Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Group uses forward contracts <strong>and</strong> loans in foreign currency to hedge<br />

certain foreign net investments. Exchange rate differences arising as result of<br />

these contracts <strong>and</strong> loans are transferred to consolidated other comprehensive<br />

income to the extent they correspond to translation differences.<br />

Following the divestment of a foreign subsidiary, the accumulated<br />

exchange rate differences, which were previously transferred to Other comprehensive<br />

income, are reported in the profit/loss for the period as a part of<br />

the profit or loss attributable to the sale.<br />

Segment reporting<br />

For the <strong>Teracom</strong> Group, the Group management team has been identified<br />

as the senior-most decision making body. The Group management team<br />

has established operating segments based on the information used to make<br />

strategic decisions. The operating segments are responsible for the operating<br />

profit <strong>and</strong> the working capital that they manage. Financial expenses, financial<br />

income <strong>and</strong> income tax are dealt with at the Group level. The "Other" item<br />

comprises Group functions, including Group management. These functionbased<br />

departments have income of insignificant amounts, which is why they<br />

are not considered to be separate operating segments (in accordance with<br />

IFRS 8).<br />

The segments are reported in accordance with the same accounting principles<br />

that are applied by the Group. Sales between segments occur at market<br />

terms <strong>and</strong> prices that are fair estimates of current market prices.<br />

Recognition of revenue<br />

Revenue is recognized when it is probable that the financial benefits will flow<br />

to the Group <strong>and</strong> the amount of revenue can be measured reliably. Revenue<br />

from fixed-price contracts for all segments is reported in the Parent Company<br />

in accordance with the percentage of completion method. Profit is thus<br />

recorded at the same rate as the work is completed, provided that the costs<br />

incurred or to be incurred in respect of the transaction can be measured reliably.<br />

Any expected loss on such contracts is recognized as an expense as soon<br />

as such loss is probable. For subscription contracts that provide the customer<br />

access to TV programs, revenue is recognized on a linear basis over the course<br />

of the contract term. This also applies to direct costs associated with such<br />

contracts, which are also recognized on a linear basis over the course of the<br />

contract term. Costs <strong>and</strong> income for program cards (which are needed to see<br />

the coded channels via a box <strong>and</strong> antenna) are not distributed over the course<br />

of the contract term since these cards cannot be returned. Both the income<br />

<strong>and</strong> costs for program cards are reported at the time card fee is invoiced to<br />

the customer.<br />

Net sales<br />

Net sales pertains to revenue from services that have been sold <strong>and</strong> subscriptions<br />

that are part of the Group's ordinary operations, less any discounts <strong>and</strong><br />

value-added tax.<br />

Other income/other operating income<br />

Other income is income obtained from activities that are not part of the<br />

Group's ordinary operations.<br />

Borrowing costs<br />

Borrowing costs, i.e. interest rates <strong>and</strong> other costs incurred in connection with<br />

the borrowing of funds, are recognized in the income statement for the period<br />

to which they refer. There are no loan expenses that are directly attributable<br />

to the purchase, performance or production of a qualified asset <strong>and</strong> thereby<br />

should be capitalized in the asset's cost of acquisition.<br />

Taxes<br />

<strong>Report</strong>ed tax is made up of current tax <strong>and</strong> deferred tax. Current tax refers to<br />

the profit or loss for the period <strong>and</strong> is valued at the tax rate prevailing on the<br />

balance sheet date. Deferred tax is comprised of amounts to be paid in the<br />

future or a reduction of future tax. Deferred tax is calculated in accordance<br />

with the tax rates decided or announced on the balance sheet date.<br />

Deferred tax is based on all identifiable temporary differences that exist on<br />

the balance sheet date. Temporary differences are defined as the difference<br />

between the carrying amount of an asset or liability <strong>and</strong> its tax base. Deferred<br />

tax assets on deficit deductions <strong>and</strong> temporary differences are reported as<br />

assets to the extent it is probable they will be utilized in the future. Deferred<br />

tax assets <strong>and</strong> deferred tax liabilities are reported net when they are attributable<br />

to a single tax authority <strong>and</strong> when a company or a group of companies,<br />

for example via a Group contribution, is legally entitled to net tax assets<br />

against tax liabilities.<br />

The carrying amount of deferred tax assets is reviewed at the end of each<br />

reporting period <strong>and</strong> reduced to the extent that it is no longer probable that<br />

sufficient taxable profit will be available to allow the benefit of part or all<br />

of that deferred tax asset to be utilized. Any such reduction is subsequently<br />

reversed to the extent that it becomes probable that sufficient taxable profit<br />

will be available.<br />

Property, plant <strong>and</strong> equipment<br />

Items of property, plant, <strong>and</strong> equipment are recognized as assets when it is<br />

probable that the future economic benefits associated with the asset will flow<br />

to the Group, <strong>and</strong> the cost of the asset can be measured reliably. Property,<br />

plant <strong>and</strong> equipment are reported at historic cost with deductions for linear,<br />

accumulated depreciation <strong>and</strong> any impairment. Depreciation is calculated<br />

from the point when an asset is acquired or a new plant is put into operation.<br />

Estimated useful lives are applied to both groups of assets <strong>and</strong> individual<br />

assets. L<strong>and</strong> is not depreciated since its useful life is judged to be unlimited. In<br />

all other cases, depreciation is calculated on a linear basis <strong>and</strong> is based on the<br />

following expected useful lives:<br />

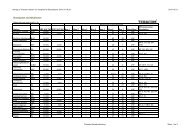

Assets<br />

L<strong>and</strong> <strong>and</strong> buildings<br />

Buildings<br />

L<strong>and</strong> improvements<br />

Plant <strong>and</strong> machinery<br />

Permanent equipment in buildings<br />

Distribution equipment<br />

Radio equipment<br />

Power generating equipment<br />

Antenna sites<br />

Mast installations<br />

Equipment, tools, fixtures <strong>and</strong> fittings<br />

Vehicles<br />

Other equipment<br />

Useful life, years<br />

20-40 years<br />

10-20 years<br />

10-15 years<br />

3-10 years<br />

7-15 years<br />

10-15 years<br />

10-20 years<br />

20-30 years<br />

3-6 years<br />

3-5 years<br />

Construction-in-progress<br />

Construction in progress refers primarily to facilities that are being built.<br />

Construction-in-progress is valued in the same way as acquired assets, i.e. in<br />

accordance with the cost method at the cost of acquisition including directly<br />

attributable expenses – that is, valuation in accordance with the actual costs<br />

incurred.<br />

Intangible assets<br />

Goodwill<br />

Goodwill is reported as an intangible asset with an uncertain useful life at<br />

cost with deductions for accumulated impairment.<br />

Br<strong>and</strong>s<br />

Acquired br<strong>and</strong>s refers to <strong>Teracom</strong>'s entitlement to use the Plus TV br<strong>and</strong>,<br />

which was acquired in June 2009, in Finl<strong>and</strong>. The br<strong>and</strong> is reported as an<br />

intangible asset that is considered to have an uncertain useful life <strong>and</strong> is not<br />

amortized.<br />

Customer agreements<br />

The acquisition of <strong>Teracom</strong> A/S in September 2010 included customer agreements,<br />

which were reported as an intangible asset. Acquired customer agreements<br />

are amortized on a linear basis over their useful life, which is 3 years.<br />

Customer relations<br />

Both the acquisition of Digi-TV Plus Oy in June 2009 <strong>and</strong> the acquisition of<br />

<strong>Teracom</strong> A/S in September 2010 included customer relationships that were<br />

reported as intangible assets. These acquired customer relationships are<br />

amortized on a linear basis over their useful lives, which are judged to be 8<br />

<strong>and</strong> 9 years, respectively.<br />

Patents, licenses <strong>and</strong> similar rights<br />

Intangible assets are recognized when it is probable that the future economic<br />

benefits that are attributable to the asset will flow to the Group <strong>and</strong> the cost<br />

of the asset can be measured reliably. Acquired patents, licenses <strong>and</strong> similar<br />

rights are reported at cost with deductions for accumulated amortization <strong>and</strong><br />

any impairment. Patents, licenses <strong>and</strong> similar rights are amortized on a linear<br />

basis over the useful life, which is 3 years. The network activities include<br />

capacity rights that are amortized over a useful life of 10 years.<br />

Test of impairment on fixed assets<br />

The Group assesses at each balance sheet date if there is any indication that<br />

the value of a non-current asset has depreciated. If such an indication arises,<br />

68