Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

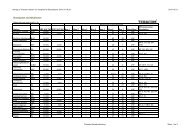

Return on plan assets <strong>2011</strong> 2010 Forecast 2012<br />

Expected return on plan assets 13 12 13<br />

Actuarial profit/loss on the plan assets (+/-) -4 8 0<br />

Actual return on plan assets 9 20 13<br />

Plan assets <strong>2011</strong> 2010 Forecast 2012<br />

Fair value of plan assets on 1 January 424 401 439<br />

Expected return on plan assets 13 12 13<br />

Fees/premiums (+) 20 16 16<br />

Paid remuneration (-) -14 -13 -16<br />

Actuarial profit/loss (+/-) on plan assets -4 8 0<br />

Fair value of plan assets on 31 December 439 424 452<br />

Reconciliation of change in pension liability <strong>2011</strong> 2010 Forecast 2012<br />

Net liability/asset on 1 January -51 -40 -59<br />

Pension expense for the period 18 22 19<br />

Paid remuneration (-) -19 -21 -18<br />

Fees, premiums (-) -20 -16 -16<br />

Reimbursement (+) 14 13 16<br />

Reductions <strong>and</strong> adjustments -1 -9 0<br />

Net liability/asset on 31 December -59 -51 -58<br />

<strong>2011</strong> 2010 Forecast 2012<br />

Accumulated unaccounted actuarial profits /losses (+/-) on 1 January -51 -133 -111<br />

<strong>Report</strong>ed actuarial profits/losses (+/-) during the year 28 -22 5<br />

Profit/loss (+/-) on obligation -84 95 0<br />

Profit/loss (+/-) on plan assets -4 8 0<br />

Profit/loss (+/-) on reductions <strong>and</strong> adjustments 0 1 0<br />

Accumulated unaccounted actuarial profits /losses (+/-) on 31 December -111 -51 -106<br />

Number entitled to pension on 1 January <strong>2011</strong> 2010 Forecast 2012<br />

Employees 504 512 519<br />

Vested benefits 743 729 786<br />

Retired persons 256 228 286<br />

Total 1 503 1 469 1 591<br />

Five-year overview <strong>2011</strong> 2010 2009 2008 2007<br />

Present value of the obligation (+) 489 397 494 454 478<br />

Fair value of plan assets (-) -439 -424 -401 -371 -358<br />

Present value of net obligation (+/-) 50 -27 93 83 120<br />

Profit/loss (+/-) on the obligation, actual effects -4 7 -22 7 -7<br />

Profit/loss (+/-) on plan assets, actual effects -4 8 -11 -14 3<br />

Plan assets <strong>2011</strong> 2010 2009 2008 2007<br />

Insurance contract 439 424 401 371 358<br />

The annual fees for pension insurance with Alecta (reported as a defined<br />

contribution plan) were SEK 2 (3) million. Alecta's surplus may be distributed<br />

amongst the policy holder(s) <strong>and</strong>/or the insured. As of 31 December <strong>2011</strong>,<br />

Alecta's surplus in the form of the collective funding ratio amounted to 113<br />

(146) percent. The collective funding ratio was calculated in accordance with<br />

IAS19.<br />

Actuarial assumptions<br />

The actuarial calculation of the Group’s pension obligations <strong>and</strong> pension costs<br />

is based on the following key assumptions stated as weighted averages for<br />

the various pension plans. A change in any of these fundamental assumptions<br />

can have a significant impact on calculated pension obligations, financing<br />

requirements <strong>and</strong> pension costs.<br />

Forecast<br />

Actuarial assumptions <strong>2011</strong> 2010 2012<br />

Discount rate (%) 3,90 5,00 3,90<br />

<strong>Annual</strong> salary increase (%) 3,00 3,00 3,00<br />

Increase in the income base amount (%) 3,00 3,00 3,00<br />

Inflation/annual increase in pension benefits (%) 2,00 2,00 2,00<br />

Termination rate (%) 3,00 3,00 3,00<br />

Expected remaining term of service (years) 17,8 18,8 17,2<br />

Expected return on plan assets (%) 3,00 3,00 3,00<br />

Discount rate<br />

The interest rate used to discount both funded <strong>and</strong> unfunded obligations for<br />

post-employment remuneration. When establishing the discount rate, consideration<br />

is given to the market yield on mortgage bonds with the same maturities<br />

as the obligation as of the balance sheet date.<br />

<strong>Annual</strong> salary increase<br />

The assessment of the annual salary increase reflects anticipated future salary<br />

increases as a combined effect of inflation, period of service, promotion <strong>and</strong><br />

other relevant factors such as supply <strong>and</strong> dem<strong>and</strong> in the labor market.<br />

Increase in the income base amount<br />

The income base amount, set annually, is used to determine the pensionable<br />

income ceiling in the national pension system. The assessment is based on the<br />

anticipated rate of inflation <strong>and</strong> historical salary trend of the entire labor market.<br />

Inflation/annual increase in pension benefits<br />

The assumption is based upon the expected rate of inflation in the market.<br />

Termination rate<br />

Historical information has been used in order to make an assessment of the<br />

termination rate. <strong>Teracom</strong> has used this information to estimate the future<br />

termination rate.<br />

Expected remaining term of service<br />

The average expected remaining term of service. This calculation is based<br />

upon the age distribution for employees <strong>and</strong> the expected future rate of<br />

employee turnover.<br />

Expected return on plan assets<br />

The assessment is based on the average expected return on existing <strong>and</strong><br />

future plan assets.<br />

77