Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2012 Annual Report<br />

For the year ended June 2012<br />

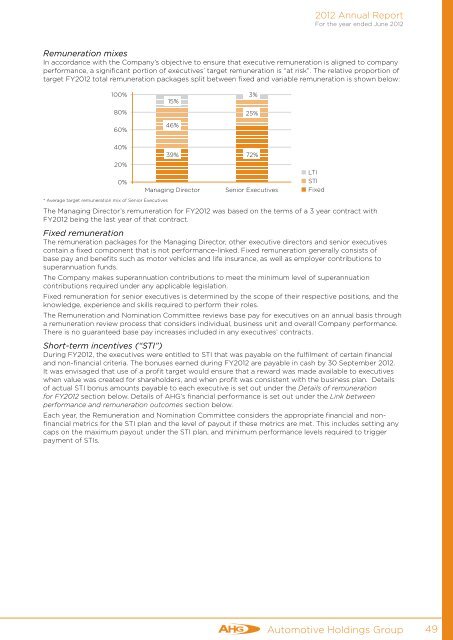

Remuneration mixes<br />

In accordance with the Company’s objective to ensure that executive remuneration is aligned to company<br />

performance, a significant portion of executives’ target remuneration is “at risk”. The relative proportion of<br />

target FY2012 total remuneration packages split between fixed and variable remuneration is shown below:<br />

100%<br />

80%<br />

60%<br />

15%<br />

46%<br />

3%<br />

25%<br />

40%<br />

20%<br />

0%<br />

39% 72%<br />

LTI<br />

STI<br />

Managing Director Senior Executives Fixed<br />

* Average target remuneration mix of Senior Executives<br />

The Managing Director’s remuneration for FY2012 was based on the terms of a 3 year contract with<br />

FY2012 being the last year of that contract.<br />

Fixed remuneration<br />

The remuneration packages for the Managing Director, other executive directors and senior executives<br />

contain a fixed component that is not performance-linked. Fixed remuneration generally consists of<br />

base pay and benefits such as motor vehicles and life insurance, as well as employer contributions to<br />

superannuation funds.<br />

The Company makes superannuation contributions to meet the minimum level of superannuation<br />

contributions required under any applicable legislation.<br />

Fixed remuneration for senior executives is determined by the scope of their respective positions, and the<br />

knowledge, experience and skills required to perform their roles.<br />

The Remuneration and Nomination Committee reviews base pay for executives on an annual basis through<br />

a remuneration review process that considers individual, business unit and overall Company performance.<br />

There is no guaranteed base pay increases included in any executives’ contracts.<br />

Short-term incentives (“STI”)<br />

During FY2012, the executives were entitled to STI that was payable on the fulfilment of certain financial<br />

and non-financial criteria. The bonuses earned during FY2012 are payable in cash by 30 September 2012.<br />

It was envisaged that use of a profit target would ensure that a reward was made available to executives<br />

when value was created for shareholders, and when profit was consistent with the business plan. Details<br />

of actual STI bonus amounts payable to each executive is set out under the Details of remuneration<br />

for FY2012 section below. Details of <strong>AHG</strong>’s financial performance is set out under the Link between<br />

performance and remuneration outcomes section below.<br />

Each year, the Remuneration and Nomination Committee considers the appropriate financial and nonfinancial<br />

metrics for the STI plan and the level of payout if these metrics are met. This includes setting any<br />

caps on the maximum payout under the STI plan, and minimum performance levels required to trigger<br />

payment of STIs.<br />

Automotive Holdings Group 49