Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Directors’ Report<br />

(continued)<br />

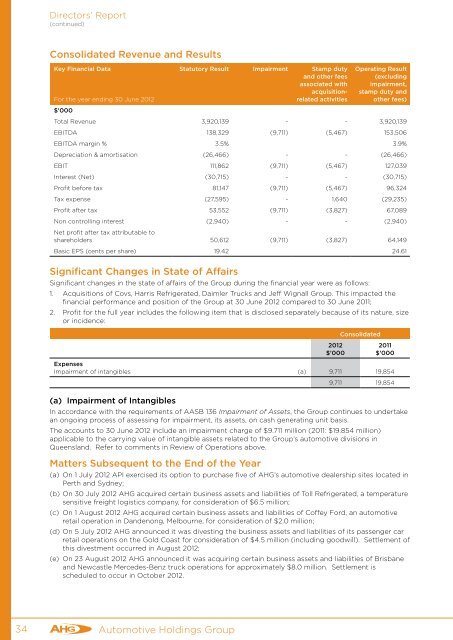

Consolidated Revenue and Results<br />

Key Financial Data<br />

For the year ending 30 June 2012<br />

Statutory Result Impairment Stamp duty<br />

and other fees<br />

associated with<br />

acquisitionrelated<br />

activities<br />

Operating Result<br />

(excluding<br />

impairment,<br />

stamp duty and<br />

other fees)<br />

$'000<br />

Total Revenue 3,920,139 - - 3,920,139<br />

EBITDA 138,329 (9,711) (5,467) 153,506<br />

EBITDA margin % 3.5% 3.9%<br />

Depreciation & amortisation (26,466) - - (26,466)<br />

EBIT 111,862 (9,711) (5,467) 127,039<br />

Interest (Net) (30,715) - - (30,715)<br />

Profit before tax 81,147 (9,711) (5,467) 96,324<br />

Tax expense (27,595) - 1,640 (29,235)<br />

Profit after tax 53,552 (9,711) (3,827) 67,089<br />

Non controlling interest (2,940) - - (2,940)<br />

Net profit after tax attributable to<br />

shareholders 50,612 (9,711) (3,827) 64,149<br />

Basic EPS (cents per share) 19.42 24.61<br />

Significant Changes in State of Affairs<br />

Significant changes in the state of affairs of the Group during the financial year were as follows:<br />

1. Acquisitions of Covs, Harris Refrigerated, Daimler Trucks and Jeff Wignall Group. This impacted the<br />

financial performance and position of the Group at 30 June 2012 compared to 30 June 2011;<br />

2. Profit for the full year includes the following item that is disclosed separately because of its nature, size<br />

or incidence:<br />

2012<br />

$’000<br />

Consolidated<br />

2011<br />

$’000<br />

Expenses<br />

Impairment of intangibles (a) 9,711 19,854<br />

9,711 19,854<br />

(a) Impairment of Intangibles<br />

In accordance with the requirements of AASB 136 Impairment of Assets, the Group continues to undertake<br />

an ongoing process of assessing for impairment, its assets, on cash generating unit basis.<br />

The accounts to 30 June 2012 include an impairment charge of $9.711 million (2011: $19.854 million)<br />

applicable to the carrying value of intangible assets related to the Group’s automotive divisions in<br />

Queensland. Refer to comments in Review of Operations above.<br />

Matters Subsequent to the End of the Year<br />

(a) On 1 July 2012 API exercised its option to purchase five of <strong>AHG</strong>’s automotive dealership sites located in<br />

Perth and Sydney;<br />

(b) On 30 July 2012 <strong>AHG</strong> acquired certain business assets and liabilities of Toll Refrigerated, a temperature<br />

sensitive freight logistics company, for consideration of $6.5 million;<br />

(c) On 1 August 2012 <strong>AHG</strong> acquired certain business assets and liabilities of Coffey Ford, an automotive<br />

retail operation in Dandenong, Melbourne, for consideration of $2.0 million;<br />

(d) On 5 July 2012 <strong>AHG</strong> announced it was divesting the business assets and liabilities of its passenger car<br />

retail operations on the Gold Coast for consideration of $4.5 million (including goodwill). Settlement of<br />

this divestment occurred in August 2012;<br />

(e) On 23 August 2012 <strong>AHG</strong> announced it was acquiring certain business assets and liabilities of Brisbane<br />

and Newcastle Mercedes-Benz truck operations for approximately $8.0 million. Settlement is<br />

scheduled to occur in October 2012.<br />

34<br />

Automotive Holdings Group