Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2012 Annual Report<br />

For the year ended June 2012<br />

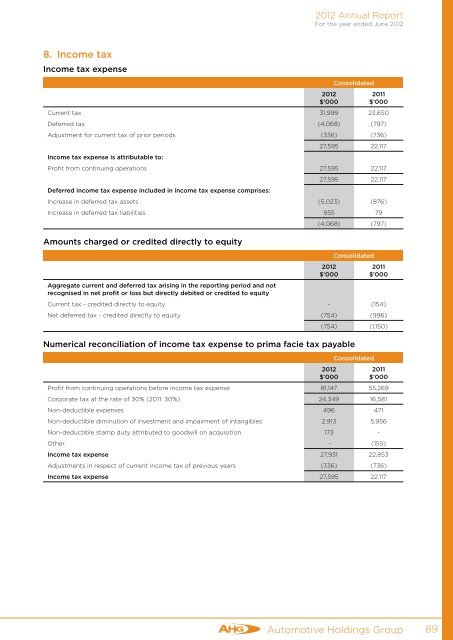

8. Income tax<br />

Income tax expense<br />

2012<br />

$’000<br />

Consolidated<br />

2011<br />

$’000<br />

Current tax 31,999 23,650<br />

Deferred tax (4,068) (797)<br />

Adjustment for current tax of prior periods (336) (736)<br />

27,595 22,117<br />

Income tax expense is attributable to:<br />

Profit from continuing operations 27,595 22,117<br />

27,595 22,117<br />

Deferred income tax expense included in income tax expense comprises:<br />

Increase in deferred tax assets (5,023) (876)<br />

Increase in deferred tax liabilities 955 79<br />

(4,068) (797)<br />

Amounts charged or credited directly to equity<br />

2012<br />

$’000<br />

Consolidated<br />

2011<br />

$’000<br />

Aggregate current and deferred tax arising in the reporting period and not<br />

recognised in net profit or loss but directly debited or credited to equity<br />

Current tax - credited directly to equity - (154)<br />

Net deferred tax - credited directly to equity (754) (996)<br />

(754) (1,150)<br />

Numerical reconciliation of income tax expense to prima facie tax payable<br />

2012<br />

$’000<br />

Consolidated<br />

2011<br />

$’000<br />

Profit from continuing operations before income tax expense 81,147 55,269<br />

Corporate tax at the rate of 30% (2011: 30%) 24,349 16,581<br />

Non-deductible expenses 496 471<br />

Non-deductible diminution of investment and impairment of intangibles 2,913 5,956<br />

Non-deductible stamp duty attributed to goodwill on acquisition 173 -<br />

Other - (155)<br />

Income tax expense 27,931 22,853<br />

Adjustments in respect of current income tax of previous years (336) (736)<br />

Income tax expense 27,595 22,117<br />

Automotive Holdings Group 89