Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2012 Annual Report<br />

For the year ended June 2012<br />

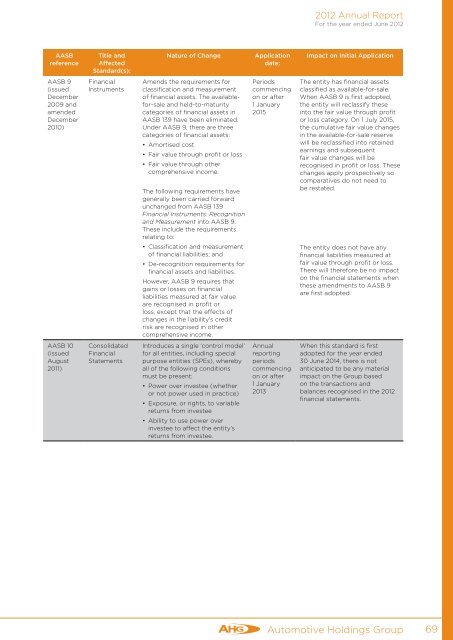

AASB<br />

reference<br />

Title and<br />

Affected<br />

Standard(s):<br />

Nature of Change<br />

Application<br />

date:<br />

Impact on Initial Application<br />

AASB 9<br />

(issued<br />

December<br />

2009 and<br />

amended<br />

December<br />

2010)<br />

Financial<br />

Instruments<br />

Amends the requirements for<br />

classification and measurement<br />

of financial assets. The availablefor-sale<br />

and held-to-maturity<br />

categories of financial assets in<br />

AASB 139 have been eliminated.<br />

Under AASB 9, there are three<br />

categories of financial assets:<br />

• Amortised cost<br />

• Fair value through profit or loss<br />

• Fair value through other<br />

comprehensive income.<br />

The following requirements have<br />

generally been carried forward<br />

unchanged from AASB 139<br />

Financial Instruments: Recognition<br />

and Measurement into AASB 9.<br />

These include the requirements<br />

relating to:<br />

• Classification and measurement<br />

of financial liabilities; and<br />

• De-recognition requirements for<br />

financial assets and liabilities.<br />

However, AASB 9 requires that<br />

gains or losses on financial<br />

liabilities measured at fair value<br />

are recognised in profit or<br />

loss, except that the effects of<br />

changes in the liability’s credit<br />

risk are recognised in other<br />

comprehensive income.<br />

Periods<br />

commencing<br />

on or after<br />

1 January<br />

2015<br />

The entity has financial assets<br />

classified as available-for-sale.<br />

When AASB 9 is first adopted,<br />

the entity will reclassify these<br />

into the fair value through profit<br />

or loss category. On 1 July 2015,<br />

the cumulative fair value changes<br />

in the available-for-sale reserve<br />

will be reclassified into retained<br />

earnings and subsequent<br />

fair value changes will be<br />

recognised in profit or loss. These<br />

changes apply prospectively so<br />

comparatives do not need to<br />

be restated.<br />

The entity does not have any<br />

financial liabilities measured at<br />

fair value through profit or loss.<br />

There will therefore be no impact<br />

on the financial statements when<br />

these amendments to AASB 9<br />

are first adopted.<br />

AASB 10<br />

(issued<br />

August<br />

2011)<br />

Consolidated<br />

Financial<br />

Statements<br />

Introduces a single ‘control model’<br />

for all entities, including special<br />

purpose entities (SPEs), whereby<br />

all of the following conditions<br />

must be present:<br />

• Power over investee (whether<br />

or not power used in practice)<br />

• Exposure, or rights, to variable<br />

returns from investee<br />

• Ability to use power over<br />

investee to affect the entity’s<br />

returns from investee.<br />

Annual<br />

reporting<br />

periods<br />

commencing<br />

on or after<br />

1 January<br />

2013<br />

When this standard is first<br />

adopted for the year ended<br />

30 June 2014, there is not<br />

anticipated to be any material<br />

impact on the Group based<br />

on the transactions and<br />

balances recognised in the 2012<br />

financial statements.<br />

Automotive Holdings Group 69