Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Directors’ Report<br />

(continued)<br />

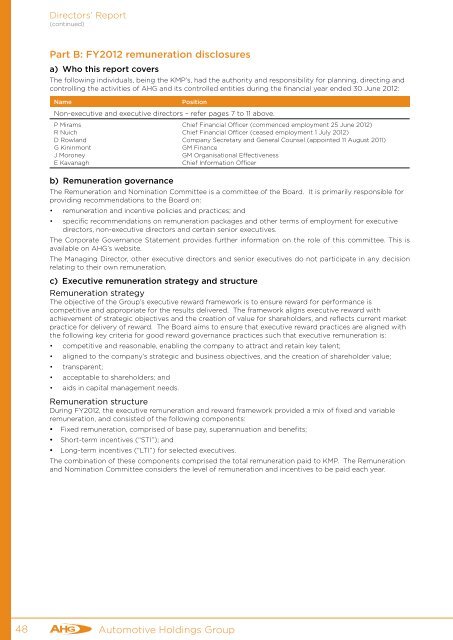

Part B: FY2012 remuneration disclosures<br />

a) Who this report covers<br />

The following individuals, being the KMP’s, had the authority and responsibility for planning, directing and<br />

controlling the activities of <strong>AHG</strong> and its controlled entities during the financial year ended 30 June 2012:<br />

Name<br />

Position<br />

Non-executive and executive directors – refer pages 7 to 11 above.<br />

P Mirams<br />

R Nuich<br />

D Rowland<br />

G Kininmont<br />

J Moroney<br />

E Kavanagh<br />

Chief Financial Officer (commenced employment 25 June 2012)<br />

Chief Financial Officer (ceased employment 1 July 2012)<br />

Company Secretary and General Counsel (appointed 11 August 2011)<br />

GM Finance<br />

GM Organisational Effectiveness<br />

Chief Information Officer<br />

b) Remuneration governance<br />

The Remuneration and Nomination Committee is a committee of the Board. It is primarily responsible for<br />

providing recommendations to the Board on:<br />

• remuneration and incentive policies and practices; and<br />

• specific recommendations on remuneration packages and other terms of employment for executive<br />

directors, non-executive directors and certain senior executives.<br />

The Corporate Governance Statement provides further information on the role of this committee. This is<br />

available on <strong>AHG</strong>’s website.<br />

The Managing Director, other executive directors and senior executives do not participate in any decision<br />

relating to their own remuneration.<br />

c) Executive remuneration strategy and structure<br />

Remuneration strategy<br />

The objective of the Group’s executive reward framework is to ensure reward for performance is<br />

competitive and appropriate for the results delivered. The framework aligns executive reward with<br />

achievement of strategic objectives and the creation of value for shareholders, and reflects current market<br />

practice for delivery of reward. The Board aims to ensure that executive reward practices are aligned with<br />

the following key criteria for good reward governance practices such that executive remuneration is:<br />

• competitive and reasonable, enabling the company to attract and retain key talent;<br />

• aligned to the company’s strategic and business objectives, and the creation of shareholder value;<br />

• transparent;<br />

• acceptable to shareholders; and<br />

• aids in capital management needs.<br />

Remuneration structure<br />

During FY2012, the executive remuneration and reward framework provided a mix of fixed and variable<br />

remuneration, and consisted of the following components:<br />

• Fixed remuneration, comprised of base pay, superannuation and benefits;<br />

• Short-term incentives (“STI”); and<br />

• Long-term incentives (“LTI”) for selected executives.<br />

The combination of these components comprised the total remuneration paid to KMP. The Remuneration<br />

and Nomination Committee considers the level of remuneration and incentives to be paid each year.<br />

48<br />

Automotive Holdings Group