Directory of Services - Kerby Centre

Directory of Services - Kerby Centre

Directory of Services - Kerby Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

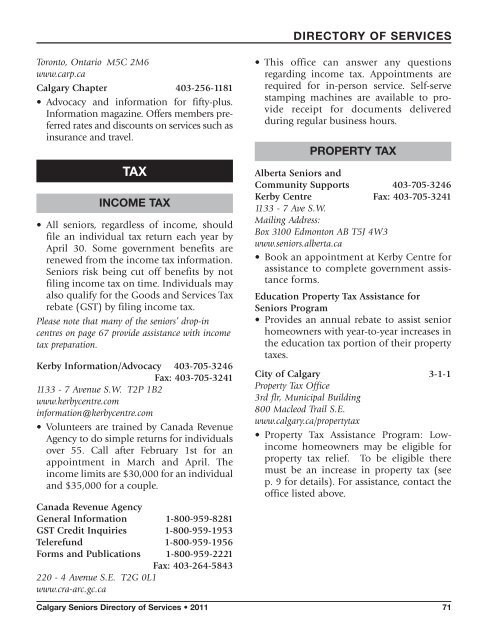

DIRECTORY OF SERVICES<br />

Toronto, Ontario M5C 2M6<br />

www.carp.ca<br />

Calgary Chapter 403-256-1181<br />

• Advocacy and information for fifty-plus.<br />

Information magazine. Offers members preferred<br />

rates and discounts on services such as<br />

insurance and travel.TAx<br />

TAx<br />

INCOME TAx<br />

• All seniors, regardless <strong>of</strong> income, should<br />

file an individual tax return each year by<br />

April 30. Some government benefits are<br />

renewed from the income tax information.<br />

Seniors risk being cut <strong>of</strong>f benefits by not<br />

filing income tax on time. Individuals may<br />

also qualify for the Goods and <strong>Services</strong> Tax<br />

rebate (GST) by filing income tax.<br />

Please note that many <strong>of</strong> the seniors’ drop-in<br />

centres on page 67 provide assistance with income<br />

tax preparation.<br />

<strong>Kerby</strong> Information/Advocacy 403-705-3246<br />

Fax: 403-705-3241<br />

1133 - 7 Avenue S.W. T2P 1B2<br />

www.kerbycentre.com<br />

information@kerbycentre.com<br />

• Volunteers are trained by Canada Revenue<br />

Agency to do simple returns for individuals<br />

over 55. Call after February 1st for an<br />

appointment in March and April. The<br />

income limits are $30,000 for an individual<br />

and $35,000 for a couple.<br />

Canada Revenue Agency<br />

General Information 1-800-959-8281<br />

GST Credit Inquiries 1-800-959-1953<br />

Telerefund 1-800-959-1956<br />

Forms and Publications 1-800-959-2221<br />

Fax: 403-264-5843<br />

220 - 4 Avenue S.E. T2G 0L1<br />

www.cra-arc.gc.ca<br />

• This <strong>of</strong>fice can answer any questions<br />

regarding income tax. Appointments are<br />

required for in-person service. Self-serve<br />

stamping machines are available to provide<br />

receipt for documents delivered<br />

during regular business hours.<br />

pROpERTY TAx<br />

Alberta Seniors and<br />

Community Supports 403-705-3246<br />

<strong>Kerby</strong> <strong>Centre</strong> Fax: 403-705-3241<br />

1133 - 7 Ave S.W.<br />

Mailing Address:<br />

Box 3100 Edmonton AB T5J 4W3<br />

www.seniors.alberta.ca<br />

• Book an appointment at <strong>Kerby</strong> <strong>Centre</strong> for<br />

assistance to complete government assistance<br />

forms.<br />

Education Property Tax Assistance for<br />

Seniors Program<br />

• Provides an annual rebate to assist senior<br />

homeowners with year-to-year increases in<br />

the education tax portion <strong>of</strong> their property<br />

taxes.<br />

City <strong>of</strong> Calgary 3-1-1<br />

Property Tax Office<br />

3rd flr, Municipal Building<br />

800 Macleod Trail S.E.<br />

www.calgary.ca/propertytax<br />

• Property Tax Assistance Program: Lowincome<br />

homeowners may be eligible for<br />

property tax relief. To be eligible there<br />

must be an increase in property tax (see<br />

p. 9 for details). For assistance, contact the<br />

<strong>of</strong>fice listed above.<br />

Calgary Seniors <strong>Directory</strong> <strong>of</strong> <strong>Services</strong> • 2011 71