Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

Value Added Tax Act 1998 - The Mauritius Chamber of Commerce ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MRA <strong>The</strong> <strong>Value</strong> <strong>Added</strong> <strong>Tax</strong> <strong>Act</strong> 94<br />

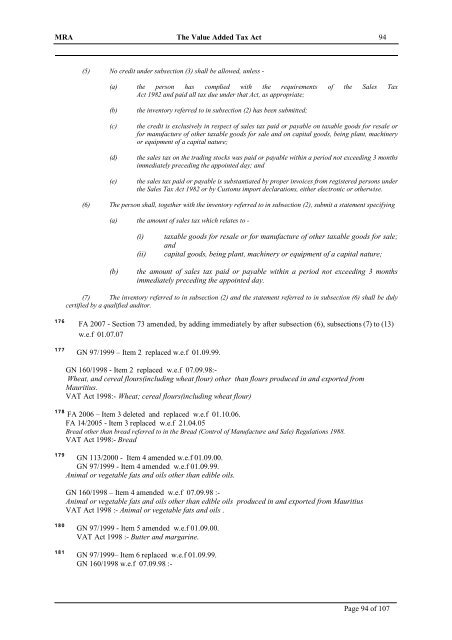

(5) No credit under subsection (3) shall be allowed, unless -<br />

(a) the person has complied with the requirements <strong>of</strong> the Sales <strong>Tax</strong><br />

<strong>Act</strong> 1982 and paid all tax due under that <strong>Act</strong>, as appropriate;<br />

(b)<br />

(c)<br />

(d)<br />

(e)<br />

the inventory referred to in subsection (2) has been submitted;<br />

the credit is exclusively in respect <strong>of</strong> sales tax paid or payable on taxable goods for resale or<br />

for manufacture <strong>of</strong> other taxable goods for sale and on capital goods, being plant, machinery<br />

or equipment <strong>of</strong> a capital nature;<br />

the sales tax on the trading stocks was paid or payable within a period not exceeding 3 months<br />

immediately preceding the appointed day; and<br />

the sales tax paid or payable is substantiated by proper invoices from registered persons under<br />

the Sales <strong>Tax</strong> <strong>Act</strong> 1982 or by Customs import declarations, either electronic or otherwise.<br />

(6) <strong>The</strong> person shall, together with the inventory referred to in subsection (2), submit a statement specifying<br />

(a) the amount <strong>of</strong> sales tax which relates to -<br />

(i)<br />

(ii)<br />

taxable goods for resale or for manufacture <strong>of</strong> other taxable goods for sale;<br />

and<br />

capital goods, being plant, machinery or equipment <strong>of</strong> a capital nature;<br />

(b)<br />

the amount <strong>of</strong> sales tax paid or payable within a period not exceeding 3 months<br />

immediately preceding the appointed day.<br />

(7) <strong>The</strong> inventory referred to in subsection (2) and the statement referred to in subsection (6) shall be duly<br />

certified by a qualified auditor.<br />

176<br />

177<br />

FA 2007 - Section 73 amended, by adding immediately by after subsection (6), subsections (7) to (13)<br />

w.e.f 01.07.07<br />

GN 97/1999 – Item 2 replaced w.e.f 01.09.99.<br />

GN 160/<strong>1998</strong> - Item 2 replaced w.e.f 07.09.98:-<br />

Wheat, and cereal flours(including wheat flour) other than flours produced in and exported from<br />

<strong>Mauritius</strong>.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Wheat; cereal flours(including wheat flour)<br />

178 FA 2006 – Item 3 deleted and replaced w.e.f 01.10.06.<br />

FA 14/2005 - Item 3 replaced w.e.f 21.04.05<br />

Bread other than bread referred to in the Bread (Control <strong>of</strong> Manufacture and Sale) Regulations 1988.<br />

VAT <strong>Act</strong> <strong>1998</strong>:- Bread<br />

179<br />

GN 113/2000 - Item 4 amended w.e.f 01.09.00.<br />

GN 97/1999 - Item 4 amended w.e.f 01.09.99.<br />

Animal or vegetable fats and oils other than edible oils.<br />

GN 160/<strong>1998</strong> – Item 4 amended w.e.f 07.09.98 :-<br />

Animal or vegetable fats and oils other than edible oils produced in and exported from <strong>Mauritius</strong><br />

VAT <strong>Act</strong> <strong>1998</strong> :- Animal or vegetable fats and oils .<br />

180<br />

181<br />

GN 97/1999 - Item 5 amended w.e.f 01.09.00.<br />

VAT <strong>Act</strong> <strong>1998</strong> :- Butter and margarine.<br />

GN 97/1999– Item 6 replaced w.e.f 01.09.99.<br />

GN 160/<strong>1998</strong> w.e.f 07.09.98 :-<br />

Page 94 <strong>of</strong> 107