Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

(continued)<br />

The nominal value less estimated credit<br />

adjustments of trade receivables and payables are<br />

assumed to approximate their fair values due to<br />

their short-term nature. The fair value of financial<br />

liabilities for disclosure purposes is estimated by<br />

discounting the future contractual cash flows at the<br />

current market interest rate that is available to the<br />

Group for similar financial instruments.<br />

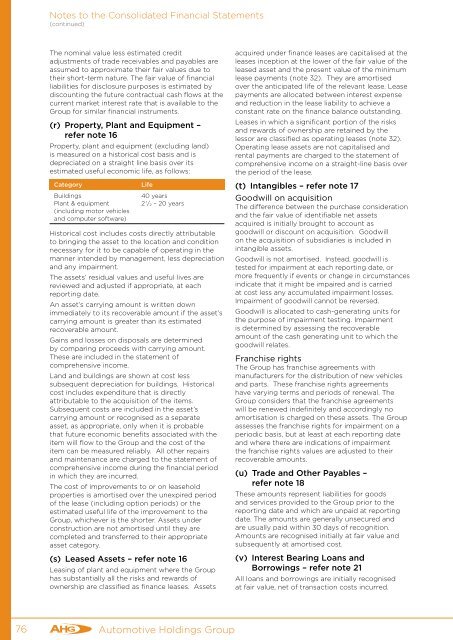

(r) Property, Plant and Equipment –<br />

refer note 16<br />

Property, plant and equipment (excluding land)<br />

is measured on a historical cost basis and is<br />

depreciated on a straight line basis over its<br />

estimated useful economic life, as follows:<br />

Category<br />

Buildings<br />

Plant & equipment<br />

(including motor vehicles<br />

and computer software)<br />

Life<br />

40 years<br />

2 1 / 2 – 20 years<br />

Historical cost includes costs directly attributable<br />

to bringing the asset to the location and condition<br />

necessary for it to be capable of operating in the<br />

manner intended by management, less depreciation<br />

and any impairment.<br />

The assets’ residual values and useful lives are<br />

reviewed and adjusted if appropriate, at each<br />

reporting date.<br />

An asset’s carrying amount is written down<br />

immediately to its recoverable amount if the asset’s<br />

carrying amount is greater than its estimated<br />

recoverable amount.<br />

Gains and losses on disposals are determined<br />

by comparing proceeds with carrying amount.<br />

These are included in the statement of<br />

comprehensive income.<br />

Land and buildings are shown at cost less<br />

subsequent depreciation for buildings. Historical<br />

cost includes expenditure that is directly<br />

attributable to the acquisition of the items.<br />

Subsequent costs are included in the asset’s<br />

carrying amount or recognised as a separate<br />

asset, as appropriate, only when it is probable<br />

that future economic benefits associated with the<br />

item will flow to the Group and the cost of the<br />

item can be measured reliably. All other repairs<br />

and maintenance are charged to the statement of<br />

comprehensive income during the financial period<br />

in which they are incurred.<br />

The cost of improvements to or on leasehold<br />

properties is amortised over the unexpired period<br />

of the lease (including option periods) or the<br />

estimated useful life of the improvement to the<br />

Group, whichever is the shorter. Assets under<br />

construction are not amortised until they are<br />

completed and transferred to their appropriate<br />

asset category.<br />

(s) Leased Assets – refer note 16<br />

Leasing of plant and equipment where the Group<br />

has substantially all the risks and rewards of<br />

ownership are classified as finance leases. Assets<br />

acquired under finance leases are capitalised at the<br />

leases inception at the lower of the fair value of the<br />

leased asset and the present value of the minimum<br />

lease payments (note 32). They are amortised<br />

over the anticipated life of the relevant lease. Lease<br />

payments are allocated between interest expense<br />

and reduction in the lease liability to achieve a<br />

constant rate on the finance balance outstanding.<br />

Leases in which a significant portion of the risks<br />

and rewards of ownership are retained by the<br />

lessor are classified as operating leases (note 32).<br />

Operating lease assets are not capitalised and<br />

rental payments are charged to the statement of<br />

comprehensive income on a straight-line basis over<br />

the period of the lease.<br />

(t) Intangibles – refer note 17<br />

Goodwill on acquisition<br />

The difference between the purchase consideration<br />

and the fair value of identifiable net assets<br />

acquired is initially brought to account as<br />

goodwill or discount on acquisition. Goodwill<br />

on the acquisition of subsidiaries is included in<br />

intangible assets.<br />

Goodwill is not amortised. Instead, goodwill is<br />

tested for impairment at each reporting date, or<br />

more frequently if events or change in circumstances<br />

indicate that it might be impaired and is carried<br />

at cost less any accumulated impairment losses.<br />

Impairment of goodwill cannot be reversed.<br />

Goodwill is allocated to cash-generating units for<br />

the purpose of impairment testing. Impairment<br />

is determined by assessing the recoverable<br />

amount of the cash generating unit to which the<br />

goodwill relates.<br />

Franchise rights<br />

The Group has franchise agreements with<br />

manufacturers for the distribution of new vehicles<br />

and parts. These franchise rights agreements<br />

have varying terms and periods of renewal. The<br />

Group considers that the franchise agreements<br />

will be renewed indefinitely and accordingly no<br />

amortisation is charged on these assets. The Group<br />

assesses the franchise rights for impairment on a<br />

periodic basis, but at least at each reporting date<br />

and where there are indications of impairment<br />

the franchise rights values are adjusted to their<br />

recoverable amounts.<br />

(u) Trade and Other Payables –<br />

refer note 18<br />

These amounts represent liabilities for goods<br />

and services provided to the Group prior to the<br />

reporting date and which are unpaid at reporting<br />

date. The amounts are generally unsecured and<br />

are usually paid within 30 days of recognition.<br />

Amounts are recognised initially at fair value and<br />

subsequently at amortised cost.<br />

(v) Interest Bearing Loans and<br />

Borrowings – refer note 21<br />

All loans and borrowings are initially recognised<br />

at fair value, net of transaction costs incurred.<br />

76<br />

Automotive Holdings Group