Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

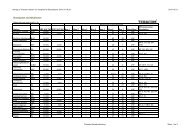

Note 19. Inventories<br />

Group<br />

Type of goods <strong>2011</strong> 2010<br />

Finished goods 67 25<br />

Total 67 25<br />

Inventories are valued at cost. The cost for inventories that is expensed is<br />

included in the item Material costs <strong>and</strong> amounted to SEK 144 (141) million for<br />

the Group. The obsolescence reserve is included in the value of the inventories.<br />

The total write-down amount for the year was SEK 0 (0) million.<br />

Note 20. Accounts receivable<br />

<strong>2011</strong> 2010<br />

Accounts receivable 353 306<br />

Provisions for bad debts -32 -11<br />

Accounts receivable, net 321 295<br />

Provisions in relation to accounts receivable 9% 4%<br />

As of 31 December <strong>2011</strong> the Group's provision for doubtful debts was SEK<br />

32 (11) million. Group companies with pay TV operations, which have end<br />

consumers as part of their customer base, make provisions in accordance with<br />

a pre-determined ladder that has been adapted to the conditions of each geographic<br />

market. Group companies with network activities, whose customers<br />

are companies, make provisions based on an individual assessment of each<br />

customer <strong>and</strong> receivable. Provisions <strong>and</strong> the utilization of reserves for doubtful<br />

receivables were transferred to the income statement <strong>and</strong> are included in<br />

cost of sales.<br />

The carrying amount of accounts receivable is the same as the fair value since<br />

the discounting effect is insignificant. The fair value of accounts receivable<br />

constitutes maximum exposure to the calculated risk for bad debt losses.<br />

The credit terms for various types of contracts <strong>and</strong> customer categories are<br />

defined in each subsidiary's credit instructions. A credit statement is obtained<br />

for sales on credit to both companies <strong>and</strong> consumers in order to minimize the<br />

risk of bad debt losses.<br />

Time analysis of accounts receivable fallen due <strong>2011</strong> 2010<br />

Accounts receivable that have not fallen due 215 188<br />

Accounts receivable overdue < 30 days 87 94<br />

Accounts receivable overdue 30 - 60 days 10 6<br />

Accounts receivable overdue 61 - 90 days 4 2<br />

Accounts receivable overdue 91 - 120 days 2 2<br />

Accounts receivable overdue > 121 days 3 3<br />

Accounts receivable, total 321 295<br />

Provisions for doubtful receivables <strong>2011</strong> 2010<br />

Provisions 1 January -11 -24<br />

New provisions -16 0<br />

Release of reserves 4 11<br />

Bad debt losses -9 2<br />

Exchange rate differences <strong>and</strong> other changes 0 0<br />

Provisions 31 December -32 -11<br />

Note 21. Financial instruments <strong>and</strong> financial risk management<br />

<strong>Teracom</strong>’s operations expose the Group to various types of financial risk. The<br />

Group’s overall financial operations <strong>and</strong> management of financial risk are<br />

centralized to the <strong>Teracom</strong> Group's Finance department. These activities are<br />

based upon the finance policy established by the Board of Directors, which is<br />

characterized by the desire to maintain a low level of risk. The Group's financial<br />

strategy <strong>and</strong> goals are designed to achieve maximum return on equity<br />

based upon reliable, cost-effective financial management practices that help<br />

ensure adequate control <strong>and</strong> high quality risk management within the Group.<br />

The overriding principle is to minimize all factors that could have a negative<br />

impact on earnings <strong>and</strong> cash flow due to short-term fluctuations in financial<br />

markets. This applies to both the Parent Company <strong>and</strong> the Group, in its entirety.<br />

The Group may use derivative instruments in order to hedge certain exposures<br />

to risk, however, only for the following purposes:<br />

- To convert future payments for electricity consumption to a fixed electricity price.<br />

- To convert future expected commercial payments in foreign currencies (primarily<br />

EUR) to Swedish krona (SEK).<br />

- To convert the fixed interest term for borrowing.<br />

- To hedge net investment in foreign operations.<br />

The market risks include currency risk, interest rate risk <strong>and</strong> electricity price<br />

risk, which are also described in this note. Other financial risks are broken<br />

down into credit risk, liquidity risk <strong>and</strong> financing risk.<br />

Currency risk<br />

This is the risk that changes in exchange rates will negatively impact the<br />

Group's profitability or financial position. This type of risk is divided into two<br />

categories (below): transactional <strong>and</strong> translational.<br />

Transactional exposure<br />

Transaction exposure encompasses all future contractual <strong>and</strong> forecasted<br />

income <strong>and</strong> expenses in foreign currencies, which thus involve a risk that the<br />

Group's profitability will be negatively impacted by changes in exchange rates.<br />

The <strong>Teracom</strong> Group has limited transactional exposure. This is because the<br />

value-added from international business activities is primarily created locally<br />

by having expenses in the same currency as the sales revenues.<br />

Currency derivatives are used to decrease transaction exposure in EUR <strong>and</strong><br />

the hedged flow on the balance sheet date was EUR 6 million.<br />

Sensitivity analysis of currency risk<br />

The <strong>Teracom</strong> Group's currency transactions are primarily in SEK, EUR <strong>and</strong> DKK.<br />

During <strong>2011</strong>, the net outflow of EUR amounted to the equivalent of SEK -148<br />

(-146) million. In <strong>2011</strong>, the average exchange rate for EUR was SEK 9.0335. A<br />

fluctuation in the exchange rate of +/- 10 percent would impact profits by<br />

SEK +/- 15 million. The Group's net flow in DKK during <strong>2011</strong> was close to zero<br />

through internal currency netting within the Group.<br />

Translational exposure<br />

Because the company has international business activities, there is also a<br />

certain degree of translation exposure. This is rooted in the value of foreign<br />

investments as well as the profits generated on an ongoing basis. Such profits<br />

are translated using the average rate for the year as the opening value <strong>and</strong><br />

comparing it to the year's ending rate, which is provided by the Swedish Central<br />

Bank. The difference is reported against equity. Accordingly, the only time<br />

that an actual cash flow is involved is in connection with disposals, investments<br />

<strong>and</strong> dividends from subsidiaries.<br />

84