Download - AHG Limited

Download - AHG Limited

Download - AHG Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2012 Annual Report<br />

For the year ended June 2012<br />

present value using a pre-tax discount rate that reflects a current market assessment of the time value of<br />

money and the risks specific to the asset. If the estimated risk-adjusted discount rate was 10% higher or<br />

lower, the fair value (and equity reserves) would increase/decrease by $0.15 million (2011: $Nil).<br />

The carrying amounts of trade receivables and payables are assumed to approximate their fair values due<br />

to their short-term nature. The fair value of financial liabilities for disclosure purposes is estimated by<br />

discounting their future contractual cash flows at the current market interest rate that is available to the<br />

Group for similar financial instruments. The fair value of current borrowings approximates the carrying<br />

value amount, as the impact of discounting is not significant.<br />

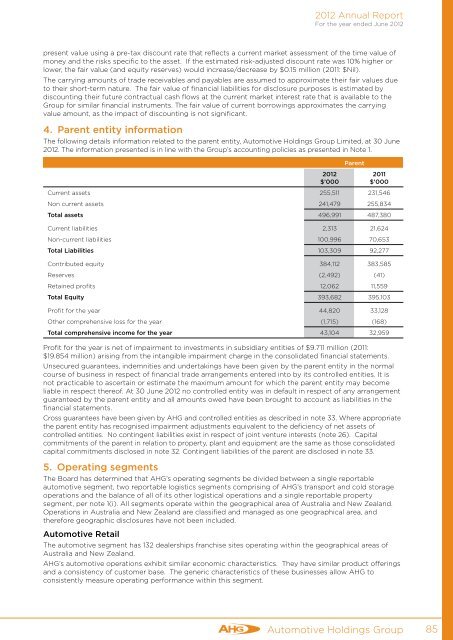

4. Parent entity information<br />

The following details information related to the parent entity, Automotive Holdings Group <strong>Limited</strong>, at 30 June<br />

2012. The information presented is in line with the Group’s accounting policies as presented in Note 1.<br />

Parent<br />

2012<br />

$’000<br />

2011<br />

$’000<br />

Current assets 255,511 231,546<br />

Non current assets 241,479 255,834<br />

Total assets 496,991 487,380<br />

Current liabilities 2,313 21,624<br />

Non-current liabilities 100,996 70,653<br />

Total Liabilities 103,309 92,277<br />

Contributed equity 384,112 383,585<br />

Reserves (2,492) (41)<br />

Retained profits 12,062 11,559<br />

Total Equity 393,682 395,103<br />

Profit for the year 44,820 33,128<br />

Other comprehensive loss for the year (1,715) (168)<br />

Total comprehensive income for the year 43,104 32,959<br />

Profit for the year is net of impairment to investments in subsidiary entities of $9.711 million (2011:<br />

$19.854 million) arising from the intangible impairment charge in the consolidated financial statements.<br />

Unsecured guarantees, indemnities and undertakings have been given by the parent entity in the normal<br />

course of business in respect of financial trade arrangements entered into by its controlled entities. It is<br />

not practicable to ascertain or estimate the maximum amount for which the parent entity may become<br />

liable in respect thereof. At 30 June 2012 no controlled entity was in default in respect of any arrangement<br />

guaranteed by the parent entity and all amounts owed have been brought to account as liabilities in the<br />

financial statements.<br />

Cross guarantees have been given by <strong>AHG</strong> and controlled entities as described in note 33. Where appropriate<br />

the parent entity has recognised impairment adjustments equivalent to the deficiency of net assets of<br />

controlled entities. No contingent liabilities exist in respect of joint venture interests (note 26). Capital<br />

commitments of the parent in relation to property, plant and equipment are the same as those consolidated<br />

capital commitments disclosed in note 32. Contingent liabilities of the parent are disclosed in note 33.<br />

5. Operating segments<br />

The Board has determined that <strong>AHG</strong>’s operating segments be divided between a single reportable<br />

automotive segment, two reportable logistics segments comprising of <strong>AHG</strong>’s transport and cold storage<br />

operations and the balance of all of its other logistical operations and a single reportable property<br />

segment, per note 1(i). All segments operate within the geographical area of Australia and New Zealand.<br />

Operations in Australia and New Zealand are classified and managed as one geographical area, and<br />

therefore geographic disclosures have not been included.<br />

Automotive Retail<br />

The automotive segment has 132 dealerships franchise sites operating within the geographical areas of<br />

Australia and New Zealand.<br />

<strong>AHG</strong>’s automotive operations exhibit similar economic characteristics. They have similar product offerings<br />

and a consistency of customer base. The generic characteristics of these businesses allow <strong>AHG</strong> to<br />

consistently measure operating performance within this segment.<br />

Automotive Holdings Group 85