Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Directors’ Report<br />

(continued)<br />

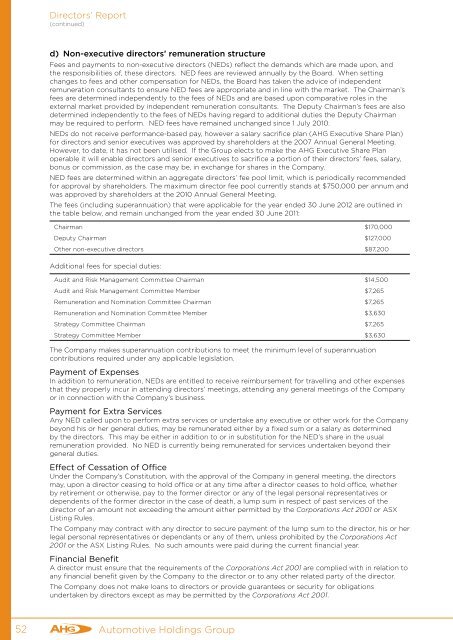

d) Non-executive directors’ remuneration structure<br />

Fees and payments to non-executive directors (NEDs) reflect the demands which are made upon, and<br />

the responsibilities of, these directors. NED fees are reviewed annually by the Board. When setting<br />

changes to fees and other compensation for NEDs, the Board has taken the advice of independent<br />

remuneration consultants to ensure NED fees are appropriate and in line with the market. The Chairman’s<br />

fees are determined independently to the fees of NEDs and are based upon comparative roles in the<br />

external market provided by independent remuneration consultants. The Deputy Chairman’s fees are also<br />

determined independently to the fees of NEDs having regard to additional duties the Deputy Chairman<br />

may be required to perform. NED fees have remained unchanged since 1 July 2010.<br />

NEDs do not receive performance-based pay, however a salary sacrifice plan (<strong>AHG</strong> Executive Share Plan)<br />

for directors and senior executives was approved by shareholders at the 2007 Annual General Meeting.<br />

However, to date, it has not been utilised. If the Group elects to make the <strong>AHG</strong> Executive Share Plan<br />

operable it will enable directors and senior executives to sacrifice a portion of their directors’ fees, salary,<br />

bonus or commission, as the case may be, in exchange for shares in the Company.<br />

NED fees are determined within an aggregate directors’ fee pool limit, which is periodically recommended<br />

for approval by shareholders. The maximum director fee pool currently stands at $750,000 per annum and<br />

was approved by shareholders at the 2010 Annual General Meeting.<br />

The fees (including superannuation) that were applicable for the year ended 30 June 2012 are outlined in<br />

the table below, and remain unchanged from the year ended 30 June 2011:<br />

Chairman $170,000<br />

Deputy Chairman $127,000<br />

Other non-executive directors $87,200<br />

Additional fees for special duties:<br />

Audit and Risk Management Committee Chairman $14,500<br />

Audit and Risk Management Committee Member $7,265<br />

Remuneration and Nomination Committee Chairman $7,265<br />

Remuneration and Nomination Committee Member $3,630<br />

Strategy Committee Chairman $7,265<br />

Strategy Committee Member $3,630<br />

The Company makes superannuation contributions to meet the minimum level of superannuation<br />

contributions required under any applicable legislation.<br />

Payment of Expenses<br />

In addition to remuneration, NEDs are entitled to receive reimbursement for travelling and other expenses<br />

that they properly incur in attending directors’ meetings, attending any general meetings of the Company<br />

or in connection with the Company’s business.<br />

Payment for Extra Services<br />

Any NED called upon to perform extra services or undertake any executive or other work for the Company<br />

beyond his or her general duties, may be remunerated either by a fixed sum or a salary as determined<br />

by the directors. This may be either in addition to or in substitution for the NED’s share in the usual<br />

remuneration provided. No NED is currently being remunerated for services undertaken beyond their<br />

general duties.<br />

Effect of Cessation of Office<br />

Under the Company’s Constitution, with the approval of the Company in general meeting, the directors<br />

may, upon a director ceasing to hold office or at any time after a director ceases to hold office, whether<br />

by retirement or otherwise, pay to the former director or any of the legal personal representatives or<br />

dependents of the former director in the case of death, a lump sum in respect of past services of the<br />

director of an amount not exceeding the amount either permitted by the Corporations Act 2001 or ASX<br />

Listing Rules.<br />

The Company may contract with any director to secure payment of the lump sum to the director, his or her<br />

legal personal representatives or dependants or any of them, unless prohibited by the Corporations Act<br />

2001 or the ASX Listing Rules. No such amounts were paid during the current financial year.<br />

Financial Benefit<br />

A director must ensure that the requirements of the Corporations Act 2001 are complied with in relation to<br />

any financial benefit given by the Company to the director or to any other related party of the director.<br />

The Company does not make loans to directors or provide guarantees or security for obligations<br />

undertaken by directors except as may be permitted by the Corporations Act 2001.<br />

52<br />

Automotive Holdings Group