Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

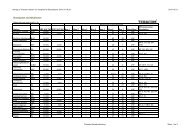

Notes<br />

Contents<br />

Note Description Page<br />

1 Accounting <strong>and</strong> valuation principles 67<br />

2 Operating income 72<br />

3 Leases 72<br />

4 Segment reporting 73<br />

5<br />

Work performed by the company for its own use <strong>and</strong><br />

capitalized<br />

73<br />

6 Employees <strong>and</strong> remuneration 74<br />

7 Pensions 76<br />

8 Depreciation/amortization 78<br />

9 Impairment 78<br />

10 Other expenses 78<br />

11 Remuneration to auditors 78<br />

12 Financial income <strong>and</strong> financial expenses 78<br />

13 Tax on profit for the year 79<br />

14 Information concerning closely related parties 79<br />

15 Property, plant <strong>and</strong> equipment 80<br />

Note Description Page<br />

16 Goodwill <strong>and</strong> other intangible assets 81<br />

17 Other financial assets 83<br />

18 Deferred tax 83<br />

19 Inventories 84<br />

20 Accounts receivable 84<br />

21 Financial instruments <strong>and</strong> financial risk management 84<br />

22 Prepaid expenses <strong>and</strong> accrued income 87<br />

23 Equity 88<br />

24 Accrued expenses <strong>and</strong> deferred income 88<br />

25 Provisions 88<br />

26 Shares <strong>and</strong> participations in Group companies 89<br />

27 Acquired businesses 89<br />

28 Pledged assets 89<br />

29 Contingent liabilities/guarantees 89<br />

Note 1. Accounting <strong>and</strong> valuation principles<br />

Basis for the preparation of the financial statements<br />

The consolidated financial statements have been prepared in accordance with<br />

IAS 27 <strong>and</strong> through application of International Financial <strong>Report</strong>ing St<strong>and</strong>ards<br />

(IFRS) as adopted by the EU. The application of these st<strong>and</strong>ards has been<br />

supplemented by the interpretations issued by the International Financial<br />

<strong>Report</strong>ing Interpretations Committee (IFRIC).<br />

The consolidated financial statements were prepared in accordance with<br />

the cost method with the exception of financial assets <strong>and</strong> liabilities (including<br />

derivative instruments) valued at fair value via the income statement.<br />

Some disclosures are prepared in accordance with Swedish Financial <strong>Report</strong>ing<br />

Board Recommendation RFR 1, the <strong>Annual</strong> Accounts Act <strong>and</strong> the requirements<br />

set forth by the Government Ownership Policy. The Parent Company's<br />

financial statements are prepared in accordance with the same accounting<br />

principles as the consolidated financial statements, with the exception of that<br />

described in the section Parent Company Accounting Principles.<br />

The consolidated financial statements <strong>and</strong> annual report for the financial<br />

year ending on 31 December <strong>2011</strong> were approved for issue by the Board of<br />

Directors <strong>and</strong> Group CEO/President on 16 March 2012 <strong>and</strong> will be brought<br />

forth for adoption at the <strong>Annual</strong> General Meeting on 18 April 2012.<br />

Consolidated financial statements<br />

The consolidated financial statements are prepared in accordance with the<br />

purchase accounting method. This method implies that the identified assets,<br />

liabilities <strong>and</strong> contingent liabilities of the operations acquired are reported<br />

at fair value at the time of the acquisition, in accordance with a prepared<br />

acquisition analysis. The acquisition cost for an acquisition includes the fair<br />

value of assets submitted as consideration <strong>and</strong> liabilities incurred or assumed<br />

on the day of transfer. This amount includes the fair value of assets or liabilities<br />

resulting from agreements for additional consideration. Expenses directly<br />

attributable to the acquisition are recognized as they are incurred. Goodwill<br />

arises <strong>and</strong> is reported as an asset whenever the consideration exceeds fair<br />

value as determined by the acquisition analysis.<br />

The Group's consolidated financial statements include the financial statements<br />

of the Parent Company <strong>and</strong> its directly or indirectly owned subsidiaries<br />

after the elimination of intra-Group transactions, unrealized gains from<br />

inventories <strong>and</strong> amortization of acquired surplus values.<br />

Definition of Group companies<br />

The consolidated financial statements include <strong>Teracom</strong> Group AB <strong>and</strong> all<br />

subsidiaries. Subsidiaries are companies in which <strong>Teracom</strong> Group AB either<br />

directly or indirectly holds more than 50 percent of the voting rights or in<br />

some other way exercises a controlling influence.<br />

With regard to companies acquired or divested during the year, the following<br />

applies:<br />

- Companies acquired during the year were included in the consolidated<br />

income statement as of the date control of the company was obtained.<br />

- Companies divested during the year are included in the consolidated income<br />

statement up until the date <strong>Teracom</strong>'s control was terminated.<br />

Transactions with closely related parties<br />

All transactions with closely related parties are based on market prices.<br />

Foreign currency translation<br />

The consolidated financial statements are prepared in SEK, which is the Parent<br />

Company's functional <strong>and</strong> reporting currency.<br />

Transactions in foreign currencies are converted to the relevant currency<br />

using the exchange rate applicable on the transaction date. Financial assets<br />

<strong>and</strong> liabilities expressed in foreign currencies are reported in the balance sheet<br />

after valuation at the exchange rate prevailing on the balance sheet date.<br />

Exchange rate differences arising during the period due to operating receivables<br />

<strong>and</strong> operating liabilities are reported as part of operating profit (loss),<br />

whereas exchange rate differences attributable to financial assets <strong>and</strong> liabilities<br />

are reported as part of the profit (loss) from financial investments. The<br />

portion of the exchange rate differences that comprises an effective hedge of<br />

net investments is reported under Other comprehensive income.<br />

The balance sheets of foreign subsidiaries were translated to SEK using the<br />

exchange rate prevailing on the balance sheet date. Goodwill <strong>and</strong> adjustments<br />

to fair value arising from acquisitions of foreign companies are treated as<br />

assets <strong>and</strong> liabilities in the foreign subsidiary <strong>and</strong> translated at the exchange<br />

rate prevailing on the balance sheet date. The income statements were translated<br />

using the average exchange rate for the year. The translation difference<br />

arising from the translation is reported directly under Other comprehensive<br />

income.<br />

67