- Page 1 and 2:

Chapter 1 INTRODUCTION TO CALCULUS

- Page 3 and 4:

y x 3 1 , if 3 6 t 6 0 t 6. A func

- Page 5 and 6:

What Is Calculus? Two simple geomet

- Page 7 and 8:

If a and b were radicals, squaring

- Page 9 and 10:

Exercise 1.1 PART A 1. Write the co

- Page 11 and 12:

Consider a curve y f 1x2 and a poi

- Page 13 and 14:

EXAMPLE 2 Tech Support For help gra

- Page 15 and 16:

The slope of the tangent at 13, 42

- Page 17 and 18:

INVESTIGATION 4 Tech Support For he

- Page 19 and 20:

4. Simplify each of the following d

- Page 21 and 22:

18. Copy the following figures. Dra

- Page 23 and 24:

A. Determine the average velocity o

- Page 25 and 26:

Instantaneous Velocity The velocity

- Page 27 and 28:

Solution a. C11002 10V100 1000 1

- Page 29 and 30:

Exercise 1.3 C PART A 1. The veloci

- Page 31 and 32:

f 1x2 f 1a2 15. Use the alternate

- Page 33 and 34:

. Use your results for part a to ap

- Page 35 and 36:

The graph shown on your calculator

- Page 37 and 38:

limits because, in each case, only

- Page 39 and 40:

11. For each function, sketch the g

- Page 41 and 42:

EXAMPLE 2 EXAMPLE 3 EXAMPLE 4 Using

- Page 43 and 44:

INVESTIGATION Here is an alternate

- Page 45 and 46:

In this section, we learned the pro

- Page 47 and 48:

A 11. Jacques Charles (1746-1823) d

- Page 49 and 50:

A second condition for continuity a

- Page 51 and 52:

d. The function F is not continuous

- Page 53 and 54:

x 3, if x 3 12. g1x2 e 2 k, if

- Page 55 and 56:

Key Concepts Review We began our in

- Page 57 and 58:

c. What is the present rate of chan

- Page 59 and 60:

16. Evaluate the limit of each diff

- Page 61 and 62:

Chapter 2 DERIVATIVES Imagine a dri

- Page 63 and 64:

2 4 5. Expand, and collect like te

- Page 65 and 66:

Section 2.1—The Derivative Functi

- Page 67 and 68:

For the Parabola f1x2 x 2 The slop

- Page 69 and 70:

Note that f 1t2 Vt is defined for

- Page 71 and 72:

EXAMPLE 6 Reasoning about different

- Page 73 and 74:

Exercise 2.1 PART A 1. State the do

- Page 75 and 76:

T 15. Match each function in graphs

- Page 77 and 78:

EXAMPLE 1 Applying the constant fun

- Page 79 and 80:

We conclude this section with the s

- Page 81 and 82:

EXAMPLE 6 Connecting the derivative

- Page 83 and 84:

x 1 8. Determine the slope of the

- Page 85 and 86:

Section 2.3—The Product Rule In t

- Page 87 and 88:

EXAMPLE 3 Selecting an efficient st

- Page 89 and 90:

EXAMPLE 6 Selecting a strategy to d

- Page 91 and 92:

PART B dy 5. Determine the value of

- Page 93 and 94:

9. Determine the equation of the ta

- Page 95 and 96:

EXAMPLE 1 Applying the quotient rul

- Page 97 and 98:

Exercise 2.4 PART A 1. What are the

- Page 99 and 100:

Section 2.5—The Derivatives of Co

- Page 101 and 102:

with respect to x is equal to the p

- Page 103 and 104:

EXAMPLE 7 Combining derivative rule

- Page 105 and 106:

Exercise 2.5 PART A 1. Given f 1x2

- Page 107 and 108:

Technology Extension: Derivatives o

- Page 109 and 110:

Key Concepts Review Now that you ha

- Page 111 and 112:

9. For what values of x does the cu

- Page 113 and 114:

24. At a manufacturing plant, produ

- Page 115 and 116:

Chapter 3 DERIVATIVES AND THEIR APP

- Page 117 and 118:

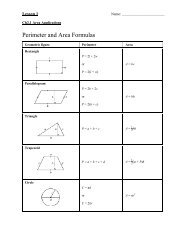

4. Determine the area of each figur

- Page 119 and 120:

Section 3.1—Higher-Order Derivati

- Page 121 and 122:

Motion on a Straight Line An object

- Page 123 and 124:

d. The object moves in a positive d

- Page 125 and 126:

EXAMPLE 5 Analyzing motion under gr

- Page 127 and 128:

Exercise 3.1 C K PART A 1. Explain

- Page 129 and 130:

T 12. A dragster races down a 400 m

- Page 131 and 132:

H. Repeat part D for the following

- Page 133 and 134:

Only t 3 is in the given interval,

- Page 135 and 136:

IN SUMMARY Key Ideas • The maximu

- Page 137 and 138:

T PART B 4. Using the algorithm for

- Page 139 and 140:

Mid-Chapter Review 1. Determine the

- Page 141 and 142:

Section 3.3—Optimization Problems

- Page 143 and 144:

For extreme values, set V¿1x2 0.

- Page 145 and 146:

Exercise 3.3 C PART A 1. A piece of

- Page 147 and 148:

a. Determine the dimensions that sh

- Page 149 and 150:

The revenue function is R1x2 17 0

- Page 151 and 152:

The minimal cost is approximately $

- Page 153 and 154:

T C 8. The fuel cost per hour for r

- Page 155 and 156:

CAREER LINK WRAP-UP Investigate and

- Page 157 and 158:

10. For each of the following cost

- Page 159 and 160:

s1t2 t 26. Find the absolute maxi

- Page 161 and 162:

Chapter 4 CURVE SKETCHING If you ar

- Page 163 and 164: 5. Determine the derivative of each

- Page 165 and 166: Section 4.1—Increasing and Decrea

- Page 167 and 168: dy Since this is a polynomial funct

- Page 169 and 170: IN SUMMARY Key Ideas • A function

- Page 171 and 172: 9. Each of the following graphs rep

- Page 173 and 174: Solution dy First determine dx . dy

- Page 175 and 176: Note that there is no value of x fo

- Page 177 and 178: EXAMPLE 4 Graphing the derivative g

- Page 179 and 180: 4. Find the x- and y-intercepts of

- Page 181 and 182: Section 4.3—Vertical and Horizont

- Page 183 and 184: The behaviour of the graph can be i

- Page 185 and 186: EXAMPLE 2 Expressing a polynomial f

- Page 187 and 188: When lim f 1x2 k or lim f 1x2 k,

- Page 189 and 190: For horizontal asymptotes, 3x f 1x2

- Page 191 and 192: Now let's consider the straight lin

- Page 193 and 194: Exercise 4.3 PART A 1. State the eq

- Page 195 and 196: 12. Use the features of each functi

- Page 197 and 198: 11. a. What does f ¿1x2 7 0 imply

- Page 199 and 200: From these investigations, we can m

- Page 201 and 202: Setting dy dx 0, we obtain 3 1x 2

- Page 203 and 204: The second derivative of f 1x2 is f

- Page 205 and 206: Exercise 4.4 K PART A 1. For each f

- Page 207 and 208: Section 4.5—An Algorithm for Curv

- Page 209 and 210: Therefore, by the second derivative

- Page 211 and 212: Interval 1, 12 11, 0.82 10.8, 22 12

- Page 213: K A 1x PART B 4. Use the algorithm

- Page 217 and 218: 5. For each of the following, check

- Page 219 and 220: 17. If f 1x2 x3 8 , determine the

- Page 221 and 222: Chapter 5 DERIVATIVES OF EXPONENTIA

- Page 223 and 224: Radian Measure A radian is the meas

- Page 225 and 226: 5. Convert the following angles to

- Page 227 and 228: Section 5.1—Derivatives of Expone

- Page 229 and 230: From the investigation, you should

- Page 231 and 232: EXAMPLE 4 Connecting the derivative

- Page 233 and 234: A C PART B 6. Determine the equatio

- Page 235 and 236: Section 5.2—The Derivative of the

- Page 237 and 238: In general, for the exponential fun

- Page 239 and 240: Solution a. January 1, 1900, is exa

- Page 241 and 242: Section 5.3—Optimization Problems

- Page 243 and 244: The average revenue to the company

- Page 245 and 246: Exercise 5.3 PART A 1. Use graphing

- Page 247 and 248: 12. Find the maximum and minimum va

- Page 249 and 250: 9. The rapid growth in the number o

- Page 251 and 252: INVESTIGATION 2 A.Using your graphi

- Page 253 and 254: With practice, you will learn how t

- Page 255 and 256: We evaluate f 1x2 at the critical n

- Page 257 and 258: A T 6. Determine the absolute extre

- Page 259 and 260: Derivatives of Composite Functions

- Page 261 and 262: CAREER LINK WRAP-UP Investigate and

- Page 263 and 264: Review Exercise 1. Differentiate ea

- Page 265 and 266:

18. The position of a particle is g

- Page 267 and 268:

Chapter 5 Test dy 1. Determine the

- Page 269 and 270:

8. Use algebraic methods to evaluat

- Page 271 and 272:

f 1x2 142e 5x1 24. For each functi

- Page 273 and 274:

Review of Prerequisite Skills In th

- Page 275 and 276:

CAREER LINK Investigate CHAPTER 6:

- Page 277 and 278:

What is a Vector? A vector is a mat

- Page 279 and 280:

EXAMPLE 1 B A E D C Connecting vect

- Page 281 and 282:

A K B 5. Given the vector AB ! as s

- Page 283 and 284:

Section 6.2—Vector Addition In th

- Page 285 and 286:

the overall magnitude would be equa

- Page 287 and 288:

Solution c b a a - b + c a - b c a

- Page 289 and 290:

W N S E The vectors are drawn so th

- Page 291 and 292:

Exercise 6.2 PART A 1. The vectors

- Page 293 and 294:

10. a. In ! the ! example ! involvi

- Page 295 and 296:

0 0 The previous example illustrate

- Page 297 and 298:

Solution a. 30˚ y x 2x-y 2x -y 30

- Page 299 and 300:

Solution Draw a sketch and determin

- Page 301 and 302:

8. The two vectors a ! and b ! are

- Page 303 and 304:

Section 6.4—Properties of Vectors

- Page 305 and 306:

Demonstrating the distributive law

- Page 307 and 308:

IN SUMMARY Key Idea • Properties

- Page 309 and 310:

Mid-Chapter Review 1. ABCD is a par

- Page 311 and 312:

Section 6.5—Vectors in R 2 and R

- Page 313 and 314:

Right-Handed System of Coordinates

- Page 315 and 316:

Solution a. A16, 0, 02 is a point o

- Page 317 and 318:

There is one further observation th

- Page 319 and 320:

C A 14. a. What is the equation of

- Page 321 and 322:

R 2 EXAMPLE 1 Representing vectors

- Page 323 and 324:

EXAMPLE 2 Representing the sum and

- Page 325 and 326:

EXAMPLE 5 Calculating the magnitude

- Page 327 and 328:

A 10. Parallelogram is determined b

- Page 329 and 330:

EXAMPLE 1 Representing vectors in R

- Page 331 and 332:

. Using components, a ! b ! c !

- Page 333 and 334:

IN SUMMARY Key Ideas • In R 3 , i

- Page 335 and 336:

Section 6.8—Linear Combinations a

- Page 337 and 338:

In R 2 , it is possible to take any

- Page 339 and 340:

Geometrically, the linear combinati

- Page 341 and 342:

IN SUMMARY Key Ideas • In R 2 , O

- Page 343 and 344:

CAREER LINK WRAP-UP Investigate and

- Page 345 and 346:

Review Exercise 1. Determine whethe

- Page 347 and 348:

15. A rectangular prism measuring 3

- Page 349 and 350:

Chapter 6 Test 1. The vectors a ! ,

- Page 351 and 352:

Review of Prerequisite Skills In th

- Page 353 and 354:

Section 7.1—Vectors as Forces The

- Page 355 and 356:

of 6 cm, also pointing east. The ve

- Page 357 and 358:

is drawn approximately to scale, an

- Page 359 and 360:

The magnitude of the vertical compo

- Page 361 and 362:

! T1 sin 105° 1961sin 45°2 T ! 1

- Page 363 and 364:

49 34 30 cos CBA 1 cos CBA 2 120

- Page 365 and 366:

C T f 3 40 N O 35 N 45° 30 N f 2 2

- Page 367 and 368:

Solution We start by drawing positi

- Page 369 and 370:

v a v + w w 20 triangles, Solving t

- Page 371 and 372:

A T C 9. A small airplane has an ai

- Page 373 and 374:

Perhaps the most important observat

- Page 375 and 376:

If we look at the right-angled tria

- Page 377 and 378:

Solution Consider the following dia

- Page 379 and 380:

A T 10. What is the value of the do

- Page 381 and 382:

Expanding, we get b 2 1 2a 1 b 1

- Page 383 and 384:

. 0 a ! 0 2 @b ! 112 2 122 2 142

- Page 385 and 386:

One of the most important propertie

- Page 387 and 388:

4. a. From the set of vectors e11,

- Page 389 and 390:

Mid-Chapter Review 1. a. If 0 a ! 0

- Page 391 and 392:

Section 7.5—Scalar and Vector Pro

- Page 393 and 394:

EXAMPLE 1 Reasoning about the chara

- Page 395 and 396:

x EXAMPLE 3 z P (2, 1, 4) g b a O(0

- Page 397 and 398:

EXAMPLE 4 Calculating a specific di

- Page 399 and 400:

IN SUMMARY Key Idea • A projectio

- Page 401 and 402:

B C 12. In the diagram shown, ^ ABC

- Page 403 and 404:

a 3 b, k = 1 O b 3 a, k = -1 b a is

- Page 405 and 406:

If we carry out an identical proced

- Page 407 and 408:

EXAMPLE 2 Calculating cross product

- Page 409 and 410:

K A C T 4. Calculate the cross prod

- Page 411 and 412:

EXAMPLE 1 Using the dot product to

- Page 413 and 414:

. We start by constructing position

- Page 415 and 416:

EXAMPLE 4 Using the cross product t

- Page 417 and 418:

CAREER LINK WRAP-UP Investigate and

- Page 419 and 420:

Review Exercise 1. Given that a !

- Page 421 and 422:

18. For the vectors m ! 1 V3, 2, 3

- Page 423 and 424:

Chapter 7 Test 1. Given the vectors

- Page 425 and 426:

Review of Prerequisite Skills In th

- Page 427 and 428:

CAREER LINK Investigate CHAPTER 8:

- Page 429 and 430:

Both of these vectors can be multip

- Page 431 and 432:

c. If the point Q121, 232 lies on t

- Page 433 and 434:

In this section, the vector and par

- Page 435 and 436:

C K A T 6. a. If the equation of a

- Page 437 and 438:

EXAMPLE 1 Representing the Cartesia

- Page 439 and 440:

It is not possible, in this case, t

- Page 441 and 442:

AP ! 1x 4, y 1222 1x 4, y 22.

- Page 443 and 444:

u cos 1 a 3 12 1 10 21 25 2 b u

- Page 445 and 446:

A T 10. For each pair of lines, det

- Page 447 and 448:

is its direction vector. If represe

- Page 449 and 450:

EXAMPLE 4 Representing the equation

- Page 451 and 452:

C A T 6. a. Determine parametric eq

- Page 453 and 454:

13. The Cartesian equation of a lin

- Page 455 and 456:

s t s(1, 2, 1) t(0, 2, 1), s, tR P

- Page 457 and 458:

After deriving vector and parametri

- Page 459 and 460:

EXAMPLE 4 Representing the equation

- Page 461 and 462:

A K T 7. a. Determine parameters co

- Page 463 and 464:

To derive the equation of this plan

- Page 465 and 466:

A number of observations can be mad

- Page 467 and 468:

When we considered lines in R 2 , w

- Page 469 and 470:

IN SUMMARY Key Idea • The Cartesi

- Page 471 and 472:

Section 8.6—Sketching Planes in R

- Page 473 and 474:

EXAMPLE 2 Representing the graph of

- Page 475 and 476:

EXAMPLE 5 Graphing planes whose Car

- Page 477 and 478:

IN SUMMARY Key Idea • A sketch of

- Page 479 and 480:

CAREER LINK WRAP-UP Investigate and

- Page 481 and 482:

Review Exercise 1. Determine vector

- Page 483 and 484:

20. Calculate the acute angle that

- Page 485 and 486:

Chapter 8 Test 1. a. Given the poin

- Page 487 and 488:

Review of Prerequisite Skills In th

- Page 489 and 490:

CAREER LINK Investigate CHAPTER 9:

- Page 491 and 492:

4 13 s2 211 4s2 12 8s2 8 0 1

- Page 493 and 494:

Method 2: Again, this result can be

- Page 495 and 496:

We can now select any two of the th

- Page 497 and 498:

IN SUMMARY Key Ideas • Line and p

- Page 499 and 500:

A T 11. a. Show that the lines and

- Page 501 and 502:

equations. Since the lines would be

- Page 503 and 504:

Solution 1: Interchange equations 1

- Page 505 and 506:

Substituting into the second equati

- Page 507 and 508:

1: Multiply equation 1 by k, and ad

- Page 509 and 510:

K C PART B 4. Solve each system of

- Page 511 and 512:

Section 9.3—The Intersection of T

- Page 513 and 514:

If we had solved the system using e

- Page 515 and 516:

then x 3s 1. Now it is a matter o

- Page 517 and 518:

Exercise 9.3 C K PART A 1. A system

- Page 519 and 520:

Mid-Chapter Review 1. Determine the

- Page 521 and 522:

Section 9.4—The Intersection of T

- Page 523 and 524:

1: Create two new equations, 4 and

- Page 525 and 526:

Thus, 7y 5t 3. Dividing by 7, we g

- Page 527 and 528:

Inconsistent Systems for Three Equa

- Page 529 and 530:

Therefore, we can choose ! ! ! m 1

- Page 531 and 532:

Exercise 9.4 PART A 1. A student is

- Page 533 and 534:

9. Solve each system of equations u

- Page 535 and 536:

Section 9.5—The Distance from a P

- Page 537 and 538:

EXAMPLE 1 Calculating the distance

- Page 539 and 540:

In triangle PQR, sin u d @ QP ! @

- Page 541 and 542:

Exercise 9.5 PART A 1. Determine th

- Page 543 and 544:

Section 9.6—The Distance from a P

- Page 545 and 546:

It is also possible to use the dist

- Page 547 and 548:

p 1 p 2 U V d L 1 : r = (-2, 1, 0)

- Page 549 and 550:

The required distance between the t

- Page 551 and 552:

K A T PART B 2. Determine the follo

- Page 553 and 554:

Review Exercise 1. The lines 2x y

- Page 555 and 556:

14. You are given the lines , and r

- Page 557 and 558:

Chapter 9 Test 1. a. Determine the

- Page 559 and 560:

P(1, -2, 4) Q P9 2x - 3y - 4z + 66

- Page 561 and 562:

29. A line that passes through the

- Page 563 and 564:

Solution a. Differentiate both side

- Page 565 and 566:

Exercise PART A 1. State the chain

- Page 567 and 568:

dA b. To determine differentiate A

- Page 569 and 570:

1 16 dh dt Therefore, at the momen

- Page 571 and 572:

11. Two cyclists depart at the same

- Page 573 and 574:

Solution a. y ln15x2 Using the cha

- Page 575 and 576:

x1x 42 0 x 4 or x 0 But x 0 is

- Page 577 and 578:

The Derivatives of General Logarith

- Page 579 and 580:

The Derivative of a Composite Funct

- Page 581 and 582:

To solve this, we take the natural

- Page 583 and 584:

Exercise PART A 1. Differentiate ea

- Page 585 and 586:

y eliminating unknowns. In Example

- Page 587 and 588:

Properties of a Matrix in Row-Echel

- Page 589 and 590:

Exercise PART A 1. Write an augment

- Page 591 and 592:

12. Determine the equation of the p

- Page 593 and 594:

1 0 0 18 4 (row 3) row 1 £ 0 1 0

- Page 595 and 596:

Finally, convert the entry in the s

- Page 597 and 598:

Review of Technical Skills Appendix

- Page 599 and 600:

3 Evaluating a Function 1. Enter th

- Page 601 and 602:

7 Making a Table of Differences To

- Page 603 and 604:

4. Cursor along the curve to any po

- Page 605 and 606:

5. Display and analyze the results.

- Page 607 and 608:

14 Graphing a Trigonometric Functio

- Page 609 and 610:

2. Enter the second equation. Press

- Page 611 and 612:

Use either the calculator keypad or

- Page 613 and 614:

20 Graphing the Derivative of a Fun

- Page 615 and 616:

4. Create a function. Right-click t

- Page 617 and 618:

composition: the process of combini

- Page 619 and 620:

G geometric vectors: vectors that a

- Page 621 and 622:

ationalizing the denominator: the p

- Page 623 and 624:

Answers Chapter 1 0 0 0 0 0 Review

- Page 625 and 626:

d. about 1 e. about 7 8 f. no tang

- Page 627 and 628:

d. 13. m 3; b 1 14. a 3, b 2, c

- Page 629 and 630:

Review Exercise, pp. 56-59 1. a. 3

- Page 631 and 632:

19. a. y 7 b. y 5x 5 c. y 18x 9

- Page 633 and 634:

20. a. 34.3 m> s b. 39.2 m> s c. 54

- Page 635 and 636:

17. a. 100 bacteria b. 1200 bacteri

- Page 637 and 638:

11. a. b. 160x y 16 0 60x y 61

- Page 639 and 640:

3. 1 2x 4. a. x 2 15x 6 b. 6012x

- Page 641 and 642:

14. t 1 s; away 15. a. s1t2 kt 2

- Page 643 and 644:

14. a. triangle side length 0.96 cm

- Page 645 and 646:

Review Exercise, pp. 156-159 11. 20

- Page 647 and 648:

c. i. ii. iii. d. i. ii. iii. 5 4 3

- Page 649 and 650:

. local minimum: 11.41, 39.62, loca

- Page 651 and 652:

2. increasing: x 6 1 and x 7 2, dec

- Page 653 and 654:

to a zero of its derivative, the nu

- Page 655 and 656:

7. (-2, 10) 10 8 y 10. a. 8 y e. 4

- Page 657 and 658:

4. hole at x 2; large and negative

- Page 659 and 660:

sin x b. 1 sin 2 tan x sec x x L

- Page 661 and 662:

12. a. no maximum or minimum value

- Page 663 and 664:

Review Exercise, pp. 263-265 1. a.

- Page 665 and 666:

x 2. 5. a. 19 000 fish> year b. 23

- Page 667 and 668:

Section 6.1, pp. 279-281 6. a. b. c

- Page 669 and 670:

17. P G 4. Answers may vary. For ex

- Page 671 and 672:

11. a. AG ! a ! b ! c ! , b. AG

- Page 673 and 674:

d. OD ! 11, 1, 12 (0, 0, 1) (1, 0,

- Page 675 and 676:

Section 6.7, pp. 332-333 1. a. 1i !

- Page 677 and 678:

24. 25. a. 0a ! b. 0a ! 0 2 0b !

- Page 679 and 680:

. Since the equilibrant is directed

- Page 681 and 682:

7. a. scalar projection: 0, vector

- Page 683 and 684:

2. a. 3 b. 7 c. 43 d. 217 e. 5 f. 1

- Page 685 and 686:

cos A 1 cos B 1 cos C 1 area of t

- Page 687 and 688:

. r ! 11, 1, 02 t10, 1, 12, tR; x

- Page 689 and 690:

2. 12, 3, 42 3. P must lie on plane

- Page 691 and 692:

25. A plane has two parameters, bec

- Page 693 and 694:

coincident with the plane, meaning

- Page 695 and 696:

Mid-Chapter Review, pp. 518-519 1.

- Page 697 and 698:

8. a. b. y 1 z 1 4 , 2 c. x 3t

- Page 699 and 700:

10. vector equation: r ! 10, 0, 42

- Page 701 and 702:

. 23. a. b. 2a 1 2 b a 6 7 , 2 7 ,

- Page 703 and 704:

16. 17. 18. 19. 2 3 4 m>min 144 m>m

- Page 705 and 706:

ln x 1 e. ln 2 4x 1 x ln 13x 2 2

- Page 707 and 708:

Index A Absolute extrema, 130, 132,

- Page 709:

normal, 461-469, 486, 512, 524 para