- Page 1 and 2:

PLENTIFUL ENERGY The Story of the I

- Page 3 and 4:

Copyright © 2011 Charles E. Till a

- Page 6 and 7:

CONTENTS FOREWORD .................

- Page 8 and 9:

CHAPTER 10 APPLICATION OF PYROPROCE

- Page 10 and 11:

FOREWORD On a breezy December day i

- Page 12 and 13:

CHAPTER 1 ARGONNE NATIONAL LABORATO

- Page 14 and 15:

even now is straining the limits of

- Page 16 and 17:

with events and time. Till saw the

- Page 18 and 19:

it, I saw how a national laboratory

- Page 20 and 21:

Figure 1-2. West stands of the Stag

- Page 22 and 23:

development of nuclear power for ci

- Page 24 and 25:

depended on U.S. ability to maintai

- Page 26 and 27:

construction funding kept increasin

- Page 28 and 29:

faced a nightmarish combination of

- Page 30 and 31:

concept in the next decade.) In sti

- Page 32 and 33:

was based on EBR-I experience, but

- Page 34 and 35:

Figure 1-9. Experimental Breeder Re

- Page 36 and 37:

Figure 1-11. Rendering of the EBR-I

- Page 38 and 39:

performance. But the decision had b

- Page 40 and 41:

its shakedown in early years it jus

- Page 42 and 43:

sense primarily a commercial power

- Page 44 and 45:

without electrical generation, the

- Page 46 and 47:

Its purpose was to demonstrate the

- Page 48 and 49:

of each period, which the managemen

- Page 50 and 51:

CHAPTER 2 THE INTEGRAL FAST REACTOR

- Page 52 and 53:

A line had been pursued that the re

- Page 54 and 55:

The IFR refining process also produ

- Page 56 and 57:

director of Argonne a year or two b

- Page 58 and 59:

eporting on nuclear power developme

- Page 60 and 61:

A few weeks later, the mid-term ele

- Page 62 and 63:

2.6 Summary In late 1983, the line

- Page 64 and 65:

Argonne would be. My Ph.D. at Imper

- Page 66 and 67:

I had worked at the United Kingdom

- Page 68 and 69:

hadn‘t bothered us with it. But t

- Page 70 and 71:

But I had gone over and over the on

- Page 72 and 73:

laboratories.‖ Incidentally, late

- Page 74 and 75:

Argonne by this time was one of sev

- Page 76 and 77:

3.1.2 Life at the Laboratory in the

- Page 78 and 79:

An anecdote: In the cooperative arr

- Page 80 and 81:

Cycle Facility‖ went. We pushed i

- Page 82 and 83:

(LMFBR), which assumed a very rapid

- Page 84 and 85:

the pool was a settled issue; it wa

- Page 86 and 87:

During the early stage of the IFR p

- Page 88 and 89:

scientific work, not on non-essenti

- Page 90 and 91:

e generally held, even as facts inc

- Page 92 and 93:

cf per day from Canada via pipeline

- Page 94 and 95:

serious, and it is made more seriou

- Page 96 and 97:

global economy. The LWR, and the Ad

- Page 98 and 99:

supply 11%, and one, the world‘s

- Page 100 and 101:

Fatih Birol, has recently been quot

- Page 102 and 103:

gas production of little use in the

- Page 104 and 105:

expenditures during a decade starti

- Page 106 and 107:

thousand tonnes in one large increm

- Page 108 and 109:

But the principal line of developme

- Page 110 and 111:

Tar sands and oil shale recovery ar

- Page 112 and 113:

14. W. H. Ziegler, C. J. Campbell,

- Page 114 and 115:

Argonne had been a part of the deve

- Page 116 and 117:

Breaches or holes in the fuel cladd

- Page 118 and 119:

waste. For efficiency in uranium us

- Page 120 and 121:

Further, as a metal, sodium does no

- Page 122 and 123:

to the boundaries and many leak fro

- Page 124 and 125:

is debatable, it remains our belief

- Page 126 and 127:

CHAPTER 6 IFR FUEL CHARACTERISTICS,

- Page 128 and 129:

To do this, an extraordinarily simp

- Page 130 and 131:

Further cementing the decision was

- Page 132 and 133:

the AEC, but the reactor operation

- Page 134 and 135:

hands-on access needed to accomplis

- Page 136 and 137:

temperature. However, a very substa

- Page 138 and 139:

It turned out that the high-plutoni

- Page 140 and 141:

In the column ―Pu content % heavy

- Page 142 and 143:

40 start-ups and shutdowns 5 15% ov

- Page 144 and 145:

During casting, a partial vacuum (1

- Page 146 and 147:

is in fact a new fuel. Plutonium-ba

- Page 148 and 149:

8. G. L. Hofman and L. C. Walters,

- Page 150 and 151:

characteristics necessary for this.

- Page 152 and 153:

exchangers, and the steam generator

- Page 154 and 155:

experiments, as mentioned; this has

- Page 156 and 157:

sufficient to allow radioactive rel

- Page 158 and 159:

In the IFR, this loss of the coolin

- Page 160 and 161:

Figure7- 2. Reactor outlet temperat

- Page 162 and 163:

for thermal expansion of heavy stru

- Page 164 and 165:

power to shut down power is basical

- Page 166 and 167:

criticality. The debris is in the f

- Page 168 and 169:

7.10.2 The EBR-I Partial Meltdown T

- Page 170 and 171:

7.11 Licensing Implications What ar

- Page 172 and 173:

The sodium flowing into the steam g

- Page 174 and 175:

[15] Provisions are also made to co

- Page 176 and 177:

disassembly comes, it is with a rea

- Page 178 and 179:

CHAPTER 8 THE PYROPROCESS In the ne

- Page 180 and 181:

EBR-II purposes, and it established

- Page 182 and 183:

valuable fuel constituents, uranium

- Page 184 and 185:

and materials and it had been renam

- Page 186 and 187:

The first operation is done in the

- Page 188 and 189:

into the receiver crucible. The hea

- Page 190 and 191:

In the final step, the pins are arr

- Page 192 and 193:

Spent Fuel Processed, kg effective

- Page 194 and 195:

products, highly radioactive and se

- Page 196 and 197:

its own bayonet-style partial inter

- Page 198 and 199:

If the bond sodium along with the s

- Page 200 and 201:

CHAPTER 9 THE BASIS OF THE ELECTROR

- Page 202 and 203:

Whether or not a given reaction can

- Page 204 and 205:

9.3 Kinetics of the Reactions Chemi

- Page 206 and 207:

The exponential exp((E f -E b )/RT)

- Page 208 and 209:

The electrorefining process brings

- Page 210 and 211:

cathode operation. Once the solutio

- Page 212 and 213:

Table 9-2. Measured data and calcul

- Page 214 and 215:

All four measurements show that eve

- Page 216 and 217:

The free energy of the reaction of

- Page 218 and 219:

2. At an actinide chloride ratio of

- Page 220 and 221:

CHAPTER 10 APPLICATION OF PYROPROCE

- Page 222 and 223:

10.2 Electrolytic Reduction Step 10

- Page 224 and 225:

The pyrochemical process simply sup

- Page 226 and 227:

Figure 10-1. Electrolytic reduction

- Page 228 and 229:

The distribution of fuel constituen

- Page 230 and 231:

an electrorefiner with a 5001,000 k

- Page 232 and 233:

aqueous reprocessing plant. The eco

- Page 234 and 235:

Li metal at the cathode. Lithium me

- Page 236 and 237:

4. D. W. Dees and J. P. Ackerman,

- Page 238 and 239:

Our intent for the IFR technology w

- Page 240 and 241:

dose to any member of the public mu

- Page 242 and 243: IFR process, as we shall see, does

- Page 244 and 245: Relative Radiological Toxicity uran

- Page 246 and 247: doses from Tc-99 and I-129 equilibr

- Page 248 and 249: Fraction of Initial Actinide, % pro

- Page 250 and 251: long-lived fission products and tra

- Page 252 and 253: to decay to the point where they co

- Page 254 and 255: References 1. ―Nuclear Waste Poli

- Page 256 and 257: 12.1 Introduction Assessment of a p

- Page 258 and 259: History provides empirical evidence

- Page 260 and 261: program offered nations help with n

- Page 262 and 263: Other nations are recycling their s

- Page 264 and 265: uranium-233 cycle has been half-hea

- Page 266 and 267: electrorefiner salt. And this, of c

- Page 268 and 269: those concentrations in making the

- Page 270 and 271: chance of ―pre-ignition‖ leadin

- Page 272 and 273: It is now known that the plutonium

- Page 274 and 275: 12.8 Monitoring of Processes Always

- Page 276 and 277: [18] In it he shows that with a spo

- Page 278 and 279: Such a system tracks the quantity a

- Page 280 and 281: weapons grade plutonium. Levels of

- Page 282 and 283: 12.13 Summary In IFR technology the

- Page 284 and 285: 12. T. P. McLaughlin, et al., ―A

- Page 286 and 287: The earliest fast reactors designed

- Page 288 and 289: India, too, has successfully operat

- Page 290 and 291: levels, actually higher than the di

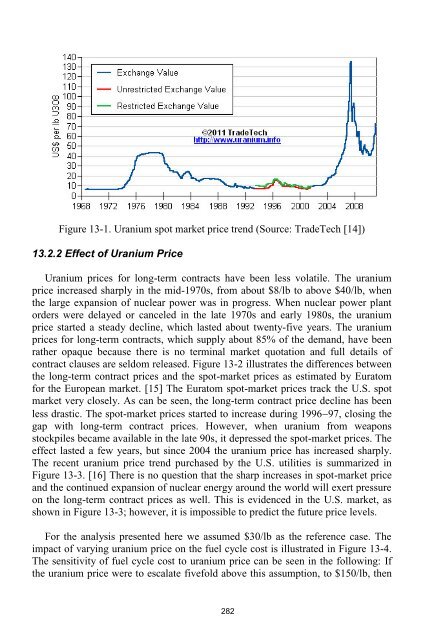

- Page 294 and 295: $/lb Uranium Price, $/lb U3O8 the f

- Page 296 and 297: the once-through fuel cycle. Howeve

- Page 298 and 299: $/kg 1200 1000 $1000/kg Rep Cost Pu

- Page 300 and 301: Table 13-7. Summary Comparison of F

- Page 302 and 303: fabrication. This, along with a low

- Page 304 and 305: Fissile Cost, $/gm-fissile Fuel Cyc

- Page 306 and 307: 13.6 System Aspects The previous se

- Page 308 and 309: waste streams have no long-term dec

- Page 310 and 311: 5. S. C. Chetal, ―India‘s Fast

- Page 312 and 313: capacity over this century, in a sy

- Page 314 and 315: thermal properties of NaK—the boi

- Page 316 and 317: It is suspected that the lead corro

- Page 318 and 319: Neutron Yield, Eta Value A = number

- Page 320 and 321: to maintain a hard spectrum, the fu

- Page 322 and 323: Table 14-3. Effects of fuel pin dia

- Page 324 and 325: Fuel Volume Fraction have a large e

- Page 326 and 327: neutron leakages from the core are

- Page 328 and 329: like breeding, does increase such d

- Page 330 and 331: substantial advantage to start with

- Page 332 and 333: Doubling Time, yrs the reactivity c

- Page 334 and 335: 14.7 Worldwide Fast Reactor Experie

- Page 336 and 337: limit to its life. The ingenuity of

- Page 338 and 339: Nuclear Capacity, GWe the replaceme

- Page 340 and 341: 14.9 How to Deploy Pyroprocessing P

- Page 342 and 343:

construction projects. They may see

- Page 344 and 345:

inferior to sodium in their thermal

- Page 346:

5. Federation of American Scientist

- Page 349 and 350:

Supporting the reactor design and c

- Page 352 and 353:

ACKNOWLEDGEMENTS In beginning this

- Page 354 and 355:

APPENDIX A DETAILED EXPLANATION OF

- Page 356 and 357:

The actinide metals (uranium, pluto

- Page 358 and 359:

As noted above, the interactions ri

- Page 360 and 361:

3. Equilibrium coefficients give th

- Page 362 and 363:

ion is created at the anode. Bulk t

- Page 364 and 365:

proceed spontaneously. If the magni

- Page 366 and 367:

product chlorides are highly stable

- Page 368 and 369:

increases with increasing temperatu

- Page 370 and 371:

Equilibrium in a chemical system is

- Page 372 and 373:

Exp(-ΔG o /RT) = [ U / Pu ] [ U /

- Page 374 and 375:

―in solution.‖ More Pu added to

- Page 376 and 377:

appropriate values are used for the

- Page 378 and 379:

A.9.5 The Second Cathode Regime: On

- Page 380 and 381:

in the real world. Uranium dendrite

- Page 382 and 383:

This is the significant number. The

- Page 384 and 385:

For those who are curious, the elec

- Page 386 and 387:

of concentration of uranium chlorid

- Page 388 and 389:

agreement with the measured ratio w

- Page 390 and 391:

eference 7. The important calculati

- Page 392 and 393:

as well. The numbers were obtained

- Page 394 and 395:

Run3: Plutonium isn’t, Uranium is

- Page 396 and 397:

The final actinide chloride ratios

- Page 398:

values of several of the constants

- Page 401 and 402:

HCDA HFEF HM HWR HTR IAEA ICRP IEA

- Page 404:

ABOUT THE AUTHORS Dr. CHARLES E. TI