Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Annual and Sustainability Report 2011 - Teracom

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 7. Pensions<br />

A majority of the Group's employees are primarily covered by defined benefit<br />

pension plans, which means that they are guaranteed a pension that corresponds<br />

to a certain percentage of their salary. The pension plans include<br />

a retirement pension, a disability pension <strong>and</strong> a survivor pension. Employees<br />

of Boxer TV-Access AB are entitled to pension benefits in accordance with<br />

the ITP pension plan, which is secured through insurance with Alecta. Other<br />

employees within the Group in Sweden are covered by the ITP-Tele pension<br />

plan. Pension obligations are calculated annually as per the reporting date,<br />

based on actuarial assumptions. Pension obligations are secured through provisions<br />

in the balance sheet <strong>and</strong> through insurance premiums.<br />

In Finl<strong>and</strong>, employees are entitled to statutory pensions benefits in accordance<br />

with Finnish legislation on pensions for employees, a defined benefit<br />

pension plan (TEL pension). Pension benefits are secured through insurances<br />

<strong>and</strong> they are not covered by IAS 19. Employees in Denmark are covered by<br />

a defined contribution pension plan. Pension benefits are secured through<br />

insurances.<br />

In addition to the ITP plan, there is a pension liability that <strong>Teracom</strong> AB<br />

assumed from the former Swedish PTT when it was incorporated in 1992.<br />

The liability consists of a non-vesting portion <strong>and</strong> a vesting portion. The nonvesting<br />

portion was terminated on <strong>2011</strong>-12-31 since all employees with this<br />

type of agreement retired in <strong>2011</strong>. The remaining vesting portion refers to<br />

retirement pensions. Employees hired after incorporation have an insuranceonly<br />

solution as of 65 years of age. Retirement pensions to employees who<br />

have been invited to take early retirement are secured through provisions in<br />

the balance sheet or insurances <strong>and</strong> are paid as a retirement pension until the<br />

person reaches 65 years of age.<br />

Actuarial gains <strong>and</strong> losses are taken up as income over the employee’s<br />

remaining period of employment to the extent that the total gain or loss per<br />

plan falls outside the 10 percent corridor corresponding to the higher of the<br />

pension obligation or the fair value of the plan assets for each plan, respectively.<br />

The cost related to service during the current year refers to the capital<br />

value of earned pension benefits during the year as calculated by the Projected<br />

Unit Credit Method.<br />

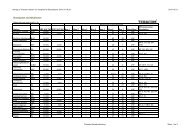

Total pension expenses are distributed as follows:<br />

Group<br />

Pension expense for the period <strong>2011</strong> 2010 Forecast 2012<br />

Cost related to service during the current year 7 11 9<br />

Interest expense 20 18 19<br />

Expected return on plan assets -13 -12 -13<br />

Change in asset reduction (IAS 19.58b) -25 27 0<br />

Actuarial profit/loss (+/-) to report for the year 28 -22 4<br />

Cost regarding service from prior periods 1 0 0<br />

Total cost for defined benefit plans 18 22 19<br />

Pension expense to report in the income statement 18 22 19<br />

Other effects to report in the income statement<br />

Reductions, profit/loss (-/+) -1 -9 0<br />

Total -1 -9 0<br />

Detailed description of pension obligations <strong>and</strong> pension expense<br />

Pension obligations, plan assets <strong>and</strong> receivables/provisions for pension obligations<br />

as well as actuarial gains/loss for defined benefit pension plans have<br />

developed as follows:<br />

Group<br />

Pension liability <strong>2011</strong> 2010 Forecast 2012<br />

Present value of wholly or partially funded obligations (+) 485 389 498<br />

Fair value of plan assets -439 -424 -452<br />

Net value of wholly or partially funded obligations (+/-) 46 -35 46<br />

Present value of unfunded obligations (+) 4 8 1<br />

Present value of net obligation (+/-) 50 -27 47<br />

Unaccounted actuarial gain/loss (+/-) -111 -51 -106<br />

Effect of the limitation rule for net assets 2 27 1<br />

Pension liability/asset to report in the balance sheet -59 -51 -58<br />

Present value of defined benefit plans <strong>2011</strong> 2010 Forecast 2012<br />

Present value of the obligation on 1 January 397 494 489<br />

Cost related to service during the current period 7 11 9<br />

Interest expense 20 18 19<br />

Paid remuneration -19 -21 -18<br />

Cost regarding service from prior periods 1 0 0<br />

Reductions <strong>and</strong> adjustments -1 -10 0<br />

Actuarial profit/loss on the obligation (+/-) 84 -95 0<br />

Present value of the obligation on 31 December 489 397 499<br />

76