Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

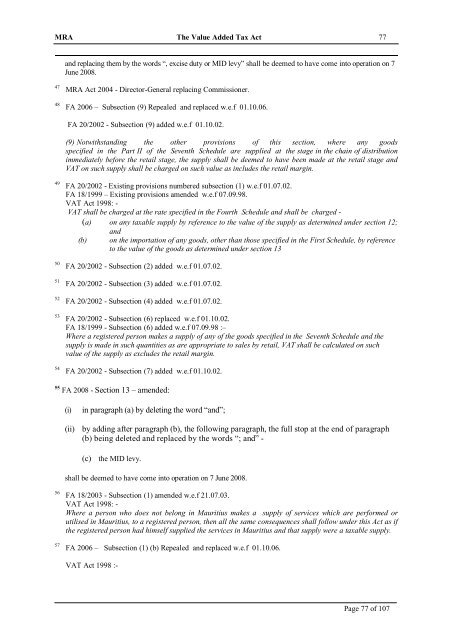

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 77<br />

and replacing them by the words “, excise duty or MID levy” shall be deemed to have come into operation on 7<br />

June 2008.<br />

47<br />

48<br />

MRA <strong>Act</strong> 2004 - Director-General replacing Commissioner.<br />

FA 2006 – Subsection (9) Repealed and replaced w.e.f 01.10.06.<br />

FA 20/2002 - Subsection (9) added w.e.f 01.10.02.<br />

(9) Notwithstanding the other provisions <strong>of</strong> this section, where any goods<br />

specified in the Part II <strong>of</strong> the Seventh Schedule are supplied at the stage in the chain <strong>of</strong> distribution<br />

immediately before the retail stage, the supply shall be deemed to have been made at the retail stage and<br />

VAT on such supply shall be charged on such value as includes the retail margin.<br />

49<br />

50<br />

51<br />

52<br />

53<br />

54<br />

FA 20/2002 - Existing provisions numbered subsection (1) w.e.f 01.07.02.<br />

FA 18/1999 – Existing provisions amended w.e.f 07.09.98.<br />

VAT <strong>Act</strong> <strong>1998</strong>: -<br />

VAT shall be charged at the rate specified in the Fourth Schedule and shall be charged -<br />

(a) on any taxable supply by reference to the value <strong>of</strong> the supply as determined under section 12;<br />

and<br />

(b) on the importation <strong>of</strong> any goods, other than those specified in the First Schedule, by reference<br />

to the value <strong>of</strong> the goods as determined under section 13<br />

FA 20/2002 - Subsection (2) added w.e.f 01.07.02.<br />

FA 20/2002 - Subsection (3) added w.e.f 01.07.02.<br />

FA 20/2002 - Subsection (4) added w.e.f 01.07.02.<br />

FA 20/2002 - Subsection (6) replaced w.e.f 01.10.02.<br />

FA 18/1999 - Subsection (6) added w.e.f 07.09.98 :–<br />

Where a registered person makes a supply <strong>of</strong> any <strong>of</strong> the goods specified in the Seventh Schedule and the<br />

supply is made in such quantities as are appropriate to sales by retail, VAT shall be calculated on such<br />

value <strong>of</strong> the supply as excludes the retail margin.<br />

FA 20/2002 - Subsection (7) added w.e.f 01.10.02.<br />

55 FA 2008 - Section 13 – amended:<br />

(i)<br />

in paragraph (a) by deleting the word “and”;<br />

(ii) by adding after paragraph (b), the following paragraph, the full stop at the end <strong>of</strong> paragraph<br />

(b) being deleted and replaced by the words “; and” -<br />

(c) the MID levy.<br />

shall be deemed to have come into operation on 7 June 2008.<br />

56<br />

57<br />

FA 18/2003 - Subsection (1) amended w.e.f 21.07.03.<br />

VAT <strong>Act</strong> <strong>1998</strong>: -<br />

Where a person who does not belong in <strong>Mauritius</strong> makes a supply <strong>of</strong> services which are performed or<br />

utilised in <strong>Mauritius</strong>, to a registered person, then all the same consequences shall follow under this <strong>Act</strong> as if<br />

the registered person had himself supplied the services in <strong>Mauritius</strong> and that supply were a taxable supply.<br />

FA 2006 – Subsection (1) (b) Repealed and replaced w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong> :-<br />

Page 77 <strong>of</strong> 107