Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

mentary evidence for verifying actual revenue, particularly in the case of<br />

small businesses that lack financial management or internal monitoring<br />

systems. Among other contributing factors may be the stiff competition<br />

that businesses face and the labour shortages that arise during economic<br />

booms.<br />

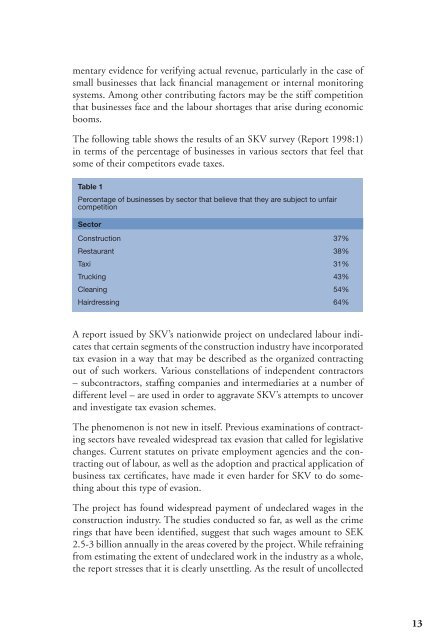

The following table shows the results of an SKV survey (Report 1998:1)<br />

in terms of the percentage of businesses in various sectors that feel that<br />

some of their competitors evade taxes.<br />

Table 1<br />

Percentage of businesses by sector that believe that they are subject to unfair<br />

competition<br />

Sector<br />

Construction 37%<br />

Restaurant 38%<br />

Taxi 31%<br />

Trucking 43%<br />

Cleaning 54%<br />

Hairdressing 64%<br />

A <strong>report</strong> issued by SKV’s nationwide project on undeclared labour indicates<br />

that certain segments of the construction industry have incorporated<br />

tax evasion in a way that may be described as the organized contracting<br />

out of such workers. Various constellations of independent contractors<br />

– subcontractors, staffing companies and intermediaries at a number of<br />

different level – are used in order to aggravate SKV’s attempts to uncover<br />

and investigate tax evasion schemes.<br />

The phenomenon is not new in itself. Previous examinations of contracting<br />

sectors have revealed widespread tax evasion that called for legislative<br />

changes. Current statutes on private employment agencies and the contracting<br />

out of labour, as well as the adoption and practical application of<br />

business tax certificates, have made it even harder for SKV to do something<br />

about this type of evasion.<br />

The project has found widespread payment of undeclared wages in the<br />

construction industry. The studies conducted so far, as well as the <strong>crime</strong><br />

rings that have been identified, suggest that such wages amount to SEK<br />

2.5-3 billion annually in the areas covered by the project. While refraining<br />

from estimating the extent of undeclared work in the industry as a whole,<br />

the <strong>report</strong> stresses that it is clearly unsettling. As the result of uncollected<br />

13