Price Determination in the Australian Food Industry A Report

Price Determination in the Australian Food Industry A Report

Price Determination in the Australian Food Industry A Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The overall use of raw material product through a fruit process<strong>in</strong>g operation is balanced between<br />

<strong>the</strong> demand for fresh (m<strong>in</strong>imally processed) l<strong>in</strong>es, <strong>the</strong> usage of product which meets specifications<br />

for cann<strong>in</strong>g and optimis<strong>in</strong>g <strong>the</strong> use of outsized fruit <strong>in</strong> juice or concentrate. A significant portion<br />

(around 30 per cent) is disposed of as waste product, generally to <strong>the</strong> livestock sector as feed.<br />

While retail prices for canned l<strong>in</strong>es have steadily risen over time (at a rate close to 2 per cent per<br />

annum), <strong>the</strong> ability for <strong>the</strong> processor to extract sufficient returns across all uses of fruit has been<br />

limited due to <strong>the</strong> strength of competition <strong>in</strong> <strong>the</strong> dr<strong>in</strong>ks market (with imported concentrates<br />

accessible to <strong>in</strong>dustry) and <strong>the</strong> need to <strong>in</strong>vest <strong>in</strong> products and market promotion to widen <strong>the</strong><br />

product range. Costs of market<strong>in</strong>g, packag<strong>in</strong>g and factory labour have <strong>in</strong>creased over time at<br />

faster rates than price rises have allowed.<br />

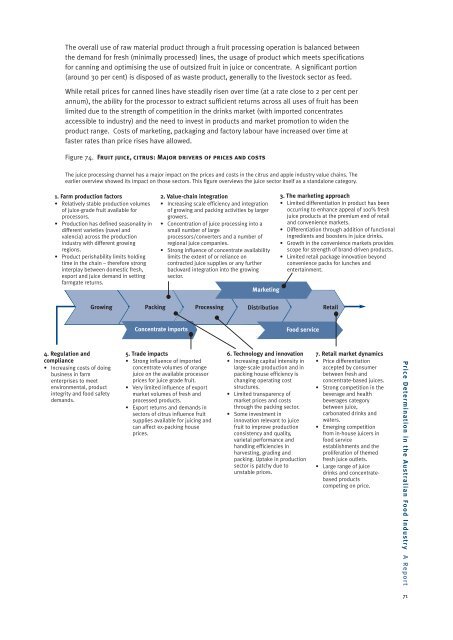

Figure 74. Fruit juice, citrus: Major drivers of prices and costs<br />

The juice process<strong>in</strong>g channel has a major impact on <strong>the</strong> prices and costs <strong>in</strong> <strong>the</strong> citrus and apple <strong>in</strong>dustry value cha<strong>in</strong>s. The<br />

earlier overview showed its impact on those sectors. This figure overviews <strong>the</strong> juice sector itself as a standalone category.<br />

1. Farm production factors<br />

• Relatively stable production volumes<br />

of juice-grade fruit available for<br />

processors.<br />

• Production has def<strong>in</strong>ed seasonality <strong>in</strong><br />

different varieties (navel and<br />

valencia) across <strong>the</strong> production<br />

<strong>in</strong>dustry with different grow<strong>in</strong>g<br />

regions.<br />

• Product perishability limits hold<strong>in</strong>g<br />

time <strong>in</strong> <strong>the</strong> cha<strong>in</strong> – <strong>the</strong>refore strong<br />

<strong>in</strong>terplay between domestic fresh,<br />

export and juice demand <strong>in</strong> sett<strong>in</strong>g<br />

farmgate returns.<br />

2. Value-cha<strong>in</strong> <strong>in</strong>tegration<br />

• Increas<strong>in</strong>g scale efficiency and <strong>in</strong>tegration<br />

of grow<strong>in</strong>g and pack<strong>in</strong>g activities by larger<br />

growers.<br />

• Concentration of juice process<strong>in</strong>g <strong>in</strong>to a<br />

small number of large<br />

processors/converters and a number of<br />

regional juice companies.<br />

• Strong <strong>in</strong>fluence of concentrate availability<br />

limits <strong>the</strong> extent of or reliance on<br />

contracted juice supplies or any fur<strong>the</strong>r<br />

backward <strong>in</strong>tegration <strong>in</strong>to <strong>the</strong> grow<strong>in</strong>g<br />

sector.<br />

Market<strong>in</strong>g<br />

3. The market<strong>in</strong>g approach<br />

• Limited differentiation <strong>in</strong> product has been<br />

occurr<strong>in</strong>g to enhance appeal of 100% fresh<br />

juice products at <strong>the</strong> premium end of retail<br />

and convenience markets.<br />

• Differentiation through addition of functional<br />

<strong>in</strong>gredients and boosters <strong>in</strong> juice dr<strong>in</strong>ks.<br />

• Growth <strong>in</strong> <strong>the</strong> convenience markets provides<br />

scope for strength of brand-driven products.<br />

• Limited retail package <strong>in</strong>novation beyond<br />

convenience packs for lunches and<br />

enterta<strong>in</strong>ment.<br />

Grow<strong>in</strong>g Pack<strong>in</strong>g Process<strong>in</strong>g Distribution Retail<br />

Concentrate imports<br />

<strong>Food</strong> service<br />

4. Regulation and<br />

compliance<br />

• Increas<strong>in</strong>g costs of do<strong>in</strong>g<br />

bus<strong>in</strong>ess <strong>in</strong> farm<br />

enterprises to meet<br />

environmental, product<br />

<strong>in</strong>tegrity and food safety<br />

demands.<br />

5. Trade impacts<br />

• Strong <strong>in</strong>fluence of imported<br />

concentrate volumes of orange<br />

juice on <strong>the</strong> available processor<br />

prices for juice grade fruit.<br />

• Very limited <strong>in</strong>fluence of export<br />

market volumes of fresh and<br />

processed products.<br />

• Export returns and demands <strong>in</strong><br />

sectors of citrus <strong>in</strong>fluence fruit<br />

supplies available for juic<strong>in</strong>g and<br />

can affect ex-pack<strong>in</strong>g house<br />

prices.<br />

6. Technology and <strong>in</strong>novation<br />

• Increas<strong>in</strong>g capital <strong>in</strong>tensity <strong>in</strong><br />

large-scale production and <strong>in</strong><br />

pack<strong>in</strong>g house efficiency is<br />

chang<strong>in</strong>g operat<strong>in</strong>g cost<br />

structures.<br />

• Limited transparency of<br />

market prices and costs<br />

through <strong>the</strong> pack<strong>in</strong>g sector.<br />

• Some <strong>in</strong>vestment <strong>in</strong><br />

<strong>in</strong>novation relevant to juice<br />

fruit to improve production<br />

consistency and quality,<br />

varietal performance and<br />

handl<strong>in</strong>g efficiencies <strong>in</strong><br />

harvest<strong>in</strong>g, grad<strong>in</strong>g and<br />

pack<strong>in</strong>g. Uptake <strong>in</strong> production<br />

sector is patchy due to<br />

unstable prices.<br />

7. Retail market dynamics<br />

• <strong>Price</strong> differentiation<br />

accepted by consumer<br />

between fresh and<br />

concentrate-based juices.<br />

• Strong competition <strong>in</strong> <strong>the</strong><br />

beverage and health<br />

beverages category<br />

between juice,<br />

carbonated dr<strong>in</strong>ks and<br />

waters.<br />

• Emerg<strong>in</strong>g competition<br />

from <strong>in</strong>-house juicers <strong>in</strong><br />

food service<br />

establishments and <strong>the</strong><br />

proliferation of <strong>the</strong>med<br />

fresh juice outlets.<br />

• Large range of juice<br />

dr<strong>in</strong>ks and concentratebased<br />

products<br />

compet<strong>in</strong>g on price.<br />

<strong>Price</strong> <strong>Determ<strong>in</strong>ation</strong> <strong>in</strong> <strong>the</strong> <strong>Australian</strong> <strong>Food</strong> <strong>Industry</strong> A <strong>Report</strong><br />

71