Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 23<br />

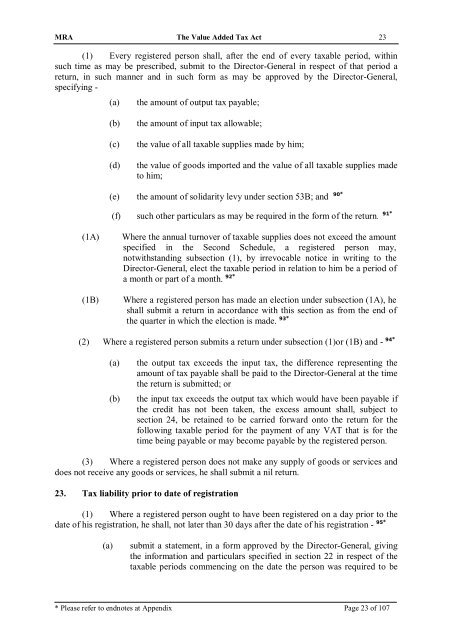

(1) Every registered person shall, after the end <strong>of</strong> every taxable period, within<br />

such time as may be prescribed, submit to the Director-General in respect <strong>of</strong> that period a<br />

return, in such manner and in such form as may be approved by the Director-General,<br />

specifying -<br />

(a)<br />

the amount <strong>of</strong> output tax payable;<br />

(b)<br />

(c)<br />

(d)<br />

the amount <strong>of</strong> input tax allowable;<br />

the value <strong>of</strong> all taxable supplies made by him;<br />

the value <strong>of</strong> goods imported and the value <strong>of</strong> all taxable supplies made<br />

to him;<br />

(e) the amount <strong>of</strong> solidarity levy under section 53B; and 90*<br />

(f) such other particulars as may be required in the form <strong>of</strong> the return. 91*<br />

(1A)<br />

(1B)<br />

Where the annual turnover <strong>of</strong> taxable supplies does not exceed the amount<br />

specified in the Second Schedule, a registered person may,<br />

notwithstanding subsection (1), by irrevocable notice in writing to the<br />

Director-General, elect the taxable period in relation to him be a period <strong>of</strong><br />

a month or part <strong>of</strong> a month. 92*<br />

Where a registered person has made an election under subsection (1A), he<br />

shall submit a return in accordance with this section as from the end <strong>of</strong><br />

the quarter in which the election is made. 93*<br />

(2) Where a registered person submits a return under subsection (1)or (1B) and - 94*<br />

(a)<br />

(b)<br />

the output tax exceeds the input tax, the difference representing the<br />

amount <strong>of</strong> tax payable shall be paid to the Director-General at the time<br />

the return is submitted; or<br />

the input tax exceeds the output tax which would have been payable if<br />

the credit has not been taken, the excess amount shall, subject to<br />

section 24, be retained to be carried forward onto the return for the<br />

following taxable period for the payment <strong>of</strong> any VAT that is for the<br />

time being payable or may become payable by the registered person.<br />

(3) Where a registered person does not make any supply <strong>of</strong> goods or services and<br />

does not receive any goods or services, he shall submit a nil return.<br />

23. <strong>Tax</strong> liability prior to date <strong>of</strong> registration<br />

(1) Where a registered person ought to have been registered on a day prior to the<br />

date <strong>of</strong> his registration, he shall, not later than 30 days after the date <strong>of</strong> his registration - 95*<br />

(a)<br />

submit a statement, in a form approved by the Director-General, giving<br />

the information and particulars specified in section 22 in respect <strong>of</strong> the<br />

taxable periods commencing on the date the person was required to be<br />

* Please refer to endnotes at Appendix Page 23 <strong>of</strong> 107