Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

(continued)<br />

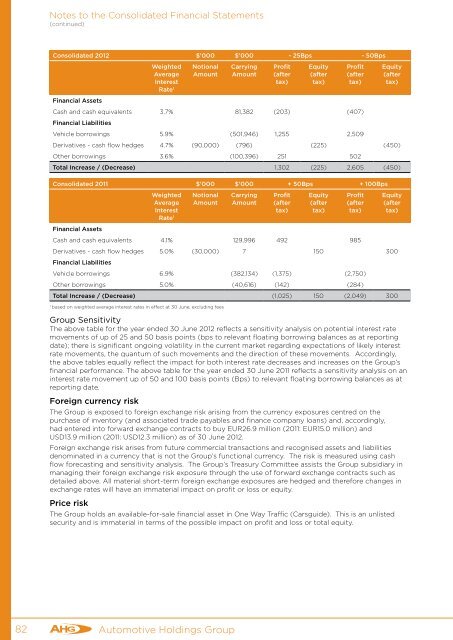

Consolidated 2012 $’000 $’000 - 25Bps - 50Bps<br />

Weighted<br />

Average<br />

Interest<br />

Rate 1<br />

Notional<br />

Amount<br />

Carrying<br />

Amount<br />

Profit<br />

(after<br />

tax)<br />

Equity<br />

(after<br />

tax)<br />

Profit<br />

(after<br />

tax)<br />

Equity<br />

(after<br />

tax)<br />

Financial Assets<br />

Cash and cash equivalents 3.7% 81,382 (203) (407)<br />

Financial Liabilities<br />

Vehicle borrowings 5.9% (501,946) 1,255 2,509<br />

Derivatives - cash flow hedges 4.7% (90,000) (796) (225) (450)<br />

Other borrowings 3.6% (100,396) 251 502<br />

Total Increase / (Decrease) 1,302 (225) 2,605 (450)<br />

Consolidated 2011 $’000 $’000 + 50Bps + 100Bps<br />

Weighted<br />

Average<br />

Interest<br />

Rate 1<br />

Notional<br />

Amount<br />

Carrying<br />

Amount<br />

Profit<br />

(after<br />

tax)<br />

Equity<br />

(after<br />

tax)<br />

Profit<br />

(after<br />

tax)<br />

Equity<br />

(after<br />

tax)<br />

Financial Assets<br />

Cash and cash equivalents 4.1% 129,996 492 985<br />

Derivatives - cash flow hedges 5.0% (30,000) 7 150 300<br />

Financial Liabilities<br />

Vehicle borrowings 6.9% (382,134) (1,375) (2,750)<br />

Other borrowings 5.0% (40,616) (142) (284)<br />

Total Increase / (Decrease) (1,025) 150 (2,049) 300<br />

1<br />

based on weighted average interest rates in effect at 30 June, excluding fees<br />

Group Sensitivity<br />

The above table for the year ended 30 June 2012 reflects a sensitivity analysis on potential interest rate<br />

movements of up of 25 and 50 basis points (bps to relevant floating borrowing balances as at reporting<br />

date); there is significant ongoing volatility in the current market regarding expectations of likely interest<br />

rate movements, the quantum of such movements and the direction of these movements. Accordingly,<br />

the above tables equally reflect the impact for both interest rate decreases and increases on the Group’s<br />

financial performance. The above table for the year ended 30 June 2011 reflects a sensitivity analysis on an<br />

interest rate movement up of 50 and 100 basis points (Bps) to relevant floating borrowing balances as at<br />

reporting date.<br />

Foreign currency risk<br />

The Group is exposed to foreign exchange risk arising from the currency exposures centred on the<br />

purchase of inventory (and associated trade payables and finance company loans) and, accordingly,<br />

had entered into forward exchange contracts to buy EUR26.9 million (2011: EUR15.0 million) and<br />

USD13.9 million (2011: USD12.3 million) as of 30 June 2012.<br />

Foreign exchange risk arises from future commercial transactions and recognised assets and liabilities<br />

denominated in a currency that is not the Group’s functional currency. The risk is measured using cash<br />

flow forecasting and sensitivity analysis. The Group’s Treasury Committee assists the Group subsidiary in<br />

managing their foreign exchange risk exposure through the use of forward exchange contracts such as<br />

detailed above. All material short-term foreign exchange exposures are hedged and therefore changes in<br />

exchange rates will have an immaterial impact on profit or loss or equity.<br />

Price risk<br />

The Group holds an available-for-sale financial asset in One Way Traffic (Carsguide). This is an unlisted<br />

security and is immaterial in terms of the possible impact on profit and loss or total equity.<br />

82<br />

Automotive Holdings Group