Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

Economic crime report 2004 - Ekobrottsmyndigheten

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

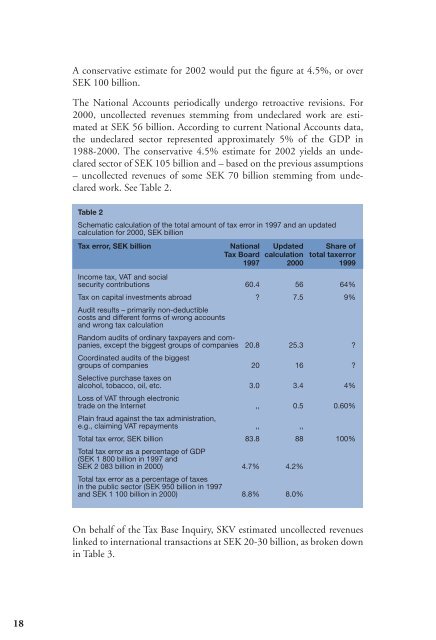

A conservative estimate for 2002 would put the figure at 4.5%, or over<br />

SEK 100 billion.<br />

The National Accounts periodically undergo retroactive revisions. For<br />

2000, uncollected revenues stemming from undeclared work are estimated<br />

at SEK 56 billion. According to current National Accounts data,<br />

the undeclared sector represented approximately 5% of the GDP in<br />

1988-2000. The conservative 4.5% estimate for 2002 yields an undeclared<br />

sector of SEK 105 billion and – based on the previous assumptions<br />

– uncollected revenues of some SEK 70 billion stemming from undeclared<br />

work. See Table 2.<br />

Table 2<br />

Schematic calculation of the total amount of tax error in 1997 and an updated<br />

calculation for 2000, SEK billion<br />

Tax error, SEK billion National Updated Share of<br />

Tax Board calculation total taxerror<br />

1997 2000 1999<br />

Income tax, VAT and social<br />

security contributions 60.4 56 64%<br />

Tax on capital investments abroad ? 7.5 9%<br />

Audit results – primarily non-deductible<br />

costs and different forms of wrong accounts<br />

and wrong tax calculation<br />

Random audits of ordinary taxpayers and companies,<br />

except the biggest groups of companies 20.8 25.3 ?<br />

Coordinated audits of the biggest<br />

groups of companies 20 16 ?<br />

Selective purchase taxes on<br />

alcohol, tobacco, oil, etc. 3.0 3.4 4%<br />

Loss of VAT through electronic<br />

trade on the Internet ,, 0.5 0.60%<br />

Plain fraud against the tax administration,<br />

e.g., claiming VAT repayments ,, ,,<br />

Total tax error, SEK billion 83.8 88 100%<br />

Total tax error as a percentage of GDP<br />

(SEK 1 800 billion in 1997 and<br />

SEK 2 083 billion in 2000) 4.7% 4.2%<br />

Total tax error as a percentage of taxes<br />

in the public sector (SEK 950 billion in 1997<br />

and SEK 1 100 billion in 2000) 8.8% 8.0%<br />

On behalf of the Tax Base Inquiry, SKV estimated uncollected revenues<br />

linked to international transactions at SEK 20-30 billion, as broken down<br />

in Table 3.<br />

18