Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

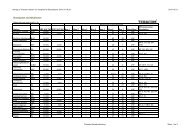

Note 17. Other financial assets<br />

Group<br />

Other financial assets <strong>2011</strong> 2010<br />

Net asset, pensions 59 51<br />

Long-term loan receivable 30 56<br />

Endowment insurance 1 1<br />

Other 5 6<br />

Total 95 114<br />

A detailed description of the item "Net asset, pensions" is provided in note 7.<br />

Note 18. Deferred tax<br />

Group<br />

Parent Company<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Deferred tax assets 172 120 25 -<br />

Deferred tax liabilities -502 -482 - -<br />

Deferred tax asset/tax liability, net -330 -362 25 -<br />

The tables below present deferred tax assets <strong>and</strong> liabilities for the Group <strong>and</strong> the Parent Company according to category <strong>and</strong> how the assets <strong>and</strong> liabilities<br />

changed during the year.<br />

Group<br />

Deferred tax assets/liabilities<br />

Untaxed<br />

reserves<br />

Intangible<br />

assets<br />

Pension<br />

liability<br />

Deficit<br />

deduction<br />

Opening balance, 1 January -449 -38 -18 134 9 -362<br />

Cash flow hedges 5 5<br />

Exchange rate differences -1 0 -1<br />

Reclassifications -4 18 2 16<br />

Taken up as income during the year -27 5 -2 37 -1 12<br />

Closing balance, 31 December <strong>2011</strong> -476 -37 -20 188 15 -330<br />

Other<br />

Total<br />

Parent Company<br />

Deferred tax assets/liabilities<br />

Deficit deductions Total<br />

Opening balance, 1 January 0 0<br />

Taken up as income during the year 25 25<br />

Closing balance, 31 December <strong>2011</strong> 25 25<br />

On the balance sheet date, the Group has unutilized deficit deductions for<br />

the Swedish operations totaling SEK 97 (0) million. The deficit deduction was<br />

reported as a deferred tax asset totaling SEK 25 (0) million.<br />

The total deficit pertaining to the Danish operations was SEK 755 (572)<br />

million on the balance sheet date, which corresponds to a deferred tax asset<br />

of SEK 189 (143) million using the Danish tax rate. Having taken into consideration<br />

uncertainties about future profits <strong>and</strong> other factors, a deferred tax<br />

asset of SEK 104 (105) million was reported by the Boxer Denmark segment.<br />

Unutilized deficit deductions for the Danish operations amount to SEK 338<br />

(151) million.<br />

For the Finnish operations, the total deficit as of the balance sheet date<br />

was SEK 655 (571) million, which corresponds to a deferred tax asset of SEK<br />

170 (148) million using the Finnish tax rate. For the Plus TV segment, SEK 58<br />

(38) million was reported as a deferred tax asset having taken into consideration<br />

uncertainties about future profits <strong>and</strong> other factors. Unutilized deficit<br />

deductions for the Finnish operations amount to SEK 431 (424) million. The<br />

unutilized deficit deductions have an unlimited life, except for the deductions<br />

in Finl<strong>and</strong>, which have a 10-year life.<br />

83