Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements<br />

(continued)<br />

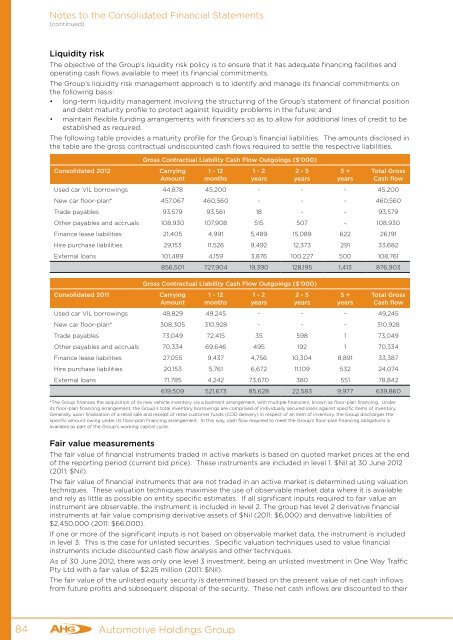

Liquidity risk<br />

The objective of the Group’s liquidity risk policy is to ensure that it has adequate financing facilities and<br />

operating cash flows available to meet its financial commitments.<br />

The Group’s liquidity risk management approach is to identify and manage its financial commitments on<br />

the following basis:<br />

• long-term liquidity management involving the structuring of the Group’s statement of financial position<br />

and debt maturity profile to protect against liquidity problems in the future; and<br />

• maintain flexible funding arrangements with financiers so as to allow for additional lines of credit to be<br />

established as required.<br />

The following table provides a maturity profile for the Group’s financial liabilities. The amounts disclosed in<br />

the table are the gross contractual undiscounted cash flows required to settle the respective liabilities.<br />

Consolidated 2012<br />

Gross Contractual Liability Cash Flow Outgoings ($’000)<br />

Carrying<br />

Amount<br />

1 - 12<br />

months<br />

1 - 2<br />

years<br />

2 - 5<br />

years<br />

5 +<br />

years<br />

Total Gross<br />

Cash flow<br />

Used car VIL borrowings 44,878 45,200 - - - 45,200<br />

New car floor-plan* 457,067 460,560 - - - 460,560<br />

Trade payables 93,579 93,561 18 - - 93,579<br />

Other payables and accruals 108,930 107,908 515 507 - 108,930<br />

Finance lease liabilities 21,405 4,991 5,489 15,089 622 26,191<br />

Hire purchase liabilities 29,153 11,526 9,492 12,373 291 33,682<br />

External loans 101,489 4,159 3,876 100,227 500 108,761<br />

Consolidated 2011<br />

856,501 727,904 19,390 128,195 1,413 876,903<br />

Gross Contractual Liability Cash Flow Outgoings ($’000)<br />

Carrying<br />

Amount<br />

1 - 12<br />

months<br />

1 - 2<br />

years<br />

2 - 5<br />

years<br />

5 +<br />

years<br />

Total Gross<br />

Cash flow<br />

Used car VIL borrowings 48,829 49,245 - - - 49,245<br />

New car floor-plan* 308,305 310,928 - - - 310,928<br />

Trade payables 73,049 72,415 35 598 1 73,049<br />

Other payables and accruals 70,334 69,646 495 192 1 70,334<br />

Finance lease liabilities 27,055 9,437 4,756 10,304 8,891 33,387<br />

Hire purchase liabilities 20,153 5,761 6,672 11,109 532 24,074<br />

External loans 71,785 4,242 73,670 380 551 78,842<br />

619,509 521,673 85,628 22,583 9,977 639,860<br />

*The Group finances the acquisition of its new vehicle inventory via a bailment arrangement, with multiple financiers, known as floor-plan financing. Under<br />

its floor-plan financing arrangement, the Group’s total inventory borrowings are comprised of individually secured loans against specific items of inventory.<br />

Generally, upon finalisation of a retail sale and receipt of retail customer funds (COD delivery) in respect of an item of inventory, the Group discharges the<br />

specific amount owing under its floor-plan financing arrangement. In this way, cash flow required to meet the Group’s floor-plan financing obligations is<br />

available as part of the Group’s working capital cycle.<br />

Fair value measurements<br />

The fair value of financial instruments traded in active markets is based on quoted market prices at the end<br />

of the reporting period (current bid price). These instruments are included in level 1. $Nil at 30 June 2012<br />

(2011: $Nil).<br />

The fair value of financial instruments that are not traded in an active market is determined using valuation<br />

techniques. These valuation techniques maximise the use of observable market data where it is available<br />

and rely as little as possible on entity specific estimates. If all significant inputs required to fair value an<br />

instrument are observable, the instrument is included in level 2. The group has level 2 derivative financial<br />

instruments at fair value comprising derivative assets of $Nil (2011: $6,000) and derivative liabilities of<br />

$2,450,000 (2011: $66,000).<br />

If one or more of the significant inputs is not based on observable market data, the instrument is included<br />

in level 3. This is the case for unlisted securities. Specific valuation techniques used to value financial<br />

instruments include discounted cash flow analysis and other techniques.<br />

As of 30 June 2012, there was only one level 3 investment, being an unlisted investment in One Way Traffic<br />

Pty Ltd with a fair value of $2.25 million (2011: $Nil).<br />

The fair value of the unlisted equity security is determined based on the present value of net cash inflows<br />

from future profits and subsequent disposal of the security. These net cash inflows are discounted to their<br />

84<br />

Automotive Holdings Group