ottawa county sewer district wastewater rules and regulations for ...

ottawa county sewer district wastewater rules and regulations for ...

ottawa county sewer district wastewater rules and regulations for ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

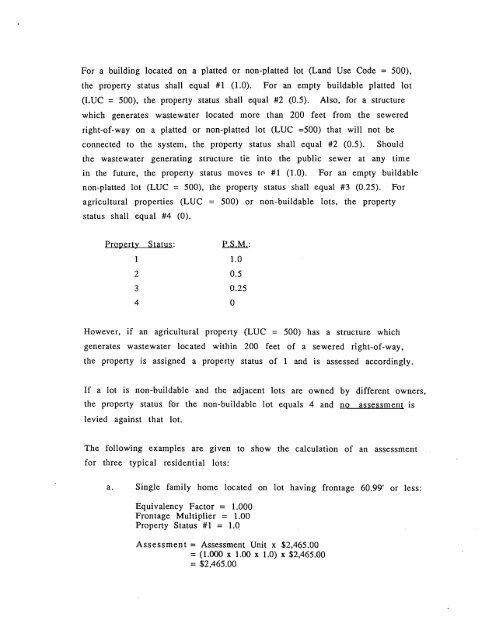

For a building located on a platted or non-platted lot (L<strong>and</strong> Use Code = 500).<br />

the property status shall equal #1 (1.0). For an empty buildable platted lot<br />

(LUC = 500). the property status shall equal #2 (0.5). Also, <strong>for</strong> a structure<br />

which generates <strong>wastewater</strong> located more than 200 feet from the <strong>sewer</strong>ed<br />

right-of-way on a platted or non-platted lot (LUC =500) that will not be<br />

connected to the system, the property status shall equal #2 (0.5). Should<br />

the <strong>wastewater</strong> generating structure tie into the public <strong>sewer</strong> at any time<br />

in the future, the property status moves to #1 (1.0). For an empty buildable<br />

non-platted lot (LUC = 500), the property status shall equal #3 (0.25). For<br />

agricultural properties (LUC = 500) or non-buildable lots, the property<br />

status shall equal #4 (0).<br />

Property Statlas: P.S.M.:<br />

1 1.0<br />

2 0.5<br />

3 0.25<br />

4 0<br />

However, if an agricultural property (LUC = 500) has a structure which<br />

generates <strong>wastewater</strong> located within 200 feet of a <strong>sewer</strong>ed right-of-way,<br />

the property is assigned a property status of 1 <strong>and</strong> is assessed accordingly.<br />

If a lot is non-buildable <strong>and</strong> the adjacent lots are owned by different owners,<br />

the property status <strong>for</strong> the non-buildable lot equals 4 <strong>and</strong> no assessment is<br />

levied against that lot.<br />

The following examples are given to show the calculation of an assessment<br />

<strong>for</strong> three typical residential lots:<br />

a. Single family home located on lot having frontage 60.99' or less:<br />

Equivalency Factor = 1.000<br />

Frontage Multiplier = 1.00<br />

Property Status #1 = 1.0<br />

Assessment = Assessment Unit x $2,465.00<br />

= (1.000 x 1.00 x 1.0) x $2,465.00<br />

= $2,465.00