the subject <strong>of</strong> finance is<br />

assigned;<br />

“money” includes currencies whether <strong>of</strong> <strong>Mauritius</strong> or any other country but does not<br />

* Please refer to endnotes at Appendix Page 6 <strong>of</strong> 107