Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

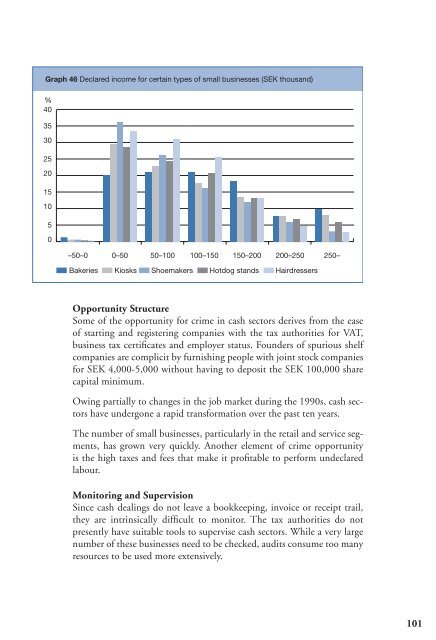

Graph 46 Declared income for certain types of small businesses (SEK thousand)<br />

%<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

–50–0 0–50 50–100 100–150 150–200 200–250 250–<br />

Bakeries Kiosks Shoemakers Hotdog stands Hairdressers<br />

Opportunity Structure<br />

Some of the opportunity for <strong>crime</strong> in cash sectors derives from the ease<br />

of starting and registering companies with the tax authorities for VAT,<br />

business tax certificates and employer status. Founders of spurious shelf<br />

companies are complicit by furnishing people with joint stock companies<br />

for SEK 4,000-5,000 without having to deposit the SEK 100,000 share<br />

capital minimum.<br />

Owing partially to changes in the job market during the 1990s, cash sectors<br />

have undergone a rapid transformation over the past ten years.<br />

The number of small businesses, particularly in the retail and service segments,<br />

has grown very quickly. Another element of <strong>crime</strong> opportunity<br />

is the high taxes and fees that make it profitable to perform undeclared<br />

labour.<br />

Monitoring and Supervision<br />

Since cash dealings do not leave a bookkeeping, invoice or receipt trail,<br />

they are intrinsically difficult to monitor. The tax authorities do not<br />

presently have suitable tools to supervise cash sectors. While a very large<br />

number of these businesses need to be checked, audits consume too many<br />

resources to be used more extensively.<br />

101