Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 7 (cont'd)<br />

Note 10. Other costs<br />

Mortality rate<br />

Assumptions regarding the mortality rate are in accordance with the Swedish<br />

Financial Supervisory Authority's regulation, DUS06 (DUS06).<br />

Parent Company<br />

The Parent Company <strong>Teracom</strong> Group AB does not carry a pension liability in<br />

its balance sheet. The only pension liability in the Group is reported by the<br />

subsidiary <strong>Teracom</strong> AB, which was the Parent Company of the Group until<br />

June <strong>2011</strong>.<br />

Note 8. Depreciation/amortization<br />

The Group's other expenses amounted to SEK -1,034 (-969) million. The comparison<br />

figures are adapted to the higher degree of detail in the income statement.<br />

The largest expense item is costs for customer service. In the Parent<br />

Company, other external expenses for the year were SEK -13 (-) million.<br />

Group Parent Company<br />

Exchange losses on receivables/payables<br />

from operating activities <strong>2011</strong> 2010<br />

<strong>2011</strong>-06-01<br />

<strong>2011</strong>-12-31<br />

Exchange losses on accounts payable -4 -11 0<br />

Total -4 -11 0<br />

Group net exchange rate differences from operating activities amounted to<br />

SEK -1 (-7) million.<br />

Parent Company net exchange rate differences from operating activities<br />

amounted to SEK 0 (-) million.<br />

Tangible <strong>and</strong> intangible fixed assets are depreciated/amortized systematically<br />

over the estimated useful life of the asset. Useful life refers to the period<br />

during which the asset is expected to be used for its intended purpose in the<br />

Group. L<strong>and</strong> is not depreciated, since its useful life is unlimited. Goodwill <strong>and</strong><br />

trademarks are not amortized because it is not possible to estimate useful life.<br />

An assessment of the residual value <strong>and</strong> useful life is performed on each<br />

balance sheet date, <strong>and</strong> an adjustment is made if necessary. During <strong>2011</strong>, no<br />

changes have been made to the lengths of useful lives.<br />

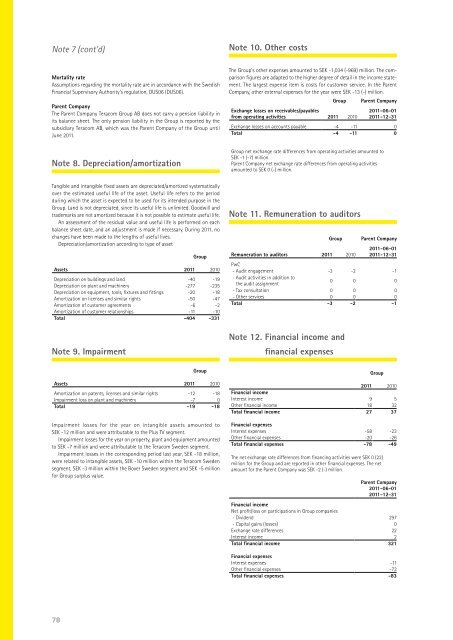

Depreciation/amortization according to type of asset<br />

Group<br />

Assets <strong>2011</strong> 2010<br />

Depreciation on buildings <strong>and</strong> l<strong>and</strong> -40 -19<br />

Depreciation on plant <strong>and</strong> machinery -277 -235<br />

Depreciation on equipment, tools, fixtures <strong>and</strong> fittings -20 -18<br />

Amortization on licenses <strong>and</strong> similar rights -50 -47<br />

Amortization of customer agreements -6 -2<br />

Amortization of customer relationships -11 -10<br />

Total -404 -331<br />

Note 9. Impairment<br />

Note 11. Remuneration to auditors<br />

Group<br />

Remuneration to auditors <strong>2011</strong> 2010<br />

Parent Company<br />

<strong>2011</strong>-06-01<br />

<strong>2011</strong>-12-31<br />

PwC<br />

- Audit engagement -3 -2 -1<br />

- Audit activities in addition to<br />

the audit assignment<br />

0 0 0<br />

- Tax consultation 0 0 0<br />

- Other services 0 0 0<br />

Total -3 -2 -1<br />

Note 12. Financial income <strong>and</strong><br />

financial expenses<br />

Group<br />

Assets <strong>2011</strong> 2010<br />

Amortization on patents, licenses <strong>and</strong> similar rights -12 -18<br />

Impairment loss on plant <strong>and</strong> machinery -7 0<br />

Total -19 -18<br />

Impairment losses for the year on intangible assets amounted to<br />

SEK -12 million <strong>and</strong> were attributable to the Plus TV segment.<br />

Impairment losses for the year on property, plant <strong>and</strong> equipment amounte d<br />

to SEK -7 million <strong>and</strong> were attributable to the <strong>Teracom</strong> Sweden segment.<br />

Impairment losses in the corresponding period last year, SEK -18 million,<br />

were related to intangible assets, SEK -10 million within the <strong>Teracom</strong> Sweden<br />

segment, SEK -3 million within the Boxer Sweden segment <strong>and</strong> SEK -5 million<br />

for Group surplus value.<br />

Group<br />

<strong>2011</strong> 2010<br />

Financial income<br />

Interest income 9 5<br />

Other financial income 18 32<br />

Total financial income 27 37<br />

Financial expenses<br />

Interest expenses -58 -23<br />

Other financial expenses -20 -26<br />

Total financial expenses -78 -49<br />

The net exchange rate differences from financing activities were SEK 0 (22)<br />

million for the Group <strong>and</strong> are reported in other financial expenses. The net<br />

amount for the Parent Company was SEK -2 (-) million.<br />

Parent Company<br />

<strong>2011</strong>-06-01<br />

<strong>2011</strong>-12-31<br />

Financial income<br />

Net profit/loss on participations in Group companies<br />

- Dividend 297<br />

- Capital gains (losses) 0<br />

Exchange rate differences 22<br />

Interest income 2<br />

Total financial income 321<br />

Financial expenses<br />

Interest expenses -11<br />

Other financial expenses -72<br />

Total financial expenses -83<br />

78