Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

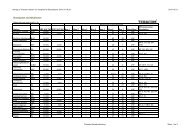

Note 26. Shares <strong>and</strong> participations in Group companies<br />

Participations in Group companies<br />

Company name CIN Registered office<br />

<strong>Teracom</strong> AB 556441-5098 Stockholm<br />

Boxer TV-Access AB 556548-1131 Stockholm<br />

Oy Boxer TV AB 1589479-9 Helsinki<br />

Boxer TV A/S 29939470 Copenhagen<br />

<strong>Teracom</strong> A/S 25598008 Taastrup<br />

Digi TV Plus Oy 1988050-3 Helsinki<br />

<strong>Teracom</strong> Mobile TV AB 556392-5303 Stockholm<br />

<strong>Teracom</strong> Mast AB 556711-9168 Stockholm<br />

Book value<br />

Company name Number shares Equity Profit (loss) for the year<br />

Capital/share<br />

of votes, % <strong>2011</strong> 2010<br />

<strong>Teracom</strong> AB (Parent Company previous year) 250 000 1 572 304 100 1 633<br />

Boxer TV-Access AB 3 332 156 156 100 1 410 1 410<br />

Oy Boxer TV AB 392 100 0 0<br />

Boxer TV A/S 5 000 -256 -258 100 444<br />

<strong>Teracom</strong> A/S 3 800 1 288 43 100 1 410 1 410<br />

Digi TV Plus Oy 2 921 500 -134 -75 53 394 413<br />

<strong>Teracom</strong> Mobile TV AB 10 000 1 0 100 0 0<br />

<strong>Teracom</strong> Mast AB 10 000 1 0 100 1 1<br />

5 292 3 234<br />

Note 27. Acquired businesses<br />

On 30 September 2010, <strong>Teracom</strong> AB acquired 100 percent of the shares in<br />

the Danish terrestrial network operator, BSD, which consists of the following<br />

three companies: Broadcast Service Denmark A/S, Broadcast Stations Company<br />

1 A/S <strong>and</strong> Broadcast Stations Company 2 A/S. The consideration, SEK<br />

1,394 million, was paid in cash. Acquisition costs amounted to SEK 16 million<br />

<strong>and</strong> have been included in the Group's income statement for 2010 as other<br />

expenses. The acquired companies, which were merged in May <strong>2011</strong>, comprise<br />

a cash-generating unit called <strong>Teracom</strong> A/S. According to the final acquisition<br />

analysis, the assets <strong>and</strong> liabilities included in the acquisition of <strong>Teracom</strong> A/S<br />

are as follows:<br />

MSEK<br />

Value according to<br />

acquisition analysis<br />

Property, plant <strong>and</strong> equipment 1 440<br />

Customer agreements 20<br />

Customer relations 12<br />

Intangible assets 39<br />

Current receivables - interest-bearing 47<br />

Current receivables - non interest-bearing 4<br />

Cash <strong>and</strong> bank balances 147<br />

Provisions (deferred tax liabilities) -8<br />

Long-term liabilities - interest-bearing -241<br />

Long-term liabilities - non interest-bearing -98<br />

Current liabilities - interest-bearing -43<br />

Current liabilities - non interest-bearing -37<br />

Acquired identifiable net assets 1 282<br />

Goodwill 112<br />

Purchase sum for shares in subsidiary 1 394<br />

possible to calculate the total amount of income that the Group would have<br />

had if <strong>Teracom</strong> A/S had been consolidated on 1 January 2010 since <strong>Teracom</strong><br />

A/S consisted of several companies during 2010 <strong>and</strong> the legal structure was<br />

changed just prior to the acquisition.<br />

Note 28. Pledged assets<br />

The Group's <strong>and</strong> the Parent Company's pledged assets at the end of the year<br />

amounted to SEK 0 (0) million <strong>and</strong> 0 (0), respectively.<br />

Note 29. Contingent liabilities/Guarantees<br />

At the end of <strong>2011</strong> there was only one contingent liability/guarantee in the<br />

Parent Company. It was also the only contingent liability in the Group. The<br />

contingent liability referred to a Parent Company guarantee for the subsidiary<br />

Boxer TV A/S. The Parent Company guarantees its subsidiary's financial commitments<br />

in a Letter of Financial Support.<br />

Purchase sum entered as a liability -6<br />

Consideration paid on 31 December 2010 -1 388<br />

Cash equivalents in acquired subsidiaries 147<br />

Change in Group cash equivalents as of<br />

31 December 2010<br />

-1 241<br />

The income from <strong>Teracom</strong> A/S included in the consolidated income statement<br />

for the period 1 October-31 December 2010 amounted to SEK 60 million.<br />

<strong>Teracom</strong> A/S also contributed a profit before tax of SEK 18 million. It is not<br />

89