Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

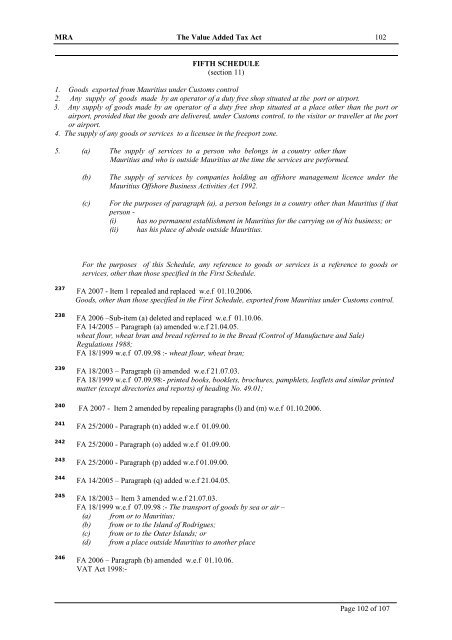

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 102<br />

FIFTH SCHEDULE<br />

(section 11)<br />

1. Goods exported from <strong>Mauritius</strong> under Customs control<br />

2. Any supply <strong>of</strong> goods made by an operator <strong>of</strong> a duty free shop situated at the port or airport.<br />

3. Any supply <strong>of</strong> goods made by an operator <strong>of</strong> a duty free shop situated at a place other than the port or<br />

airport, provided that the goods are delivered, under Customs control, to the visitor or traveller at the port<br />

or airport.<br />

4. <strong>The</strong> supply <strong>of</strong> any goods or services to a licensee in the freeport zone.<br />

5. (a) <strong>The</strong> supply <strong>of</strong> services to a person who belongs in a country other than<br />

<strong>Mauritius</strong> and who is outside <strong>Mauritius</strong> at the time the services are performed.<br />

(b)<br />

(c)<br />

<strong>The</strong> supply <strong>of</strong> services by companies holding an <strong>of</strong>fshore management licence under the<br />

<strong>Mauritius</strong> Offshore Business <strong>Act</strong>ivities <strong>Act</strong> 1992.<br />

For the purposes <strong>of</strong> paragraph (a), a person belongs in a country other than <strong>Mauritius</strong> if that<br />

person -<br />

(i) has no permanent establishment in <strong>Mauritius</strong> for the carrying on <strong>of</strong> his business; or<br />

(ii) has his place <strong>of</strong> abode outside <strong>Mauritius</strong>.<br />

For the purposes <strong>of</strong> this Schedule, any reference to goods or services is a reference to goods or<br />

services, other than those specified in the First Schedule.<br />

237<br />

238<br />

239<br />

FA 2007 - Item 1 repealed and replaced w.e.f 01.10.2006.<br />

Goods, other than those specified in the First Schedule, exported from <strong>Mauritius</strong> under Customs control.<br />

FA 2006 –Sub-item (a) deleted and replaced w.e.f 01.10.06.<br />

FA 14/2005 – Paragraph (a) amended w.e.f 21.04.05.<br />

wheat flour, wheat bran and bread referred to in the Bread (Control <strong>of</strong> Manufacture and Sale)<br />

Regulations 1988;<br />

FA 18/1999 w.e.f 07.09.98 :- wheat flour, wheat bran;<br />

FA 18/2003 – Paragraph (i) amended w.e.f 21.07.03.<br />

FA 18/1999 w.e.f 07.09.98:- printed books, booklets, brochures, pamphlets, leaflets and similar printed<br />

matter (except directories and reports) <strong>of</strong> heading No. 49.01;<br />

240<br />

241<br />

242<br />

243<br />

244<br />

245<br />

246<br />

FA 2007 - Item 2 amended by repealing paragraphs (l) and (m) w.e.f 01.10.2006.<br />

FA 25/2000 - Paragraph (n) added w.e.f 01.09.00.<br />

FA 25/2000 - Paragraph (o) added w.e.f 01.09.00.<br />

FA 25/2000 - Paragraph (p) added w.e.f 01.09.00.<br />

FA 14/2005 – Paragraph (q) added w.e.f 21.04.05.<br />

FA 18/2003 – Item 3 amended w.e.f 21.07.03.<br />

FA 18/1999 w.e.f 07.09.98 :- <strong>The</strong> transport <strong>of</strong> goods by sea or air –<br />

(a) from or to <strong>Mauritius</strong>;<br />

(b) from or to the Island <strong>of</strong> Rodrigues;<br />

(c) from or to the Outer Islands; or<br />

(d) from a place outside <strong>Mauritius</strong> to another place<br />

FA 2006 – Paragraph (b) amended w.e.f 01.10.06.<br />

VAT <strong>Act</strong> <strong>1998</strong>:-<br />

Page 102 <strong>of</strong> 107